While the institutional investing industry spends enormous time and effort on the details of glide path design for target date funds in defined contribution plans to improve retirement for participants, it might be as important to revisit the role savings plays in determining outcomes.

To underscore this point, Callan analyzed the effect of an increase in a participant’s savings rate from 8% to 9%. Our analysis assumed:

- Use of the Callan Consensus Glide Path

- Starting salary of $40,000

- 40-year holding period (age 25-65)

- Salary growth at CPI +0.5%

By saving an additional 1 percentage point per year (for perspective, that is roughly $8 a week in Year 1), the median income replacement ratio increases from 54% to 60%.

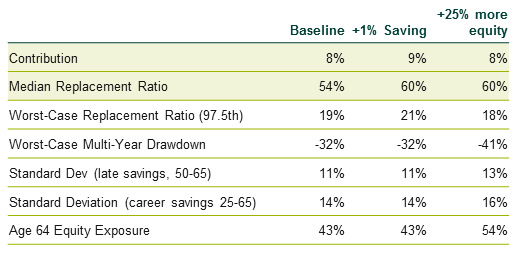

More notably, to achieve a similar increase in the replacement ratio, the equity along the glide path would have to be increased by 25%, by reducing other investments in the glide path on a pro rata basis. One issue to note: The equity increase in the early years of the glide path would be less than 25% because the equity allocation is already so high. And a caveat: even that additional equity allocation still has a 50 percent chance of having less impact than the 1 percentage point increase in the savings rate.

The table below illustrates the impact that equity increase would have on risk characteristics:

The analysis tells a similar story when rates increase more, demonstrating both the power of savings and the impact of auto escalation. Note that results will differ greatly based on the assumed increase and the assumed contribution rate.