This blog post is one of a series excerpted from Aaron Quach’s white paper on rental housing, available at the link above. For other posts in the series, click here.

The vast majority of institutional real estate portfolios are invested in the rental housing sector in some form. The rental housing sector is unique in that it fulfills the basic human need for shelter and therefore benefits from a certain inelasticity of demand not found in most other property sectors.

The rental housing sector is comprised of several different housing types serving various segments of the market, including market-rate multi-family apartments, rent-regulated multi-family apartments (“affordable housing”), manufactured housing communities, single-family rental homes, student housing accommodations, and senior housing facilities.

This blog post will examine implementation issues faced by all of the housing types categorized under the rental housing sector.

While each of the rental housing sectors fulfills the common goal of providing housing, they each offer distinct investment attributes that can be complementary. Diversifying institutional real estate portfolios across one or more rental housing sectors could be advantageous considering these distinct investment attributes. It may be obvious that an investor with a portfolio currently consisting solely of market-rate multi-family apartments could diversify the age of its portfolio’s tenant base by adding senior housing, the income level of their portfolio’s tenant base by adding affordable housing, or both the age and income of their portfolio’s tenant base by adding manufactured housing. However, it is also worth considering the return characteristics of the various rental housing sectors.

Using Performance to Help with Rental Housing Portfolio Construction

NCREIF tracks historical performance for the multi-family sector as well as certain alternative property sectors, including senior housing, student housing, manufactured housing, and single-family rentals, in its NPI Plus Index. NCREIF does not currently provide historical performance for the affordable housing sector. By analyzing the performance history of the sectors included in the NPI Plus Index, we can identify trends that inform portfolio construction decisions.

