Sovereign debt performed well in the first quarter amid political uncertainty about the future of the European Union (EU). Emerging market debt outperformed developed market debt for the third straight quarter as the JPM GBI-EM Global Diversified Index advanced 6.50% versus the Bloomberg Barclays Global Aggregate ex-US Index’s 2.48% gain. Returns were bolstered by the U.S. dollar’s drop against most currencies.

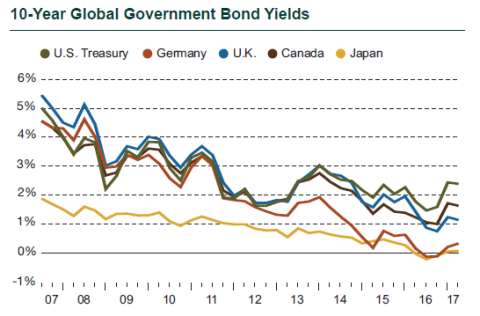

European sovereign bond yields rose in the midst of critical elections and debate over the future of the EU. The safe-haven German 10-year bond climbed 12 basis points to 0.33%, steepening the yield curve to its highest since 2014. France’s 10-year bonds sold off in the middle of the quarter as the markets priced in the risk of a potential victory by presidential candidate Marine Le Pen, who wants the French to vote on whether to leave the EU. The Italian 10-year yield jumped 50 bps to 2.32% as an air of political risk also loomed over Europe’s third-largest economy.

The European Central Bank continued its stimulus efforts, extending its bond-buying program until December 2017 and maintaining interest rates near record lows. Yet there was renewed confidence in the region’s economic health as a result of solid manufacturing data, strength in the region’s labor market, and encouraging inflation news. The euro strengthened against the U.S. dollar, providing some headwind to the hedged Bloomberg Barclays Global Aggregate ex-US Index, which increased only slightly (+0.06%).

In the Asia-Pacific region, Japan’s 10-year yield edged up 2 bps to 0.07%, in line with the Bank of Japan’s goal of maintaining its yield at approximately zero. The Reserve Bank of Australia left rates unchanged despite rapid growth in household debt. The Australian 10-year yield declined 6 bps to 2.70%. Both countries’ currencies advanced roughly 5% against the U.S. dollar.

Emerging markets performed quite well. The U.S. dollar-denominated JPM EMBI Global Diversified Index rose 3.87%, and only three countries out of 65 posted negative returns for the quarter. Mexico, the most heavily weighted in the Index, was the strongest performer (+5.46%). Venezuela was the worst, falling 1.29%. Emerging market currencies also generally appreciated versus the U.S. dollar, accounting for the JPM GBI-EM Global Diversified Index’s 6.50% rise. Argentina reentered the Index in February, and its debt posted the strongest return (+15.60%). Mexico (+13.60%) and Brazil (+9.69%) were also top performers, while Turkey (-0.68%) was the only country to deliver a negative return in the Index.

2.48%

The Bloomberg Barclays Global Aggregate ex-US Index’s first quarter gain.