With the return of market volatility, investors are asking whether it is an appropriate time to rebalance their portfolios. Our view: Yes! This sometimes-overlooked procedural discipline is extremely important.

Asset allocation may be the most important decision fund sponsors make as fiduciaries for their investment program. The key to the success of an investment program is maintaining the risk/return profile and adhering to the selected allocation over time.

One way to help maintain the appropriate risk/return profile is to feature the target allocation strategy prominently in a fund’s investment policy statement. This helps to overcome the behavioral inclination to let better-performing assets continue to grow unencumbered over time. The thoughtful action is to take from the managers or strategies that have enjoyed recent relative outperformance and add to the recent underperformers, effectively “buying low and selling high.”

Also, failing to rebalance to the target allocation is a policy decision referred to as “buy and hold.” This action may compromise the risk expectations created during the development of the target asset allocation strategy.

Rebalancing is less about return enhancement and more about managing the risk relative to the target allocation. Over long periods of time, investing in growth assets such as equities is expected to generate a greater return than other asset classes such as fixed income. Left unchecked in an upward-trending market like the one we have experienced since the second quarter of 2009, growth assets will occupy a greater percentage of the fund allocation. But it is at the expense of an expected higher risk profile.

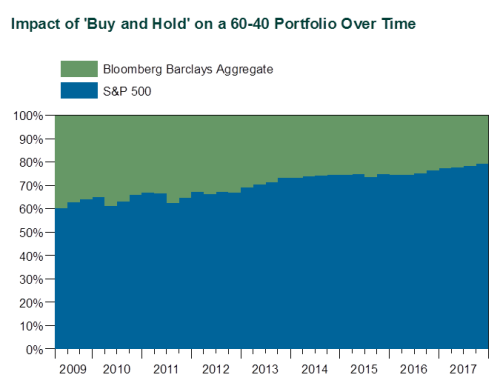

The chart below illustrates the point. A “buy and hold” investor who started in March 2009 with a portfolio of 60% equity/40% fixed income and did not rebalance would have held a portfolio comprised of 79% equities by December 2017. (In this example, equities are represented by the S&P 500 Index, and bonds by the Bloomberg Barclays U.S. Aggregate Bond Index.)

While investors with the buy-and-hold strategy would have enjoyed stronger returns during this period, their risk profile would have changed significantly from their modeling projections. Since the Global Financial Crisis in 2009, the recovery period has been longer than those of the past. And it has been with very little volatility, which would have exacerbated the funding imbalance and perhaps lulled investors into a sense of complacency.

The magnitude of loss in declining markets increases materially when looking at an 80% equity allocation versus a 60% equity allocation. The table below shows the returns in rising/declining markets in the last decade. While more aggressive investors enjoy the rising market returns, they may not be so confident when markets decline. Note that the duration of down markets is short, but the loss of value is significant.

Investors may have perceived the market volatility in February as a disconcerting event, but market turbulence should be expected and is within the normal range. The CBOE Volatility Index (trades as VIX) is a standard gauge of U.S. equity market volatility, and it posted an average value of 22.5 for February 2018. The long-term average of the VIX is approximately 18.5. It is during volatile periods rather than trending markets that investors tend to increase their focus on risk exposures and governance policies. A thoughtful rebalancing policy tends to lessen the anxiety during such periods.

What about implementing a rebalancing strategy?

Once investors are dedicated to the principle that rebalancing is necessary and important, the next decision is implementation—determining the frequency or trigger for the action. There are certainly costs to be considered when rebalancing the fund. Consequently, most practitioners establish rebalancing ranges around their asset class targets (typically 5-10%) to hold down the frequency of rebalancing and associated transaction costs.

Others find designating a specific time (e.g., monthly or quarterly) for rebalancing provides a systematic discipline that removes emotion from the decision. It should be noted that studies have not identified a universally optimal rebalancing strategy or range, but best practice is to include specific rebalancing practices as an element of the fund’s investment policy statement.

Furthermore, regardless of the approach selected, most fund sponsors use cash flows as a way to mitigate the cost of rebalancing. They do this by sourcing cash from asset classes above their targets and directing cash flows to those asset classes below target.

Best practices in rebalancing and other governance policies in fund sponsors’ investment policy statements are among the educational topics that Callan offers through the “Callan College.” For more information about our Introduction to Investments sessions, please click here.

The equity percentage a “buy and hold” investor that started March 2009 with a portfolio of 60% equity/40% fixed income would have held by December 2017.