Reinsurance has relatively recently emerged as an alternative asset class, one that is more closely affected by the risks of natural catastrophes and not those of the capital markets. As a result, it inherently serves well as a portfolio diversifier. This blog post will introduce the concept of reinsurance and explain why it can be a compelling addition to an institutional portfolio.

What is reinsurance?

Reinsurance is the mechanism by which insurers protect their insured portfolio from large, remote catastrophic risks by creating specialized investment instruments, generally referred to as insurance-linked securities (ILS), and marketing them to reinsurers or alternative capital providers. To compensate investors for assuming these risks, premiums commensurate with the varying level of riskiness can be earned for a finite duration of time.

Why should investors consider reinsurance in their portfolio?

The primary reasons to invest in ILS are threefold:

Real diversification: The performance of ILS is primarily tied to non-financial risks, and this lack of correlation makes ILS an attractive diversifier beside a traditional portfolio of stocks and bonds.

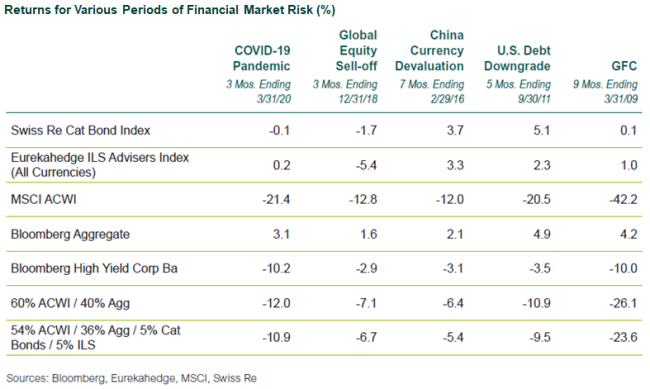

To illustrate the benefits of ILS to a traditional portfolio, the below exhibit highlights periods where equity drawdowns were more than 10%. During these periods, the two most popular ILS benchmarks were flat or positive except during the global equity sell-off in 2018. In contrast, the Ba-rated sleeve of the high yield index was down over 5% in each of those periods. While the investment grade-rated Aggregate index was notably positive, one must consider its future diversification benefit with its current yields close to historical lows.

Attractive risk-adjusted returns: ILS returns have matched or exceeded those of traditional fixed income.

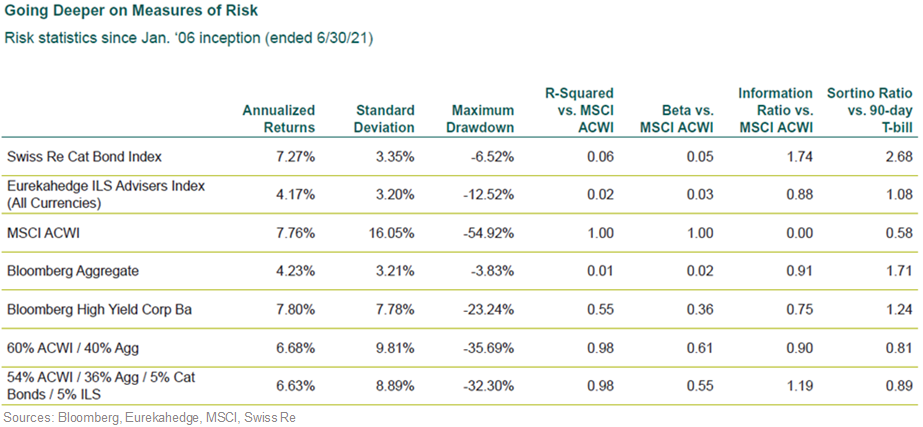

To measure the performance and attractive risk-adjusted return of ILS, the below exhibit shows the two ILS-related indices compared to other general indices. In particular, the higher information ratio (aka appraisal ratio) and relatively low standard deviation and maximum drawdown statistics underscore the attractive performance properties of ILS.

Hedge against inflation and interest rate risk: Since the typical ILS contract has a maturity of one to three years, repricing occurs frequently. Furthermore, the premiums received are invested in short-term securities that generally benefit from rising rates. The risks of higher inflation and rising interest rates will thus be reflected in the next round of policy renewals and priced accordingly. Insurance-linked securities are much less exposed to duration risk than long-term corporate bonds or stocks dependent on long-term earnings growth.

Another factor that should be considered is market timing. While spreads on corporate credits are at cyclical lows, reinsurance premium levels per unit of exposure risk are at cyclically high levels. Unusually large catastrophe risks in recent years have left the industry hungry for new capital. Suppliers of that capital are in a position to negotiate better terms, including higher premiums. The market is relatively attractive for institutional investors.

Callan has just published a research paper that provides a more detailed overview of reinsurance and why institutional investors should consider an allocation, explores how the reinsurance market works, touches on implementation concerns, and ends with a review of available benchmarks. For those who are interested in learning more about the world of ILS, further information can be found on Callan’s website in the abridged and long-form versions of this paper, linked below.