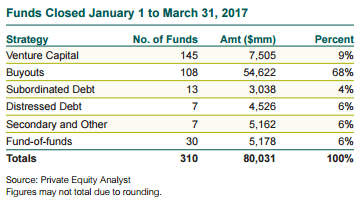

New private equity partnership commitments totaled $80.0 billion in the first quarter, with 310 new partnerships formed, according to preliminary data from Private Equity Analyst. The number of partnerships jumped 75% from 177 in the first quarter of 2016, and the dollar volume rose 51% from $53.1 billion. KKR Americas Fund XII raised the most money in the quarter, $3.1 billion, and its final close of $13.9 billion exceeded its $12 billion target.

Investments by funds into companies totaled 379 deals, up 18% from 322 in the prior quarter, according to Buyouts newsletter. The announced total volume was $35.0 billion, up 24% from $28.3 billion in the fourth quarter. The $6.0 billion take-private of hospital staffing firm Team Health Holdings was the quarter’s largest buyout. Nine deals with announced values of $1 billion or more closed in the quarter.

According to the National Venture Capital Association, new investments in VC companies totaled 1,808 rounds with $16.5 billion of announced value. The number of rounds fell by 5% from 1,898 in the fourth quarter, but disclosed value increased 15% from $14.3 billion.

Buyout M&A exits fell steeply; there were just 117 in the first quarter, down 25% from the prior quarter’s 157, according to Buyouts. Announced deal value also dropped: 30 deals totaling $14.4 billion, off 47% from $27.0 billion in the fourth. Three buyout-backed IPOs in the first quarter raised an aggregate $2.4 billion. The number of IPOs was the same as the prior quarter, but the proceeds increased from $2.0 billion.

Venture-backed M&A exits totaled 132 and disclosed value hit $10.4 billion. The number of exits declined 19% but the dollar volume increased 53% from the fourth quarter, which had 162 sales totaling $6.8 billion. There were seven VC-backed IPOs in the first quarter with a combined float of $4 billion. The fourth quarter also had seven but they only raised $684 million.

18%

The increase in the number of investments by funds into companies from the prior quarter.