With inflation concerns on the minds of many investors, asset classes and securities that can help mitigate its impacts have gained new interest. Among these securities are TIPS, or Treasury Inflation-Protected Securities, because they are designed to provide protection against unexpected inflation.

The market’s expectation for future inflation, as measured by the CPI, is reflected in the price of TIPS. TIPS are issued with lower yields than nominal Treasuries because investors are compensated for inflation over the life of the security.

Here is how they work: TIPS pay interest every six months based on a fixed rate applied to the principal outstanding. The inflation protection comes from changes made to the principal value of the bond, which is adjusted for inflation as measured by the Consumer Price Index-All Urban Consumers (not seasonally adjusted).

At maturity, the greater of the adjusted principal value or the issuance value (par) will be paid. The amount paid out at maturity will reflect inflation as measured by the CPI. The principal value cannot be adjusted below par, and thus this feature benefits investors in a deflationary environment (when CPI changes are negative) if and when this “floor” (par value) is reached. This feature introduces a bit of “optionality” into TIPS because the potential for price changes is asymmetric—the principal can be adjusted upward without limit but cannot be adjusted below par value if CPI declines.

Here’s an example of how TIPS work:

- April 15, 2014: 5-year TIPS issued at par ($1,000) with a coupon rate of 0.125%. CPI was 234.31967.

- October 15, 2014: First coupon payment due and CPI was 238.07026 (change of 1.6%). Coupon payment will be 0.125% x $1,000 x 1.016% / 2.

- April 15, 2019: CPI was 252.20853; change of 7.6%. Principal repaid will be $1,000 x 1.076%.

- If deflation had occurred over that period (i.e., the CPI had fallen), principal repaid would be $1,000.

The performance of TIPS is driven primarily by changes in inflation expectations and changes in real yields. Further, TIPS can be less liquid than nominal U.S. Treasuries at times, especially during periods of market stress, and short-term price changes may reflect some “liquidity risk.” TIPS are backed by the full faith and credit of the U.S. government, like nominal U.S. Treasuries, and thus do not have credit risk.

Another important concept to understand about TIPS is that of “breakeven spreads,” which are the differences in yields between nominal Treasuries and TIPS of the same maturity. This spread is a measure of expected inflation (i.e., the inflation that is priced into the market) over the life of the bond.

Example:

- March 31, 2021: 5-year TIPS yield = -1.62% vs. 5-year U.S. Treasury yield = 0.92%

- Difference = 2.54%

- Investors expect inflation over the next five years to be 2.54%.

- If it is higher, TIPS will outperform over the five-year period.

Active core and core plus fixed income managers include TIPS in their opportunity set, although they are not in the Bloomberg Barclays US Aggregate Bond Index. TIPS are viewed as relative value opportunities when a manager expects inflation to be higher than what is reflected in TIPS valuations.

Institutional investors can include TIPS in their portfolios either as part of a dedicated strategic allocation, or as a tactical allocation. For both, the source of funds is important to consider from a relative value perspective as well as from the impact on overall fixed income structure characteristics such as duration, yield, and credit quality.

Here are some considerations:

Strategic allocation

- TIPS provide protection against inflation as measured by the CPI if held to maturity; however, interim price changes will reflect changes in real interest rates and changes in expected inflation and can be volatile.

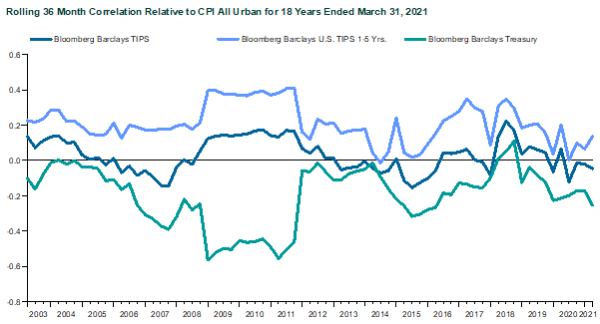

- Shorter-term TIPS have demonstrated a higher correlation to CPI than longer-term TIPS, due primarily to the fact that they have less interest rate sensitivity, which tempers price movements due to changes in real rates. Prices of longer-term TIPS fluctuate more due to interest rate sensitivity than to changes in CPI.

- TIPS can be expected to outperform nominal U.S. Treasuries when actual inflation is higher than expected inflation.

- They provide diversification benefits to equity exposure, but less so than nominal U.S. Treasuries, which are the investment of choice for investors seeking safety given the size and liquidity of the market, though both are backed by the U.S. government. The TIPS market is only a fraction of the size of the nominal U.S. Treasury market and there are fewer than 50 securities outstanding.

Tactical allocation

- TIPS may make sense if an investor’s expectation for inflation is higher than what the market expects and the source of funds is fixed income.

- They may be appropriate if the expectation is for real yields to fall.

- A tactical implementation requires decisions around when to reverse the trade.

In summary, TIPS performance reflects changes in real rates as well as changes in inflation expectations; these are the key drivers of performance. Since TIPS will not return less than par at maturity, they also provide downside protection in a highly deflationary environment. Shorter-term TIPS provide a more pure hedge against unexpected inflation because they have less interest rate risk, but the hedge is imperfect.