This blog post is one of a series excerpted from Aaron Quach’s white paper on rental housing, available at the link above. For other posts in the series, click here.

The vast majority of institutional real estate portfolios are invested in the rental housing sector in some form. The rental housing sector is unique in that it fulfills the basic human need for shelter and therefore benefits from a certain inelasticity of demand not found in most other property sectors.

The rental housing sector is comprised of several different housing types serving various segments of the market, including market-rate multi-family apartments, rent-regulated multi-family apartments (“affordable housing”), manufactured housing communities, single-family rental homes, student housing accommodations, and senior housing facilities.

This blog post will detail issues for institutional investors regarding student housing. Other blog posts will examine the additional sectors as well as implementation issues faced by all of the housing types categorized under the rental housing sector.

Student Housing: Shift in Operators and Developers in Recent Years

Early student housing properties were owned and managed by the universities themselves before private investment in student housing began in the early 1990s, and institutional investors began allocating capital to the sector in earnest following the Global Financial Crisis-induced surge in academic enrollment across U.S. colleges and universities. Over the past several decades, the industry has experienced an increase in private operators and developers specializing in building, owning, and managing student housing. While student housing REITs had been large players in the sector starting in the mid-2000s, the last remaining one, American Campus Communities, was acquired by Blackstone in August 2022 for $12.8 billion.

While some traditional multi-family apartments located near colleges and universities may have some tenancy exposure to students, student housing investments today primarily consist of purpose-built student accommodations. These assets are typically rented by the bed, rather than by the unit, and offer a more tailored experience to students, with individual leases, study areas, fully furnished units, and roommate matching. Some recent high-profile projects described in a paper from SIMCO have featured resort-like amenities such as water slides, lazy rivers, and rock-climbing walls.

The demographics of the prime student housing renter cohort—defined as those aged 20-24 years old—has gradually increased with the aging of Generation Z, to 22.7 million in 2022. The prime renter age cohort is projected to decline slightly, due to Generation Z being smaller than the Millennial generation, representing an estimated 21.4 million in 2035, according to the Census Bureau.

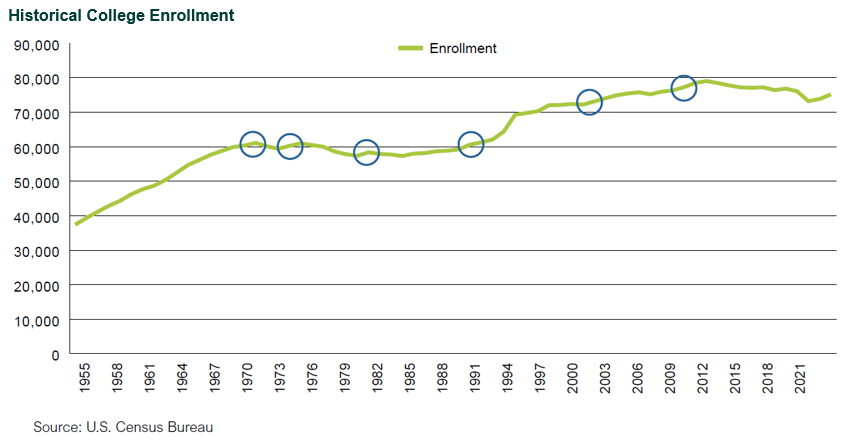

Demand for student housing—much like that of higher education broadly—has historically been considered demand-inelastic and recession-resilient. Student housing demand is supported throughout economic cycles due to the opportunity cost of pursuing education, which falls during economic downturns. This resilience comes from both undergraduate and graduate students who opt to pursue college degrees at higher rates in recessionary environments where the job market is less favorable. As indicated above, enrollment has already begun steadily declining as millennials have aged out of their college years and are replaced by a smaller generation in gen Z. Leading up to the COVID-19 pandemic, college enrollment has historically increased during each of the last six recessions in the U.S., according to the Census Bureau.

While there are several important factors that investors must consider—including operator quality, proximity to campus, competitiveness with nearby housing options, and market liquidity—the selection of the right universities will ultimately be the most significant determinant of success in student housing investment. The demographic-driven decline in college enrollment is expected to drive a bifurcation between higher-tier and lower-tier schools. Tier I universities—particularly those in “Power 5” conferences—and Tier II state schools in high-growth regions are expected to flourish, while lower tier and smaller, private colleges may struggle to drive enrollment growth.

Institutional investors seeking exposure to student housing will find few investable options focused solely on the student housing sector, although dedicated funds investing in both open-end and closed-end fund formats do exist. A variety of diversified funds offer exposure to student housing, including open-end core and core plus funds, diversified closed-end value-add and opportunistic funds, and closed-end residential-focused funds that invest in a range of rental housing types.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.