I recently wrote an article on risk parity for a CFA Institute publication on multi-asset-class strategies. This excerpt from that article covers all the basics and should put you well on the path to risk parity expertise.

“Risk parity” is a term used to describe investment strategies where capital is allocated across asset classes so that each one contributes an equal amount of volatility to the total portfolio. Because this approach favors larger allocations to lower-returning asset classes, leverage is then used to achieve the desired expected return.

By contrast, the typical institutional investment portfolio employs an unlevered approach where equities typically contribute roughly 90% of the total portfolio volatility. Advocates of risk parity argue that the traditional approach is overly dependent on equities, and therefore less efficient than a more risk-balanced approach. This argument proved compelling in the wake of the 2008 Global Financial Crisis, allowing risk parity strategies to gain significant traction with institutional investors.

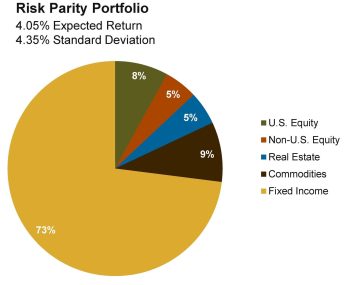

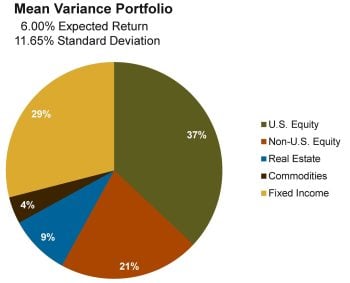

The two pie charts below contrast the allocations of a traditional institutional portfolio (labelled “Mean Variance Portfolio”) and a risk parity portfolio, each made up of the same five asset classes. Return and standard deviation estimates are ex-ante (projected):

As the charts indicate, the expected return for the unlevered risk parity portfolio is roughly 2% lower than that of the traditional equity-focused institutional portfolio. This is due to its relatively large allocation to fixed income and relatively small allocation to equities. In order to achieve the same expected return as the mean variance portfolio, the risk parity portfolio requires roughly one full turn of leverage (100%) given current borrowing rates.

There is substantial empirical evidence that risk parity would have delivered on its promise of higher risk-adjusted returns over the last 25 years. There is also a strong theoretical argument that lower-returning asset classes combined with leverage can deliver higher risk-adjusted returns than unlevered higher-returning asset classes.

Furthermore, as the financial markets have continued to evolve the use of leverage has become increasingly mainstream. This has led to an expansion in the number and types of available leverage instruments, as well as a general decrease in their costs. Together these factors have made the implementation of a risk parity portfolio more efficient today than it has been in the past.

Leverage, however, does not come without its own set of risks and challenges. Maintaining a leveraged portfolio, particularly one with significant scale, during times of market dislocation can prove to be a very difficult proposition. Maintaining the right amount of leverage during periods of volatility and optimizing the mix of leverage instruments are specialized functions that need to be properly resourced. A negatively sloped yield curve, particularly if it is steep or protracted, can also present significant challenges. Finally, the introduction of systematic leverage will require advances in the monitoring, benchmarking, reporting, and risk-management tools employed by institutional investors.

It is not surprising after the Global Financial Crisis that institutional investors took an acute interest in alternatives to equity-centric strategies. The previous 10 years had been characterized by:

- two major crises in the global equity markets,

- a consistently upward-sloping yield curve, and

- a general decline in interest rates.

The combination of these factors created the perfect environment for the risk parity approach to show its value. While concerns around peer risk and the use of leverage have kept large institutions from adopting the approach at the policy level, many of them have carved out smaller strategic allocations to risk parity in an effort to further diversify their overall portfolios.

Practitioners have responded with a wide variety of products and assets managed within these strategies have steadily grown. Questions remain around the use of leverage, specifically around levering fixed income during a period of rising rates or one characterized by a persistently inverted yield curve. Practitioners argue, however, that interest rate risk is but one of many exposures within a well-balanced risk parity portfolio, and that the approach will ultimately show its worth over the long run by delivering on its promise of a higher risk-adjusted return.