The strategic glidepaths of target date funds (TDFs) play an integral role in driving the participant experience. TDF providers review their asset allocations periodically to better align exposures with the evolving needs of defined contribution (DC) plan participants and the ever-changing nature of the capital markets.

In 2021 and the first half of 2022, multiple TDF providers announced changes to their strategic target date fund glidepaths. The timing of these changes was unique, as capital markets adjusted to a post-pandemic world and a vastly different global outlook.

Our Target Date Fund Glidepath Analysis

To better understand the nature and extent of these changes, we leveraged the data that we gather for our proprietary TDF analytics, which allow us to track broad TDF asset allocation trends.

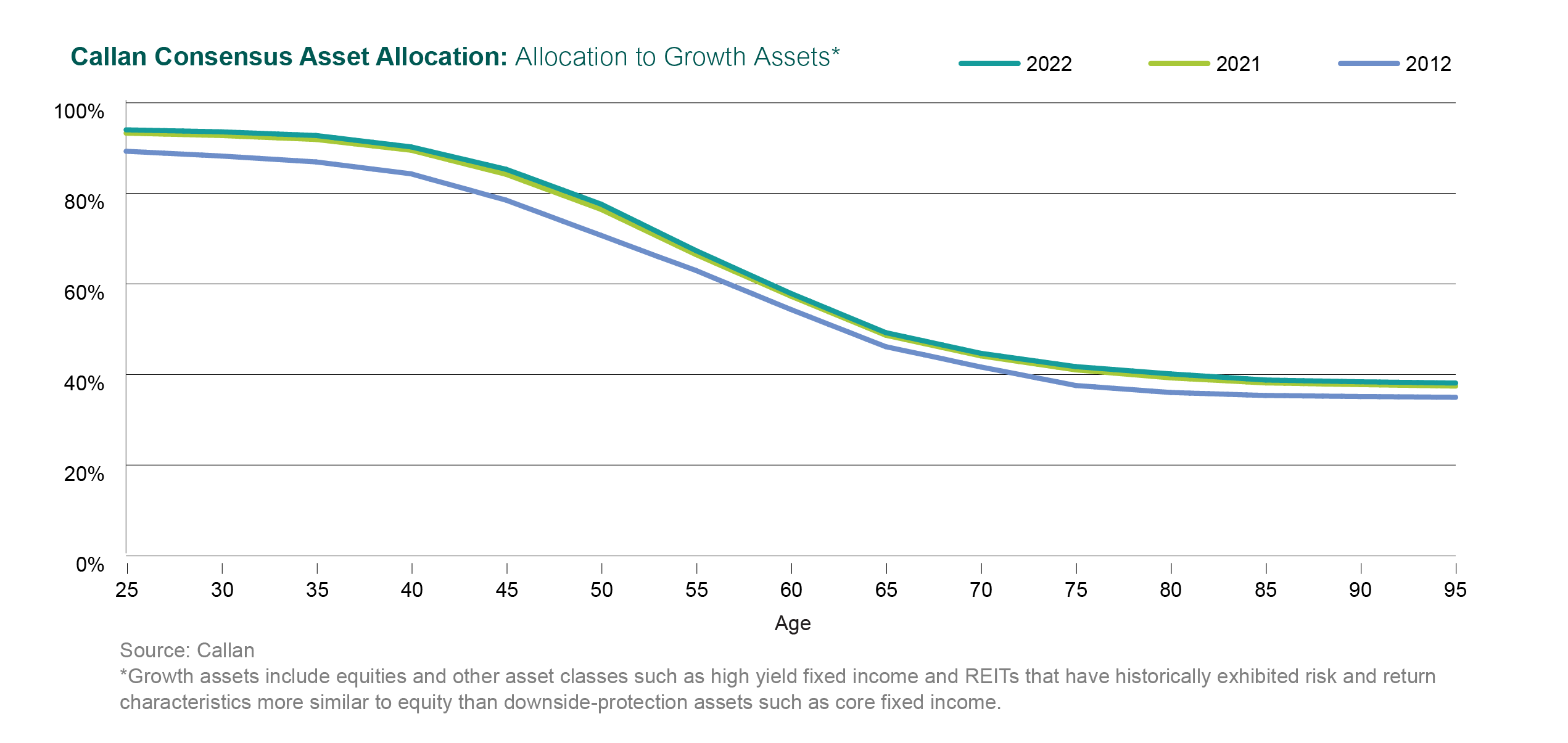

Many providers increased growth asset exposure to help address shortfall and longevity risk. This follows a similar trend displayed over the last 10 years, a time period that saw low expected returns from other asset classes such as fixed income. For example, the allocation to growth assets at age 25 increased from 89% in 2012 to 93% in 2021, and subsequently to 94% in 2022.

We also observed a reconfiguration of exposure within fixed income. Fixed income returns are sensitive to a number of factors, including changing inflation expectations, interest rates, and credit spreads. Participants may be less tolerant to these various sensitivities at different stages of their investment lifecycle. Thus, we have seen fixed income composition get adjusted to target these exposures at various stages along the glidepath. For example, participants early in the glidepath are more able to withstand volatility. Thus, we have witnessed providers increase credit risk within the fixed income allocation at these stages.

