Listen to This Blog Post

The last five years have been interesting, to say the least: the first global pandemic in a century, a major land war in Europe, partisan power swaps in Washington, and AI became either our salvation or our doom, depending on who you ask (or which chatbot you talk to).

With all of that upheaval, institutional investors with developed ex-U.S. equity allocations have felt it was impossible to keep up with their managers’ performance quarter to quarter amid whipsawing returns—and they haven’t been wrong.

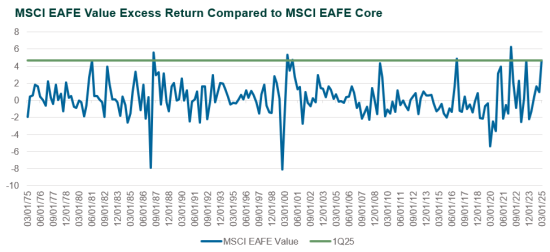

We looked at the quarterly outperformance of the MSCI EAFE Value Index relative to the core benchmark since 1975. (Unlike in the U.S., the value benchmark has outperformed the core and growth benchmark in each calendar year since 2022, with periods of volatility in between.) In 1Q25, the value index beat its core benchmark by 4.7 percentage points, the sixth-highest figure since 1975. That might sound impressive until you realize that three of the top six happened just since 2022.

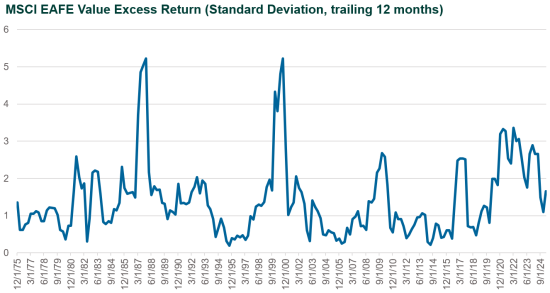

We also looked at the standard deviation of EAFE Value’s excess returns over rolling four-quarter windows. This tells us how chaotic style rotations have been (remember: when value wins, growth loses, and vice versa—it’s a zero-sum cage match). Since 2020, the market’s style rotation has been the investment version of “hold my beer”—three of the five most volatile periods in nearly 50 years happened in the last four years.

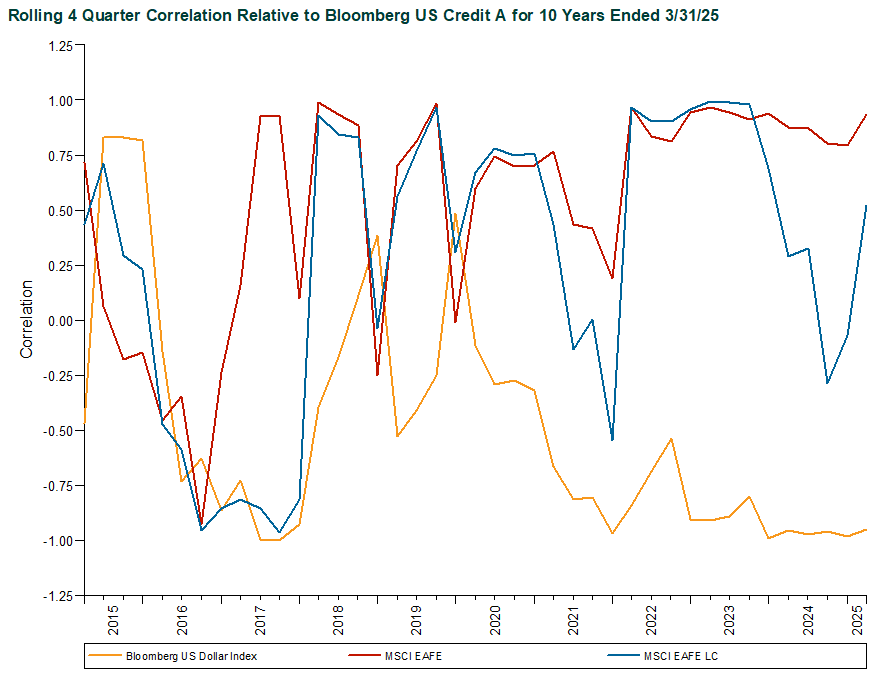

For developed ex-U.S. markets, much like the rest of the economy, interest rates have been a primary driver of performance. Looking at the correlation of the MSCI EAFE Index to the Bloomberg US Credit A Index (high-quality U.S. credit), there is a sharp increase in 2022 from volatile correlation to near-constant correlation above 0.80 (meaning that when fixed-income prices rose, so did developed ex-U.S. markets).

While credit drove this correlation from 2022-23, for U.S.-based investors in dollars the U.S. currency (strongly negatively correlated to fixed income prices) drove returns from 2024-25. This is evident in the MSCI EAFE Local Currency correlation, which dropped to near zero during that period, suggesting that currency fluctuations, rather than interest rates, drove returns since 2024.

Recent market dynamics—pandemic, war, rates, and currency whiplash—have made manager performance look more erratic than it truly is. Institutional investors judging their developed ex-U.S. equity managers based on recent style-driven swings should take a breath. This hasn’t been “normal volatility,” and a little patience might go a long way.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.