If interest rates decline, corporate defined benefit (DB) plans face a significant increase in their pension liabilities. They can partially offset, or “hedge,” this increase with their fixed income allocation, since its value would also rise in these environments. Longer-duration instruments (duration refers to the magnitude of a bond’s sensitivity to interest rate changes) can be used to achieve a similar or higher liability hedge with less capital employed than other fixed income options, freeing up resources to invest in growth assets to seek diversification or higher expected returns.

One such liability-hedging instrument are STRIPS (i.e., Separate Trading of Registered Interest and Principal of Securities), which are long-dated U.S. Treasury bonds that have been “stripped” into their components: periodic coupon payments and the final principal payment. In a falling interest rate environment, longer-duration bonds like STRIPS increase the value of the fixed income portfolio by a larger amount than shorter-duration bonds, typically protecting the plan’s funded status and reducing its volatility.

The principal STRIPS are of particular interest because of their especially long durations—the final principal payment is a zero-coupon bond with up to a 30-year maturity and the longest duration of any U.S. government-issued bond available in the public market.

Who Should Consider STRIPS?

STRIPS may be appropriate for corporate DB plan sponsors with:

- A fairly low funded status—perhaps below 80%

- High liability durations—perhaps above 10

- Low allocations to liability-hedging instruments—perhaps below 30% of the total portfolio

- A desire to maintain a significant return-seeking allocation

Extending portfolio duration with principal STRIPS can be a relatively straightforward way to achieve a higher hedge ratio without disrupting the entire portfolio. Some sponsors with lower duration liabilities may also want to consider purchasing coupon STRIPS.

Why Invest in STRIPS?

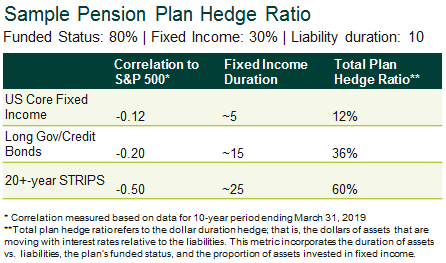

Relative to the Bloomberg Barclays US Aggregate or Long Gov/Credit Bond Indices, STRIPS increase the interest rate sensitivity of the portfolio and therefore allow for better hedging of a pension plan liability. They provide the ability to extend duration with less invested capital but without the use of synthetic instruments. Since these are U.S. Treasury bonds, they usually also better hedge downside equity risk in “flight-to-quality” scenarios when compared to corporate bonds. The table below outlines an example of how hedging and correlations with an equity portfolio can be improved via the use of STRIPS.

Pros and Cons of STRIPS Investing

STRIPS investing can typically improve several asset-liability plan metrics but at the cost of worsening some asset-only portfolio metrics.

Benefits include:

- Strong hedge against liability interest rate risk without use of synthetics

- Flight-to-quality hedge against equity risk

- Reduction of asset-liability risks: improved volatility of both funded status and contributions

- Improved capital efficiency of portfolio

- Liquidity (relative to some synthetics)

Potential drawbacks:

- Increased asset-only portfolio volatility

- Likely to have lower expected asset-only returns than other types of fixed income

- Potentially poor investment performance in rising interest rate environments

- Potential curve risk due to cash flow mismatch

- More expensive to trade relative to un-stripped Treasury bonds (higher bid/ask spreads)

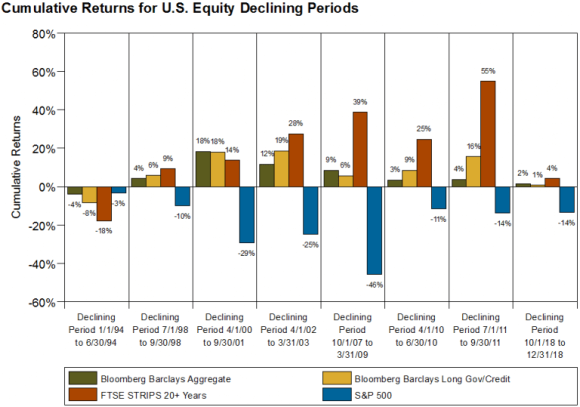

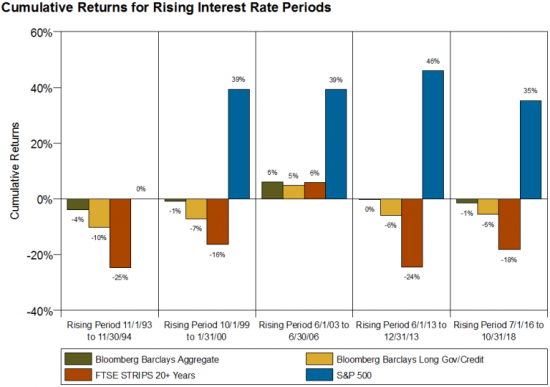

The charts below show historical analysis to support the use of STRIPS as a hedge against equity risk and show the poor performance in the event that interest rates rise instead of fall.

STRIPS Can Provide a Hedge Against Equity Risk

STRIPS May Perform Poorly in Rising Rate Environments

The data in the chart above highlight the importance of managing “regret risk” if interest rates rise shortly after duration extension has occurred. To mitigate this risk, investors could fund STRIPS gradually with ongoing cash flows or dollar-cost averaging, or fund STRIPS incrementally along with a dynamic de-risking glidepath. As always, investors should also closely monitor hedge ratios to avoid over-hedging the liability and perhaps over-purchasing STRIPS.

Implementation Considerations

Plan sponsors should take into account several tactical issues before creating a STRIPS allocation:

- Choosing an appropriate benchmark

- Active vs. passive management

- Liquidity and transaction costs

- Market segmentation, security selection, curve positioning (TBD by asset manager)

- Whether to use securities lending

Some plan sponsors with corporate bonds in their portfolios may be reluctant to sell them in the current environment. For example, plans on a de-risking glidepath (in which the size of the liability-hedging portfolio is nearly certain to increase) may not always need a high allocation to STRIPS to help improve hedging efficiency and may need to eventually re-introduce corporate bonds into their investment policies. In that case they may want to avoid the round-trip transaction costs of selling corporate bonds in favor of STRIPS (only to buy them back later). This issue may be exacerbated by concerns about the future supply of investment-grade credit in the public markets, in light of tax reform and other methods of funding corporate activity.

Note that the magnitude of the additional risk reduction gained by extending duration is likely to dwarf the transaction costs of buying and selling fixed income over the period. However, if this remains a hurdle to implementation, one way to mitigate this regret risk would be to transition only the current government bond exposures into STRIPS, holding onto corporates. While this would provide limited funded status protection relative to a full STRIPS strategy, it would still represent an improvement over a Core or Long Gov/Credit policy.

Wrap-Up

Corporate pension plan sponsors could achieve better liability-hedging and capital efficiency by including STRIPS as part of their investment policies. Relative to synthetics, STRIPS are a less complex way to extend duration and free up capital for growth assets. While there are risks associated with these types of instruments and potential issues with regards to implementation, careful consideration could improve funded status protection and provide better outcomes to plan sponsors.