After a 10-year bull market in equities, the Global Financial Crisis (GFC) may seem like a distant memory. Yet the financial lessons of those times should be branded into our memory as fiduciaries. As financial markets collapsed, the lack of liquidity across all asset classes had serious consequences and limited the ability of institutional investors to effectively raise short-term capital to meet spending obligations.

Many nonprofits were forced to liquidate assets at deep discounts; some had to sell private assets on the secondary markets; and, in extreme cases, others were forced to borrow. As the crisis continued, spending rates for organizations with flexibility declined, resulting in fewer scholarships, lower grants, reduced staff, and delayed capital investments. As nonprofit portfolios suffered losses in public equity and fixed income allocations, their relatively large allocations to illiquid private investments grew to represent an even larger percentage of portfolios, oftentimes in excess of allowable ranges as defined by investment policy statements.

And allocations to illiquid private assets have only continued to rise over the last decade as investors sought out diversified sources of return in an environment of low capital market projections. While most investor-types have participated in this trend, endowments and foundations have been at the forefront of the movement. According to the NACUBO-TIAA Study of Endowments, between 2007 and 2018 allocations to alternatives have jumped from 40% to 58% for endowments over $1 billion, and from 33% to 41% for those between $501 million-$1 billion, an increase of 45% and 24%, respectively! The pattern is similar for smaller organizations.

Callan believes illiquid investments deserve a place in portfolios for their diversification benefits and differentiated return sources. However, a true understanding of their liquidity profile, and how changes in liquidity may affect the total portfolio and the organization, is critical.

Liquidity management begins with understanding cash flow requirements and constraints. Consider reviewing the following every year:

- What are the cash flow needs of your organization for the next 6, 12, and 18 months to cover mission-related support, the operational budget, capital expenditures, etc.?

- What percentage of that is supported by endowment funds?

- What are the projected inflows, and can they change in a stressed environment?

- How much uncalled capital is outstanding and how much is anticipated to be called in the next 12 to 24 months? The impact of leverage on the uncalled capital must also be reviewed periodically, since it may exacerbate liquidity needs. Managers may be tapping lines of credit in lieu of calling all the capital they are investing. If their lines of credit are pulled, investors can expect larger capital calls.

- Are you maintaining a cushion to fund new investment opportunities during times of financial stress? The inability to fund new investments will further negatively impact long-term returns and portfolio liquidity.

The answers to these questions will help you better understand the amount of liquidity necessary to maintain current operations and ultimately enable you to develop an asset allocation plan consistent with enterprise-level needs. With these questions addressed, we also recommend performing a liquidity stress test.

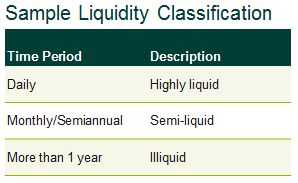

While asset allocation is critical to overall portfolio positioning, understanding your portfolio’s liquidity position also depends on evaluating the underlying investment strategies and vehicles used to implement the investment policy. At its most basic, creating liquidity classifications for each vehicle in your portfolio will offer you a view of where your portfolio stands. Liquidity classifications should be based on the time horizon to liquidate the position, ranging from highly liquid daily publicly traded vehicles to highly illiquid multi-year private investments. Below is a sample classification that can be used as a starting point.

In stressed environments liquidity can change for various reasons. For example, open-ended real estate funds and hedge funds could impose gates, and liquidity can be extended from quarterly to one to two years. In addition, private real estate and private equity managers could extend the life of the fund and delay distributions, and capital calls could increase. A simple classification of your liquidity profile is helpful, but modeling your liquidity profile in both normal and stressed environments will provide insights into how much illiquidity the organization is actually able to tolerate.

Scenario testing is also critical. For instance, assume annual outflows will be taken from liquid investments and build in various negative market scenarios from the probable to the extreme. Consider both quick and shallow events as well as long and protracted. How long could your organization continue to support the mission without disrupting the investment program or reliving the scenarios faced by many in 2008? Does your organization have liquidity buckets designated for immediate cash needs in such environments? Does your organization have a line of credit? (But note, during the GFC many institutions found banks withdrew lines of credit.)

Organizations have increased their allocations to illiquid investments, and concurrently we find ourselves in the longest bull run in the history of the stock market. Given where we are in the market cycle, and the return of market volatility in late 2018 and more recently, now is a good time to re-evaluate liquidity levels and portfolio positioning so as not to relive the scenarios that preceded the last decade.