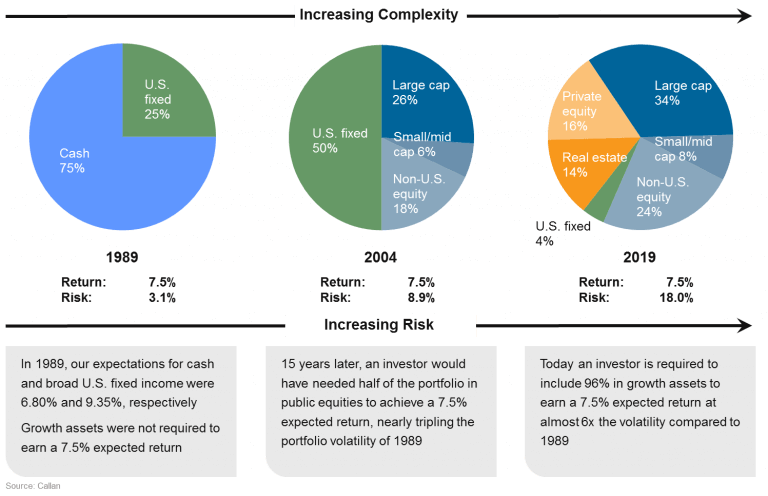

Callan published a paper titled “Risky Business” in 2016 that focused on the challenges faced by investors in the low return environment they found themselves in. The paper received a lot of attention, including from The Wall Street Journal, largely due to the graphic illustrating what was required in terms of asset allocation to earn an expected return of 7.5% over various time periods. Our analysis found that investors in 2015 needed to take on three times as much risk as they did 20 years before to earn the same expected return.

Given that attention and the interest in our work from the institutional investing community, we wanted to update our analysis to reflect current conditions and to extend the comparison over an even longer time period.

As they were in 2015, interest rates in the U.S. and abroad remain near historic lows despite the recent increases in the Fed Funds rate. Coupled with expectations for modest global economic growth, fund sponsors continue to face a difficult investing environment.

To find out how difficult, our experts once again examined what would it take for an investor to achieve an expected 7.5% nominal return over the next 10 years. Using Callan’s proprietary forward-looking capital market projections, we found that investors in 2019 needed to take on almost six times as much risk as they did 30 years ago.

Portfolios seeking high returns are now more complex and expensive than ever. Whereas in 1989 a portfolio made up of just cash (cash!) and U.S. fixed income was projected to return 7.5%, by 2019 to achieve comparable returns that fixed income portion was down to just 4%, with private equity and stocks making up over 80% of the portfolio.

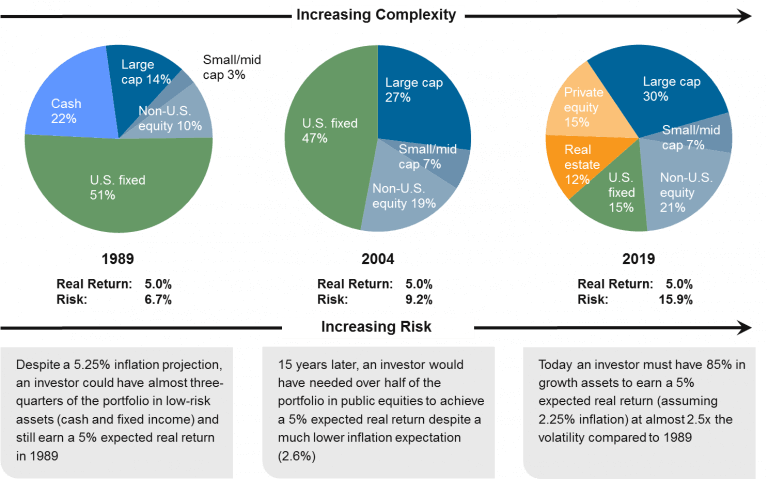

Some would argue that the late ‘80s were a different time, with not only higher fixed income yields but also higher inflation. Therefore, we examined what it would take to earn an expected 5% real return over time given our inflation expectations. The graphic below shows that while the pattern of increasing complexity and associated risk remains the same over the 30-year period, today investors need to take on roughly 2½ times the volatility as they did 30 years ago to earn the same 5% projected real return, versus almost 6 times the risk when matching nominal returns expectations.

While investors are cautiously optimistic that we’re finally returning to a “normal” market environment, fears of an equity market downturn and the impact it would have on portfolios is on the minds of many. Because the future is uncertain, Callan continues to encourage investors to maintain a long-term perspective and prudent asset allocation with appropriate levels of diversification.