For many, the new year leads to a fair amount of reflection on the previous year and also a pivot to goals and objectives for the coming year. While public defined benefit (DB) plans tend to focus their investment results around fiscal years typically ending at midyear, they can’t help but look at their investment performance during the very challenging period that was 2022, a year that saw high inflation, unprecedented losses in fixed income, and a bear market for equities globally.

Public DB Plan Returns in 2022

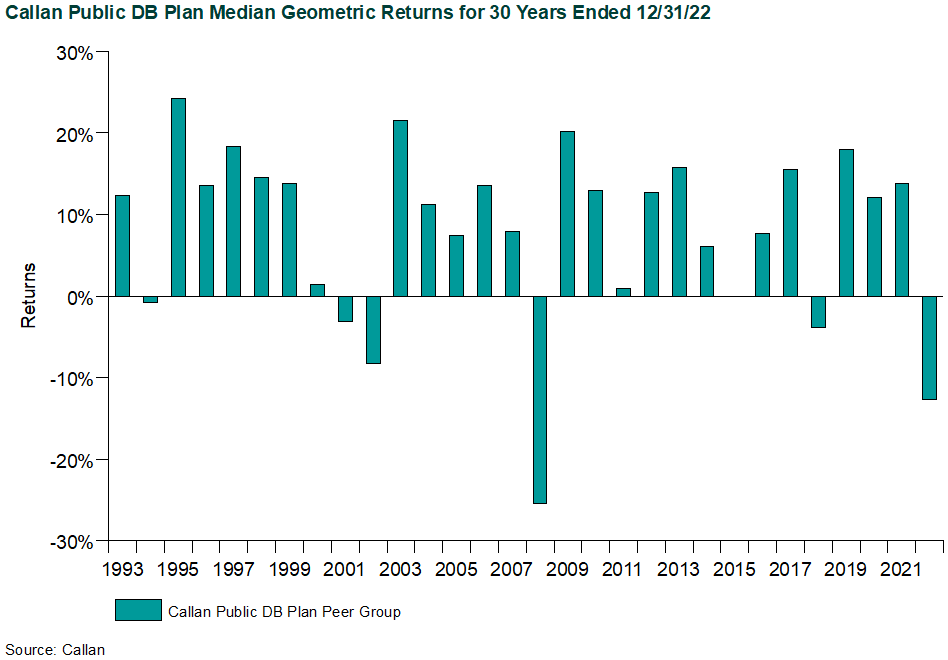

Amid this challenging environment, the median public defined benefit (DB) plan fell 12.7%. As the chart below illustrates, this was just the sixth negative calendar year the median public plan has experienced during the past 30 years. This particular 30-year period includes major economic events such as the busting of the Dot-Com Bubble and the Global Financial Crisis. During 17 calendar years—over half of the time—the median public plan posted double-digit positive returns.

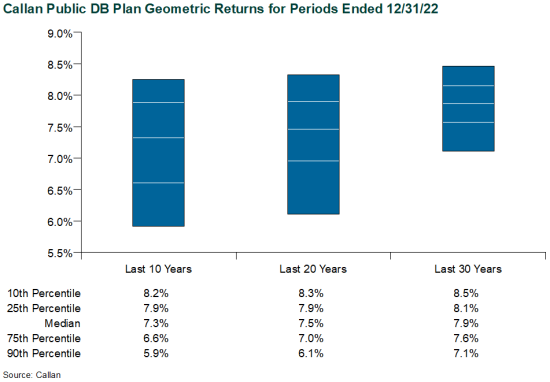

While much can be learned from performance during shorter time periods—and one year is indeed a short stretch of time for investors with long-term time horizons—we should also view recent results relative to longer-term returns. When adding this very difficult 2022 to previous years and viewing the trailing 10-, 20-, and 30-year periods, we see evidence of returns that are favorable when stacked up next to actuarial discount rates, which have ranged from 6.75% to 8% over the last 20 years and which often serve as the long-term investment objective for public retirement plans.

As we digest the full results from a difficult year, and turn our focus to the future, let us not lose sight of the long-term goals for most public retirement plans. It is also important to note that while rising interest rates created losses rarely seen in the bond markets, they have also created a forward-looking investment environment that offers much more compelling returns for bond investors than were available a year ago. For more information on our future outlook, we encourage our clients to view our recent webinar on Callan’s 2023 Capital Markets Assumptions.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.