Hedge funds and other multi-asset class (MAC) strategies with long and short exposures are a tough act to follow…at least for many fiduciaries investing in these strategies. To showcase their portfolios, managers often use a proprietary language that fits their unique strategy.

Unfortunately, they then don’t sound like each other, making one manager’s performance hard to compare with another. Also, a manager’s performance over time can be tough to assess if evolving exposures do not have familiar and constant reference points about the underlying risks. To solve these problems, Callan believes standardized risk reporting will help such managers of complex strategies communicate better with their investors.

Fortunately, such a standardized risk reporting template exists. It’s called Open Protocol, an industry-backed initiative now supported by the Standards Board of Alternative Investments (SBAI). As a freely available, standardized template within SBAI’s Toolbox (www.sbai.org/toolbox/open-protocol-op-risk-reporting/), Open Protocol is meant to help fiduciaries with their fund governance regarding risk monitoring, if not risk management. Open Protocol provides a consistent format of familiar detail on systematic risk exposures, long and short, across the capital markets, geographies, industry sectors, credit ratings, instrument types, and other common risk factors.

With its consistent structure of risk exposures to enable quick portfolio reviews, Open Protocol is like a playbill that reliably gets a theater audience on the same page as stage performers. Armed with this newfound understanding, fiduciaries will be more likely to “own” the underlying risks as they ebb and flow over market cycles. This risk-reporting tool can also be the basis for aggregating risk exposures across most, if not all, fund sponsor allocations, so its application is not limited to hedge fund and liquid alternative implementations.

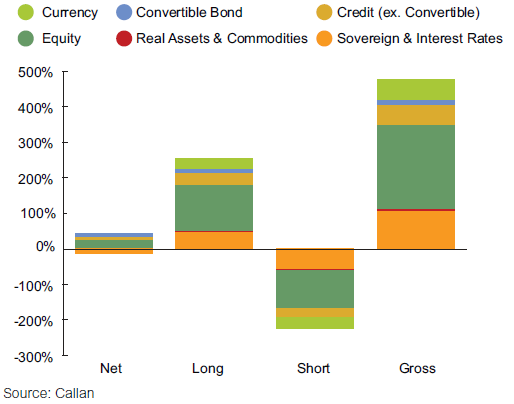

When parsed and aggregated, Open Protocol data can yield key risk exposure insights, whether over time or against other portfolios. To illustrate, we present below two sample illustrations of portfolio exposures derived from Open Protocol reports submitted by managers to Callan. The first chart displays the aggregated exposures (i.e., net, long, short, gross) of 12 large multi-strategy hedge funds across asset classes.

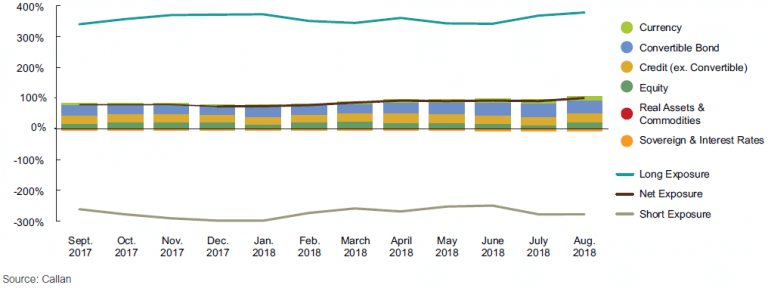

When looking at a timeline of exposure data, we can also get a sense of a fund’s shifting styles or risk appetites related to exposures across risk factors. Below is a timeline of net exposures, broken down by the same underlying asset classes as above, over the 12 months ended Aug. 31, 2018, for a sample manager. Also included for more color on overall risk appetites are the fund’s aggregated long and short exposure levels. In this illustration, for example, both long and short exposures in recent months are increasing, indicating the manager’s growing conviction to add risk on both sides of its portfolio.

The same chart formats above can also illustrate other Open Protocol data types, such as geographic regions, industry sectors, market cap, credit ratings, and instrument types.

Today’s complex investment solutions targeting higher risk-adjusted returns have many more moving parts than those of the past. Whether embodied in hedge funds, MACs, or even multi-manager solutions, this growing complexity presents a challenge to fund sponsors evaluating such investments or a portfolio of such investments. Adding to a star performer who is taking unseen risks can lead to an unexpected fall in the investor’s performance. Terminating an underperformer without adjusting for market hedges or better liquidity can also undermine future performance.

Resources for evaluating and monitoring investments are finite, so efforts to improve the productivity of the fiduciary process while potentially enhancing its decision-making outcome are important. Enter the role of standardized risk reporting. As an increasingly accepted industry standard, Open Protocol provides that standardized risk framework to bring an otherwise hard-to-fathom portfolio to life so that the audience can more quickly and consistently understand an investment opportunity and make a better assessment of risks involved. Otherwise, if the audience misunderstands what the performer is saying or doing, not even Fred Astaire’s fancy footwork can save the show.

For more insights on Open Protocol, including important disclaimers on what is lacking in this standardized risk report, check out the latest issue of our quarterly Hedge Fund Monitor.