Geopolitical upheaval across the globe dominated the news cycle, feeding anxieties about the future of monetary and fiscal policy, taxes, trade, and conflict. Tension remained high with North Korea and continued to escalate with Russia. Richly priced capital markets spurred concerns about an “inevitable” correction. Comparisons to the pre-Global Financial Crisis (GFC) period in 2007, to before the Dot-Com Bubble in 2000, and particularly to 1987 before the 20% one-day drop in the U.S. stock market abound. Then two hurricanes of historic proportions slammed the Caribbean, the Gulf of Mexico, and the U.S. mainland within a couple weeks of each other in September.

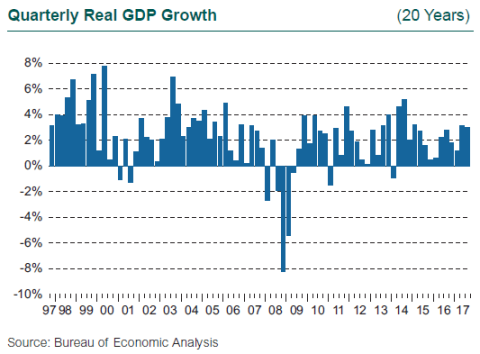

Stepping back from the conjecture and hand-wringing, the state of the global economy as we head into the fourth quarter of 2017 is much better than this general sentiment might suggest. Investors are certainly less concerned about the economy than the news would lead us to believe. The U.S. economy has actually gathered momentum as 2017 progressed. After a relatively weak first quarter (1.4% growth), GDP was revised up to 3.1% in the second quarter and grew an astounding 3.0% in the third quarter after accounting for the impact of Harvey and Irma. Without the hurricanes, real GDP would likely have seen a robust gain in excess of 4%, perhaps as strong as 4.5%. Initial estimates for fourth quarter growth are equally lofty.

What gives? Is this growth spurt the last, exuberant gasp before the economy collapses from exhaustion? First and foremost, we should recall that expansions do not die of old age; they typically expire under the weight of imbalances in spending versus income, a run-up in debt, a build-up in inventory for demand that wanes, or over-building for economic activity that doesn’t materialize. These imbalances are obvious in hindsight but difficult to spot in the moment. The current cycle is particularly hard to pin down; the expansion may be getting long in the tooth after more than seven years, but the GDP gains since the GFC (2.2% per year) are substantially lower than those enjoyed in previous recoveries (above 3%). Consumers spent the first several years following the GFC deleveraging, whether voluntarily or involuntarily. Businesses have been persistently reluctant to invest in capital, except perhaps for equipment replacement and technology.

Consumer spending is finally leading GDP growth, fueled by tight labor markets, a long-awaited nudge upward in wages and salaries, and in a perhaps less sanguine development, a renewed interest in and ability to borrow. While mortgage debt is still more difficult to obtain than pre-GFC, consumer credit as a percentage of disposable income has regained its pre-GFC peak of 24% and then some, reaching past 26% in the third quarter of 2017. Business spending is also finally accelerating after years of fits and starts. The ISM Report on Business for September shows strength across almost all measures of manufacturing and non-manufacturing activity. The Purchasing Managers’ Index came in at 58.8 in August and 60.8 in September, well above 50, the dividing line between expansion and contraction. The new orders, production, and employment indices are even stronger, and coupled with a sharp decline in inventories following the hurricanes, activity is poised to be even stronger in the fourth quarter.

The sustainability of the 2017 burst in growth will certainly fall under scrutiny. Hopes for near-term fiscal stimulus in the U.S. are diminished, and tight labor markets suggest limited potential for further growth from the existing set of labor and capital inputs available in the U.S. economy.

Outside the U.S., euro zone GDP for the second quarter was revised upwards to 2.3% from 1.7%, and preliminary data support continued improvement in the third quarter. The long-awaited response to the stimulus appears to have arrived. In China, annual growth increased by 6.9% in the second quarter, identical to the first quarter and slightly ahead of expectations. Initial data on industrial production and investment in fixed assets released in July and August are consistent with a third quarter slowdown. Robust gains in developed non-U.S. and emerging equity markets are fueled by renewed optimism, or at least reduced skepticism, about growth prospects in many markets around the globe.

3.0%

GDP growth in the third quarter after accounting for the impact of Harvey and Irma