The private equity landscape has evolved significantly, marked by intense competition and a pivot toward operational expertise over financial engineering. Today’s private equity market demands deep industry knowledge from general partners (GPs), particularly in specialized sectors, to successfully navigate high capital costs and secure valuable deals.

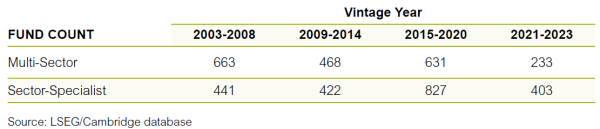

Sector specialization has become a critical differentiator. This trend has spurred the rise of sector-specialist strategies, which have increasingly outpaced traditional multi-sector funds in terms of the number of funds raised since 2013. These specialized funds concentrate on specific industries, leveraging deep knowledge to execute targeted value-creation strategies that potentially offer higher returns.

This blog post summarizes my recent white paper on the topic, which is available at the link above.

The shift toward sector specialization is also reflected in the restructuring of investment teams within multi-sector funds. These teams are increasingly segmented by industry expertise, morphing from generalist to “multi-sector-specialist” approaches. This structural adjustment is driven by the need to compete effectively with sector-specialist GPs for attractive investment opportunities. Many limited partners (LPs) favor these funds because they offer flexibility, enabling investment across multiple industries through various economic cycles.

Over the past two decades, sector-specialist funds have consistently outperformed multi-sector funds across various industries, particularly in technology and health care. My study using the LSEG/Cambridge database illustrates that sector-specialized funds have had a significant performance edge over their multi-sector counterparts in nearly every vintage year since 2003.

Sector-Specialist Strategies and Accessibility

However, the dominance of sector-specialist funds raises concerns about accessibility for larger LPs like public defined benefit plans and sovereign wealth funds. The typically smaller size of sector-specialist funds can pose challenges for these large investors in terms of achieving sufficient exposure without managing an unwieldy number of GP relationships.

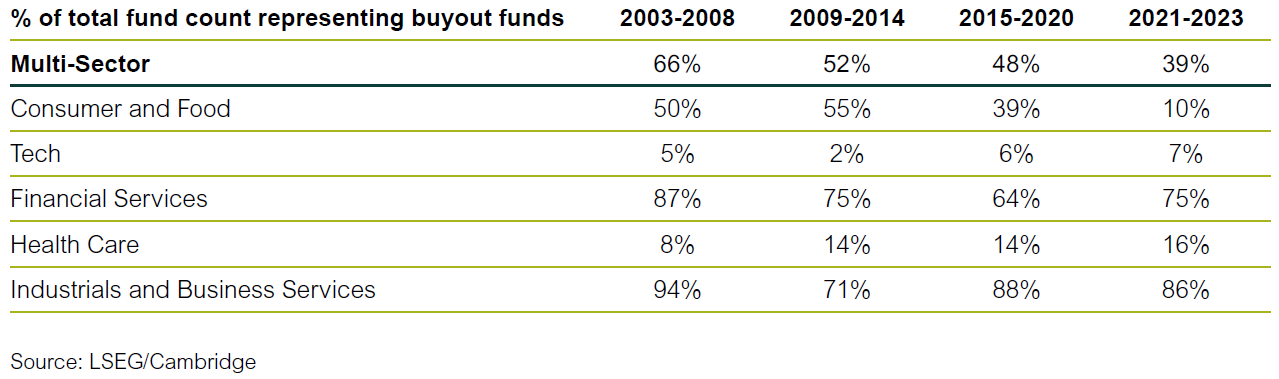

Interestingly, when we drill down into the data to break out sector-specialized buyout funds from venture capital and growth equity funds, we find that sector-specialized funds are far more prevalent in the venture capital and growth equity universe than they are in the buyout universe. Only about 5% of technology-focused fund offerings are buyout funds, on average, translating to about 95% of fund offerings representing either venture capital or growth equity funds. Industrial-focused funds, on the other hand, tilt more toward investing in large cap companies, with 83% of industrial-focused funds representing buyout funds, and 17% representing venture capital and growth equity.

In the context of venture capital and growth equity, sector expertise is particularly crucial given the higher technical risks involved with early-stage investments. For instance, in the fintech sector, GPs must possess a profound understanding of the industry to effectively navigate and exploit AI-driven opportunities.

Additionally, the increased need for technical understanding within each sector among GPs has opened the door for emerging and minority managers to differentiate themselves from more established managers by way of their specific expertise and experience in a space that has not been penetrated by bigger/more established firms yet. LPs have gotten comfortable investing in small and emerging managers for this reason, as access to certain emerging sectors can be limited by networks and technical knowledge and experience, particularly in emerging niche sub-sectors within technology and health care. While not all LPs can directly invest in these emerging managers, the space can also be accessed through a fund-of-funds approach, or by working with a discretionary consultant. Selecting these managers does require a specific skillset, and in every case, manager selection should be very carefully considered.

There is an additional consideration for LPs that desire to access the return enhancement from sector-specialized funds. If the majority of opportunities to invest in sector-specialized funds exist in venture capital and growth equity, higher fees can be expected relative to buyout funds. While the fees associated with sector-focused funds tend to be in line with multi-sector funds, on average the fees associated with venture capital are higher than those associated with buyout funds.

While it is not appropriate for most large LPs to manage a portfolio of sector-specialized funds entirely, it is prudent for large LPs to incorporate sector-specialized funds in addition to multi-sector or diversified funds. This approach should deliver stronger performance than a diversified-only approach. In particular, investors should consider adding industrials/business services and consumer exposure to their buyout portfolios through sector-specialized funds, which should serve to offset some of the overweighted technology exposure in private equity generally.

While tech funds do tend to outperform diversified funds, most of the opportunity for outperformance can be found in venture capital and growth equity, whereas consumer and industrials buyout funds have outperformed multi-sector buyout funds. For LPs with the resources to manage a larger number of GPs in venture capital and growth equity, such LPs would benefit from adding health care-, consumer-, and financial services-focused funds in venture capital and growth equity to their likely tech-heavy portfolios in order to better diversify and enhance overall performance.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.