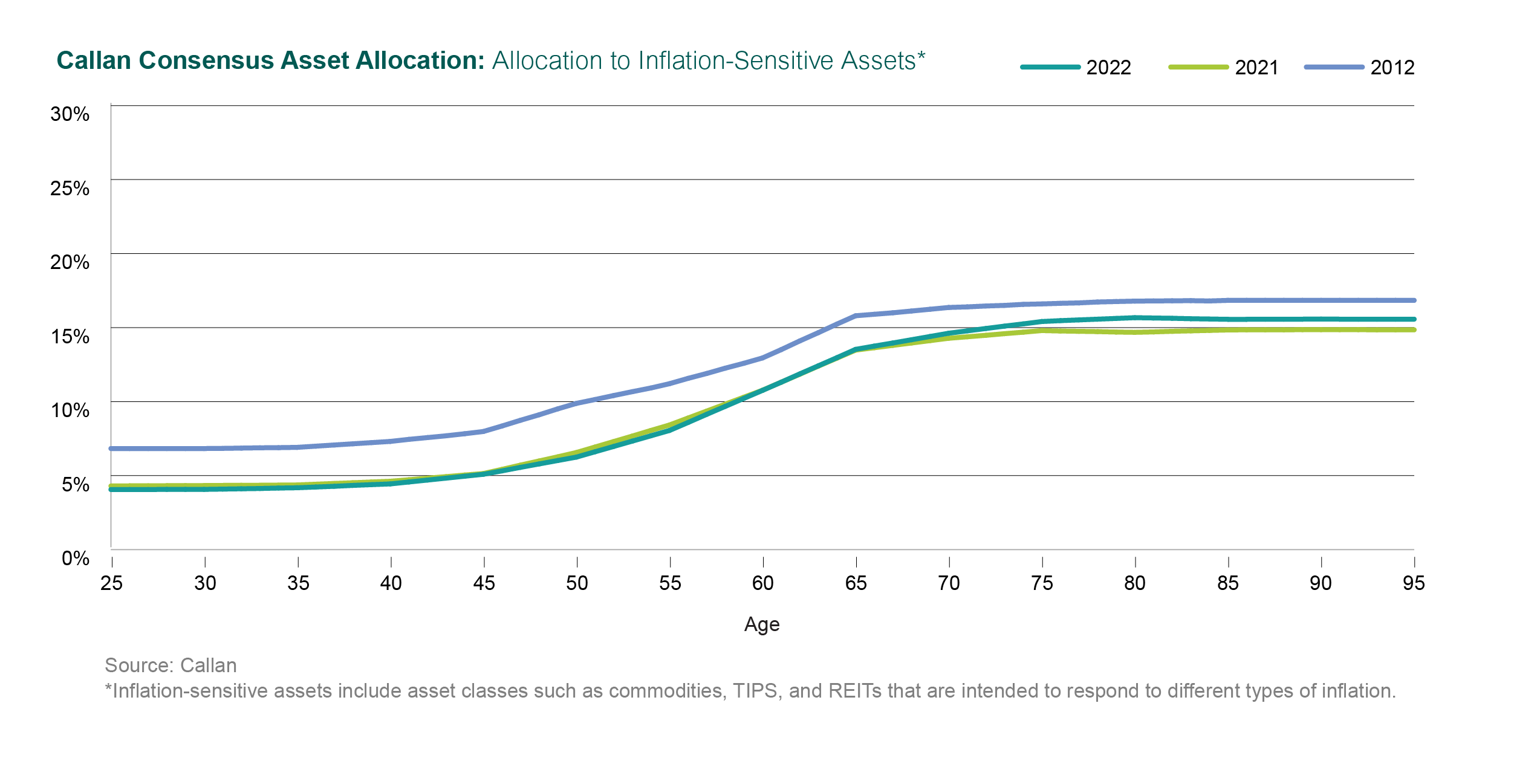

Lastly, we have seen a number of providers increase exposure to inflation-sensitive assets, most notably late in the glidepath. These changes are relevant, as inflation has taken a more prominent role in the minds of market participants amid a marked uptick in both realized and expected inflation over recent quarters. However, as a result of nascent inflation in recent years, exposure to inflation-sensitive assets remains well below 2012 levels.

In conclusion, the last 1½ years were busy for target date providers as they adapted to a changing capital markets environment. As strategic asset allocation plays a critical role in outcomes for participants, researching and evolving the glidepath is of the utmost importance to help ensure participant needs are met. When their TDF manager makes strategic asset allocation changes, DC plan sponsors should seek to understand the rationale behind the changes in the context of the capital markets and participant needs.

Disclosures

Certain information herein has been compiled by Callan and is based on information provided by a variety of sources believed to be reliable for which Callan has not necessarily verified the accuracy or completeness of or updated. This report is for informational purposes only and should not be construed as legal or tax advice on any matter. Any investment decision you make on the basis of this report is your sole responsibility. You should consult with legal and tax advisers before applying any of this information to your particular situation. Reference in this report to any product, service, or entity should not be construed as a recommendation, approval, affiliation, or endorsement of such product, service, or entity by Callan. Past performance is no guarantee of future results. This report may consist of statements of opinion, which are made as of the date they are expressed and are not statements of fact. The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to subsidiaries or parents, or post on internal web sites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.