Private equity activity measures in 3Q21 backed down slightly from 2Q, although totals were still strong. The IPO market for both venture capital and buyouts showed the largest declines as public equity markets flattened in 3Q. All year-to-date (YTD) comparisons are strongly up, not surprising given that the first two quarters of 2020 experienced the brunt of the pandemic slowdown. So far this year, private equity activity has been vigorous, fueled by rapidly rising public equity valuations and very liquid capital markets.

Fundraising: Making Hay

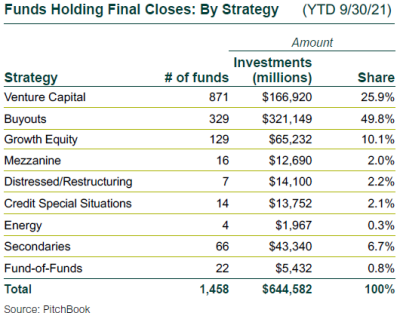

- The number of funds holding final closes in 3Q slowed to 398, down 28% from 2Q; commitments fell to $165 billion, off 32%.

- YTD commitments are running 24% ahead of 2020, with the fund count up 15%. This year could set a new record—at least for U.S. fundraising.

- Venture capital has surged in popularity, accounting for more than one-quarter of new commitments year-to-date. This is a very large change from the two decades after the Dot-Com Bubble.

Buyout Investments: Business Services Shows Strength

- The quarter’s private equity transactions were down a slight 7% to 2,615, and dollar volume fell 2% to $160 billion.

- Three broad industry sectors have dominated 75% of YTD capital deployment. The largest was Business Products and Services (27%), which can be taken as a sign of expectations for continued economic improvement. The other two were Consumer Products and Services and Information Technology.

Prices Level-Out

- Average buyout prices are 12.8x EBITDA through 3Q21, which is essentially flat with the average for all of 2020.

- The average equity investment in new deals of 6.3x represents about 49% of the total purchase price, down from 55% in 2020, indicating GPs are using a little more debt as markets seem to improve.

VC Investments: Fewer but Pricier Rounds

- The number of venture capital (VC) rounds of financings in 3Q fell by 5% to 10,208, but the announced dollar volume increased 8% to $180 billion, the largest quarter this year.

- YTD, the VC count is up 10%, to 32,641. More astonishing, the announced value of VC financings ($496 billion) is more than double the value of those in the first three quarters of 2020.

- Financing of unicorns (VC companies with valuations of over $1 billion) ticked up from the prior quarter with 191, up 24 rounds from 2Q, with the $60 billion of announced funding up $7 billion and representing 33% of VC capital deployed.

- The median pre-money valuations of Seed through Series D rounds continued to increase for YTD 2021 over 2020, with Series D prices up 145% in 2021 to $800 million.

PE-Backed M&A Exits: Both Down and Up

- The flattening public market prices seemed to impact M&A exit counts, but not dollar volume.

- 3Q private equity-backed M&A exits fell 44% by number to 348, but rose 29% by announced dollar volume to $174 billion.

- The specter of new and significant tax hikes, particularly on capital gains, has likely helped to fuel sales processes.

PE-Backed IPOs: Liquidity Persists

- 3Q private equity-backed IPOs dipped with the count slowing 7% to 104, and the total raised off by 18% to $32 billion.

- The amount raised in individual company offerings was consistent with other quarters this year, with the largest being $2.2 billion.

- The YTD total of 304 outpaced last year’s pandemic-impacted 36 IPOs by a remarkable 234%, and the total raised is up 175% to $99 billion.

Venture-Backed M&A Exits: Strong Quarter, Remarkable Year

- 3Q VC exits maintained strength, with the count up 5% to 735, and announced value rising 10% to $57 billion.

- YTD venture-backed M&A exits by count were up 43% to 2,168, and announced proceeds leaped 111% to $148 billion.

Venture-Backed IPOs: Mixed Messages

- While public equity markets were volatile and ended flat in 3Q21, venture-backed IPOs maintained reasonable momentum.

- Following a very strong 2Q, the number of IPOs fell 30% to 119, and the combined new issuance dropped 41% to a still very respectable $43 billion. But YTD figures are significantly ahead of those for the same period in 2020.

- Eyeglass maker Warby Parker was a household-name 3Q IPO, but Wise raised by far the largest amount in the quarter, netting $12.2 billion. But the $37.7 billion Coinbase IPO in 2Q was over three times larger than any other this year.

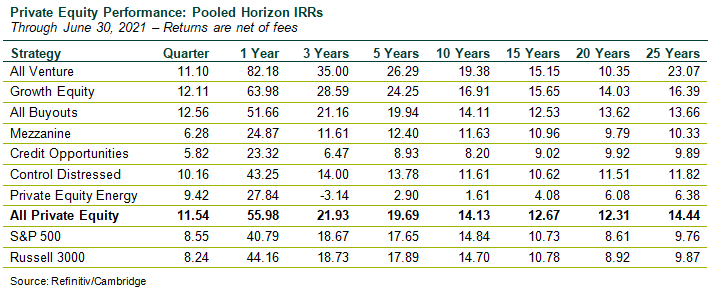

Returns: PE Outperforms Public Equity

- The year ended 2Q21 saw a consistent public equity bull market, with private equity returns even stronger (Russell 3000 Index: +44.2%; Cambridge PE Index: +57.7%)

- Rising equity valuations produced tremendous IPO markets (particularly 2Q, which included the $37.7 billion Coinbase offering) for both venture and private equity-backed exits, with generally strong aftermarkets.

- On a public market equivalent (PME) basis, the Refinitiv/Cambridge private equity database outperformed broad public equity indices over all horizons.