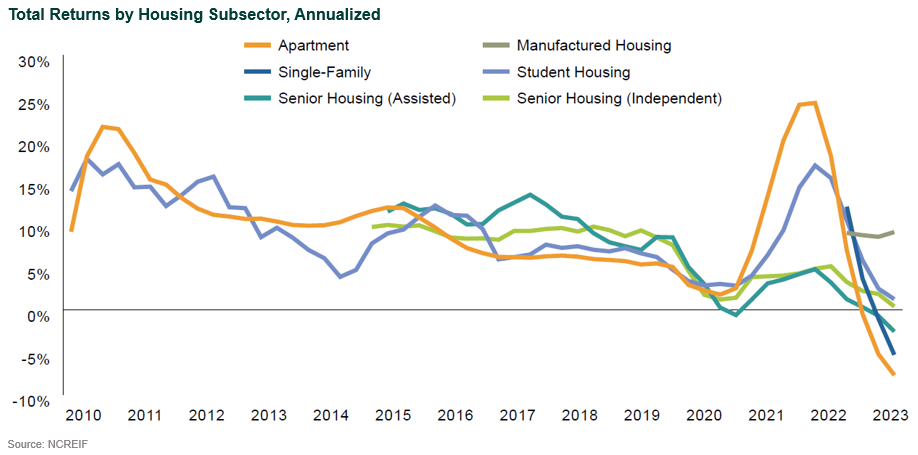

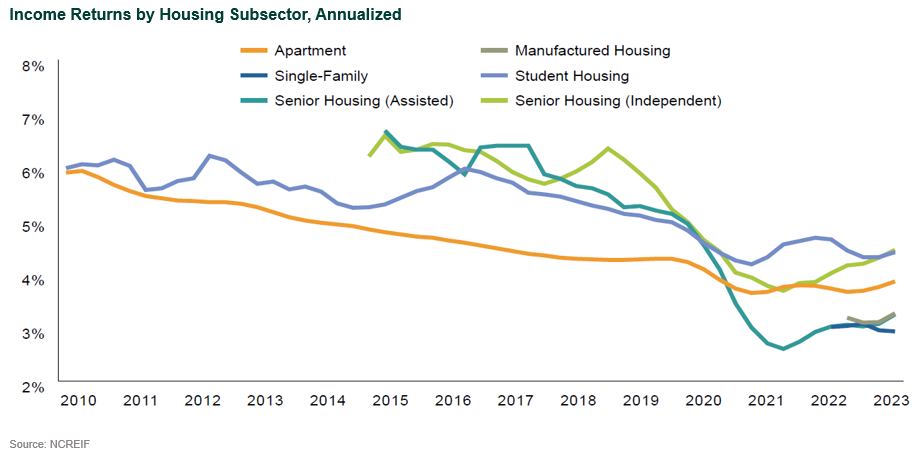

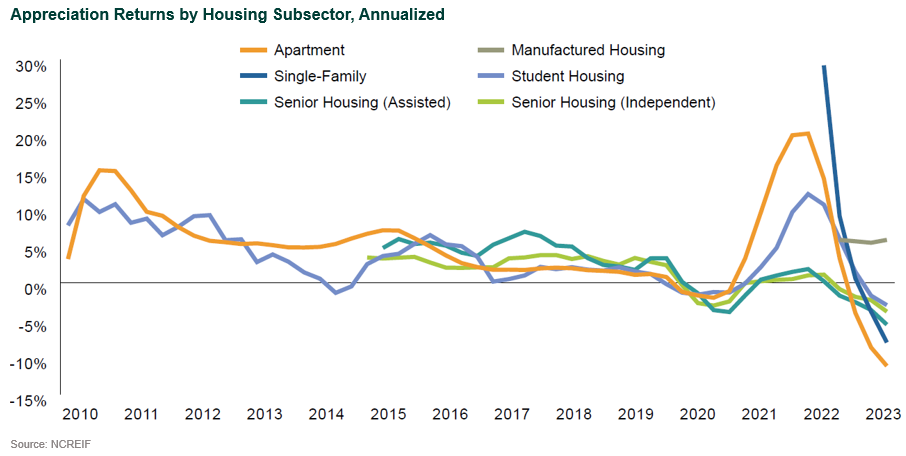

Student housing performance history dates to 3Q10 and has recorded 10 quarters of negative appreciation returns and zero quarters of negative total returns. Senior housing performance history dates to 2Q04 and has recorded 19 quarters of negative appreciation returns and six quarters of negative total returns. Manufactured housing performance history dates to 4Q22 and has recorded zero quarters of negative appreciation returns and zero quarters of negative total returns. Single-family rentals performance history dates to 4Q22 and has recorded two quarters of negative appreciation returns and two quarters of negative total returns. The charts below show the historical total returns, income returns, and appreciation returns of each of the five sectors tracked by NCREIF, as of 3Q23.

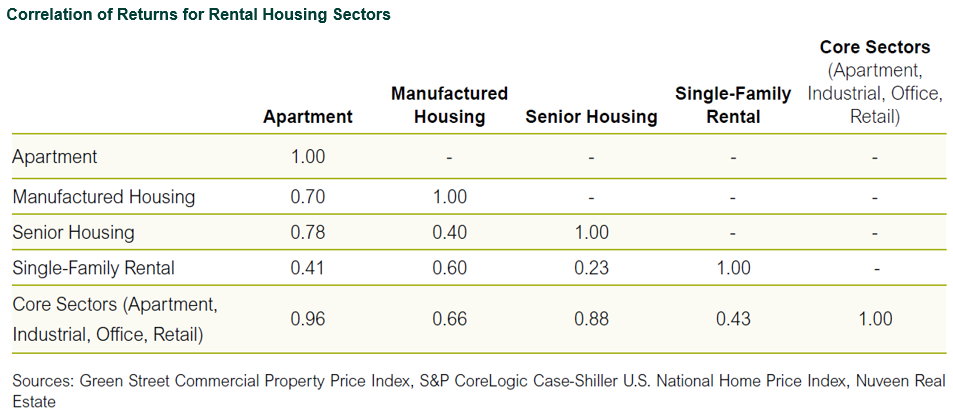

The table below details the correlation of the various rental housing sectors, including apartments, manufactured housing, senior housing, and single-family rentals, from 2Q06 to 3Q23, based on data from the Green Street Commercial Property Price Index and the S&P CoreLogic Case-Shiller U.S. National Home Price Index (for single-family rentals). While certain housing sectors such as manufactured housing and senior housing yield a moderately positive linear relationship to multi-family returns, the relationship is perhaps not as strong as one might assume based on the fact that multi-family, manufactured housing, senior housing, and single-family rentals all serve the same purpose of housing residents.

In addition, the rental housing sectors analyzed also have varying levels of correlation to a composite of the four major property types (apartment, industrial, office, and retail). Diversification benefits that may not be fully captured in the correlation values include differences in tenant age, tenant income levels, tenant sources of income, and geography.

It is worth noting that all housing sectors are subject to headline risk, as the concept of institutional ownership of housing can be contentious in many contexts. Institutional owners can face criticism for unsafe or unhealthy property conditions, rental rate increases, evictions, displacement, and many other concerns.

This headline risk is less prominent in sectors that have been accepted as institutional property types for decades, such as traditional multi-family apartments. In more nascent sectors such as manufactured housing and single-family rentals, these concerns are exacerbated as market participants consider the impact of institutional ownership on the sector overall. In some cases, the vulnerability of tenants can amplify potential concerns, including in the affordable housing and senior housing sectors.

It is imperative that investors targeting rental housing are knowledgeable about these headline risks and select investment managers and operators that are cognizant of the various risks to be considered. Investors should target investment managers that prioritize tenant safety and well-being, employ a reasonable approach to rent hikes and evictions, and otherwise act as responsible landlords. Affordability concerns can often be alleviated in development strategies, where housing supply is being added and therefore is not expected to increase upward pressure on rents or home prices. This is one of the principal arguments for build-to-rent single-family rentals over scattered-site single-family rentals but also applies to the development of multi-family apartments, affordable housing, and other rental housing sectors.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.