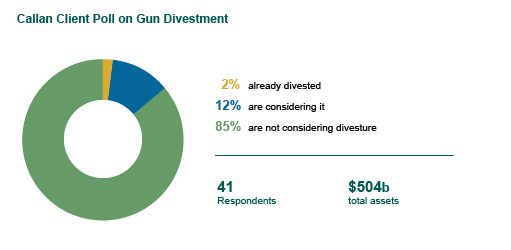

At the request of one of Callan’s large public fund clients, we conducted a timely “micro-poll” last week to understand where these investors stand on the issue of divestiture from gun manufacturing companies (note this poll did not inquire about related companies such as civilian firearms retailers). The poll included 41 of Callan’s public fund clients representing approximately $504 billion in total assets.

Our poll placed funds in one of three categories:

- Those not considering divestiture

- Those considering it

- Those that have adopted a divestiture policy

In this relatively small sample, the overwhelming majority (35 funds, or 85%) are not considering a divestiture policy regarding gun manufacturers. Five funds (12%) are in the second category and are evaluating the question. Only one fund (2%) has adopted a policy to divest from gun makers, which was put in place several years ago.

These results, while reflective of the decisions of a very small sample, highlight a couple of interesting points regarding institutional investors. First, any reactions to the recent heightened press coverage are likely only in their early stages. The fact is that the decision-making time frame (and attention span) for the typical long-term institutional investor is much longer than that of the popular press. This means that, given mounting pressures, we may see a greater percentage of funds formally taking up this issue over the coming months and moving into that second category, but as of now there is little or no sign of it.

Because this is not a new issue, however, these results may also highlight the inherent difficulty that institutional investors (particularly public ones) have in grappling with the conflict of fully meeting their fiduciary obligations while also responding to the social concerns of their beneficiaries and stakeholders.

This particular issue provides an unusual combination of pressures and considerations that may ultimately lead to the adoption of formal changes to investment policies:

- First of all, this seems to be a deeply personal subject for public employees and for teachers in particular (both of which are represented by strong unions and typically have significant representation on public fund boards).

- The second pressure comes from politicians (governors and mayors in particular who often have a say in the make-up of public fund boards), who are eager to demonstrate a decisive and meaningful response to this issue to their constituents.

- The third consideration is somewhat technical, but derives from the fact that gun-related exposure in major indices is extremely small at around half a percentage point for both the MSCI ACWI Index and the Russell 3000 (the majority of which is Walmart, a retailer of guns, not a manufacturer). What this means is that a divestiture policy focused on U.S. gun manufacturers would likely have only a tiny impact on the return and risk expectations for a globally diversified, capitalization-weighted equity portfolio. While this does not completely eliminate the fiduciary considerations around a divestiture policy, it significantly reduces the potential impact on the risk and return of a portfolio compared with broader policies such as fossil fuel divestiture. This will likely give advocates for a divestiture policy some leverage to argue that the social considerations outweigh the fiduciary ones on this narrowly focused issue.

As with every divestiture question, this one presents a number of thorny questions, which we addressed in detail in a previous blog post. Based on the results of the poll, it looks like the industry is just at the very beginning of taking these issues under consideration through the lens of gun violence. Given the measured pace at which institutional investors have (and should) move, we wouldn’t expect them to be resolved anytime soon.

85%

Percentage of funds not considering a divestiture policy regarding gun manufacturers in a Callan poll