Troubles in Turkey’s capital markets—a depreciating lira, plunging stock market, skyrocketing bond yields—are raising concerns about contagion. The country’s problems are unique to its circumstances and largely a result of internal policy, but investor concerns are starting to spread across all emerging markets, whether justified or not. EM investing has always come with heightened volatility, often the result of a sudden spike in risk aversion spurred by bad news somewhere within the emerging markets.

The potential contagion in this case would be a self-fulfilling cycle of worsening sentiment between investors, as opposed to a macroeconomic contagion. The macro circumstances causing heartburn in Turkey are not likely to just suddenly appear in most other emerging market countries. Turkey has followed its own course with substantial stimulative fiscal policy—financed largely with foreign currency debt—and loose monetary policy, with a rather unique belief that higher interest rates lead to inflation.

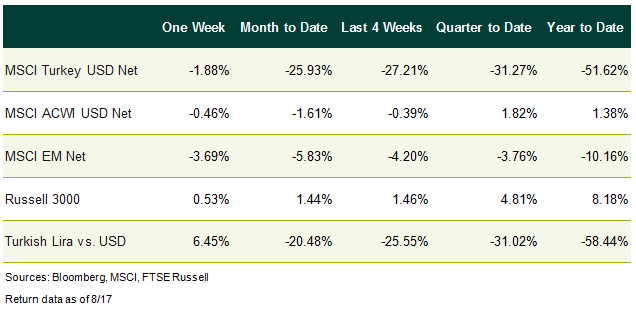

Over the last four weeks, the MSCI Turkey Index fell 27% in U.S. dollar terms and the lira lost another 25.6% of its value against the dollar. Year-to-date, the Turkish equity market is down 51.6%, and the lira has declined 58.4% versus the dollar. Turkey’s 10-year government bond yield soared to 22.7% by August 10, before slipping to 21.0% by August 17. (For a stunning view of the dramatic turn of events in Turkey, get a load of this chart.) The market has punished Turkish yields, driving them to a level comparable to that of countries with much lower debt ratings. Interestingly, the lira saw a bear market rally the week of August 13, rising 6.4%.

First, some perspective. Turkey’s equity markets are relatively small. As of June 30, Turkey’s weights in global equity indices were as follows:

- MSCI Emerging Markets = 0.76%

- MSCI ACWI ex-US = 0.19%

- MSCI ACWI = 0.09%

Within the global debt markets, the story is a bit different. Turkey makes up 6% of the JPM EMBI Global Index and 3.5% of the JPM EMBI Global Diversified, both commonly used external debt indices, denominated in U.S. dollars. Within the local currency version of the JPM EMBI Global Diversified, Turkey’s weight is 5%. This relatively large position in global debt markets is the cumulative result of substantial borrowing, primarily in the foreign currency markets, a policy encouraged by the government to spur growth starting in 2009. Persistent low interest rates extending far longer than anyone expected supported continued borrowing and may have exacerbated the imbalances. Turkey relies on foreign-currency debt more than any other major emerging market. Corporate, financial, and other debt denominated in foreign currencies, mostly dollars, represents about 70% of Turkey’s economy, according to the Institute of International Finance. While this credit has fueled strong economic growth, the dependence on foreign capital flows means Turkey is vulnerable to shifts in global capital markets. U.S. interest rates are on the way up, leading to a rise in the value of the dollar and making it harder for overseas companies and nations (like Turkey) to repay loans in their falling national currencies.

Adding to the uncertainty for investors are two more troubling developments. The first is a current account deficit of more than 6% of GDP, which is the highest in the emerging markets. The current account consists of the balance of trade, net primary income or factor income (earnings on foreign investments minus payments made to foreign investors) and net cash transfers, according to Wikipedia. A current account deficit indicates that the value of a country’s net foreign assets shrank. The second development is the recent doubling of tariffs by the U.S. on Turkish aluminum and steel, and a sharp deterioration in U.S.-Turkish relations.

The situation is changing by the day and it is unclear how it will play out. We at Callan can, however, provide some context. Emerging markets are known for periodic boom and bust cycles, and they can be subject to these sudden spikes in investors’ risk aversion. We advise investors to tread carefully and fully understand the magnitude of potential volatility from investing in emerging markets, and how that may impact their portfolio. Crises flare in emerging markets routinely, if irregularly—over the past several decades, recall challenges in Thailand, Russia, Malaysia, Argentina, Brazil, and Venezuela, to name a few, and now Turkey. Dire as many of those situations seemed at the time, the markets ultimately recovered in each case, although it is true that several EM countries have suffered subsequent repeat flare-ups.

True macroeconomic contagion between EM countries is now less likely, as monetary and fiscal discipline is much improved following the Russian and Asian crises in the late 1990s. (See the following link to the “Asian Contagion timeline” for how different things were at that time: https://www.pbs.org/wgbh/pages/frontline/shows/crash/etc/cron.html). That is not to say there aren’t other fragile economies within the emerging markets, which are perhaps suffering more than most from investor flight: Argentina, South Africa, Russia, and Brazil.

U.S. exposure to Turkey is very small, both in trade and investment. European capital markets are the most exposed to Turkey. The euro zone is Turkey’s largest trading partner and its banks are the largest lenders to Turkey; according to Lazard Asset Management, the largest bank exposures are BBVA, Unicredit, and BNP Paribas. Of course, Turkey is a key NATO ally.

The solution to the current crisis is unclear, but would most likely involve both internal policy reform and outside financial assistance. However, any outside assistance from Europe will come with conditions. The conditions would likely be similar to those imposed on the countries within the euro zone (Portugal, Italy, Ireland, Greece, Spain) following the Global Financial Crisis: tighter monetary and fiscal policy (better known as austerity). Turkey has bristled at conventional outside assistance and is seeking alternative ideas from Russia, China, and countries in the Arab sphere such as Qatar.