In the current low-return environment, institutional investors have pursued high-return objectives by increasing their exposure to equity and equity-like investments. However, with uncertain profit growth, high equity valuations, and fresh memories of the Global Financial Crisis (GFC), they are also seeking investments to reduce equity risk.

Since the timing and severity of any equity market retreat is uncertain, investors are anxious to avoid hedges that involve high continuing costs. Under these circumstances many are considering investing in fixed income—primarily long-term Treasuries. Treasuries are considered a reliable “flight-to-quality” asset in a severe equity market downturn. Given their interest rate sensitivity, they are also likely to have the highest returns among flight-to-quality assets and therefore require only a small allocation. This minimizes the displacement of growth assets and their associated returns.

To test the thesis that long-term Treasury gains often offset equity losses, I conducted an extensive analysis of the interaction between long-term Treasuries and equities over the last several decades. My research found that:

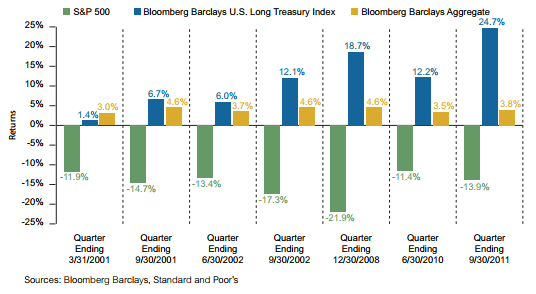

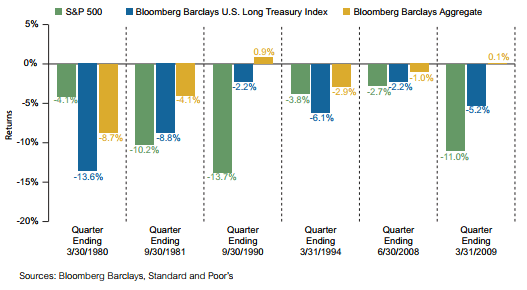

- First, the data clearly show that long-term Treasuries can have high returns in quarters when equity markets perform poorly. They can also have poor returns when equity is down (as well as up). Consequently, the first conclusion is that long-term Treasuries are not an equity hedge. They have the potential to offset equity losses but there is certainly no guarantee. The opportunity for positive long Treasury returns when equity markets are negative improves if time periods are lengthened from one quarter to one year.

- Second, both the Long Treasury and the Bloomberg Barclays US Aggregate Bond indices generally moved in the same direction under the same circumstances. Performance differences were in terms of degree rather than kind because interest rates are the primary determinate of bond performance. Consequently, fixed income investments generally cushion equity losses. Investors who hold long duration Treasuries in an effort to increase the potential offset for equity losses have to be able to accept the largest potential losses from these bonds in either up or down stock markets. Diversified bond portfolios with shorter durations reduce the potential for both gains and losses at the expense of some, but certainly not all, equity diversification. The additional duration of the Long Treasury Index is likely to cause it to underperform the Aggregate benchmark in a rising interest rate environment.

Positive Bond Market Performance in Select Down Markets for Equity

Poor Bond Index Performance in Select Down Equity Markets

- The benefits of investing in long Treasuries may be limited not only by uncertainty over the magnitude and direction of their returns, but also by practical limitations on the size of the allocation. In an environment like the GFC—when many investments are suffering losses simultaneously—it would take a large allocation to long Treasuries to make a meaningful difference in the overall portfolio return. The ability to hold a larger allocation to a broad market bond portfolio may actually result in better diversification of the equity holdings.

- Finally, time frame is a key consideration. Institutional investment programs are almost always strategic in nature. Losses during the GFC were painful but stock markets recovered relatively quickly. If time horizons are measured in years rather than quarters, an allocation to long Treasuries may not be necessary.

Read the detailed findings of my search here.