Subscription credit facilities are lines of credit used to finance activities—such as new investments, fees, or expenses—that would otherwise be funded by capital calls from the investors (limited partners, or LPs) in a private markets fund. These “sub lines” give the fund’s manager (the general partner, or GP) the flexibility to call capital less frequently by combining multiple cash flows into a single capital call, and they also can delay initial capital calls until a large capital outlay is required. This increases the internal rate of return (IRR) as it shortens the effective investment period. Because these sub lines are backed by investors’ capital commitments, though, they do not allow the GP to invest a greater amount of capital than those commitments.

Subscription lines have been popular with real estate funds for many years, but they are becoming increasingly common in private equity and private credit funds. Originally these credit lines were only used for short-term cash needs. Over the last few years, they have evolved into longer-term financing for new investments for many private markets funds. Callan discussed the topic in 2017, but the significant expansion in credit line usage since then merits a renewed examination. According to a recent analysis by Preqin, only 13% of private equity funds in pre-2010 vintage years used subscription facilities, while 47% in the 2010-19 vintage years did. (Given the “private” nature of private markets, different data sources vary widely, and some experts cite recent usage as high as 90%.) The increase in popularity was similar for private credit funds, with only 25% of pre-2010 vintage year funds using subscription facilities versus 44% of vintage 2010 and onwards. In the same analysis, approximately half of real estate funds utilized subscription facilities in both pre-2010 vintages and vintage 2010 and onwards.

As more funds adopt subscription facilities, particularly credit lines that are kept outstanding for longer periods, both GPs and LPs and their consultants are spending more time thinking about the benefits and drawbacks of these products, some of which we have highlighted below:

Advantages

- In normal circumstances, funds with a credit facility may experience a shorter and shallower J-curve because the credit facility can significantly lift the IRR, especially early in a fund’s life. This impact will be reduced as the fund matures and the credit line is paid down, but may still remain elevated compared to the same hypothetical fund that did not utilize the credit line. It’s worth noting that if the portfolio has early impairments funded by the credit line, the leverage effect of the credit line will magnify those losses.

- GPs and LPs will have a reduced administrative burden from fewer capital calls.

- GPs are able to quickly draw capital from one source to close new deals, rather than calling capital over a period of several days from multiple LPs.

Disadvantages

- It becomes more difficult for LPs to assess performance on an IRR basis between funds and benchmarks because credit facilities can artificially boost IRRs, especially as the duration of the credit facilities increases.

- Net TVPI (Total Value (distributions + net asset value) divided by Paid-In capital) will be reduced due to interest and fees related to the subscription facility—in essence the short-term IRR boost comes at the expense of longer-term TVPI.

- LPs can experience delayed cash distributions due to the repayment of credit lines and GPs taking carry much sooner in the fund’s life.

- LPs have an additional layer of analysis to determine their true level of exposure in their private markets programs. LPs may also become unintentionally levered if their exposure does not correctly capture the impact of the credit line, especially if unfunded commitments are invested elsewhere.

- Some tax-exempt investors may realize unrelated business income tax, especially in longer-dated subscription facilities.

- Capital calls will be larger, which could present liquidity challenges, especially in times of stress.

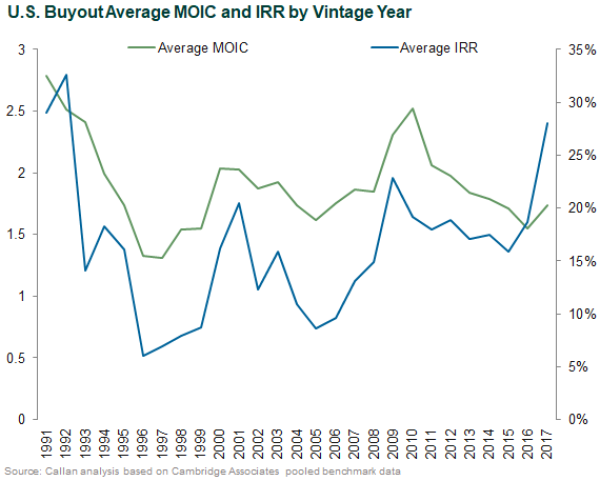

The performance impact of credit facilities is starting to appear in U.S. private equity pooled returns. Callan examined the average multiple of invested capital (MOIC) and average IRRs by vintage year from the Cambridge database. Over the last 10 years, the average MOIC for U.S. buyout funds has steadily declined while net IRR has largely increased.

As these credit lines become more popular, standardization in reporting would benefit both GPs and LPs. In June 2020, ILPA updated its guidance for enhanced transparency and reporting around subscription credit facilities. As use of credit lines grows, investors will benefit from greater transparency and Callan will continue to gauge the impact of such facilities on private markets performance.