The NCREIF Property Index advanced 1.55% during the first quarter (1.15% from income and 0.40% from appreciation). This was the lowest return since 2010, eclipsing the fourth quarter’s mark of 1.73%. Appreciation fell for the eighth consecutive quarter and made up less than a third of total return.

Industrial (+2.83%) was the best-performing sector for the fourth consecutive quarter with Retail (+1.56%) and Apartments (+1.30%) also posting positive returns; Hotels (-0.16%) fared the worst and was the only property sector to fall during the quarter. All property sectors posted lower results than the previous quarter.

The West surpassed all other regions for the second quarter in a row, rising 1.96%; the East was the weakest, up only 0.95%. Transaction volume fell steeply to $6.6 billion, a 53% decline from last quarter’s all-time high. This also represented a drop of 13% from the first quarter of 2016. Appraisal capitalization rates stayed mostly flat, increasing to 4.44%, 1 basis point above last quarter’s all-time low of 4.43%. Transaction capitalization rates recovered from the precipitous decline of the fourth quarter and rose from 5.7% to 6.3%. The spread between appraisal and transactional rates increased to 183 bps.

Occupancy rates dropped slightly from the 15-year high in the fourth quarter to 92.96%. Apartment occupancy rates increased slightly while Industrial, Office, and Retail rates decreased.

The NCREIF Open End Diversified Core Equity Index rose 1.54%. This marked a 34 basis point decrease from the fourth quarter return of 1.88%, and was the lowest for the index since 2010. Income accounted for 0.84% of the return, moderating slightly; appreciation (+0.71%, with rounding accounting for the slight discrepancy) fell to a new seven-year low.

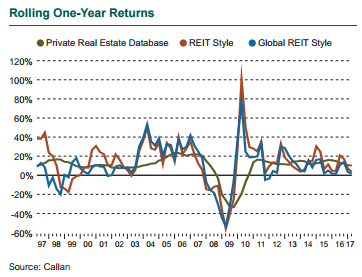

Global real estate investment trusts (REITs), tracked by the FTSE EPRA/NAREIT Developed REIT Index (USD), outperformed their U.S. counterparts and rose 2.29%. U.S. REITs, as measured by the FTSE NAREIT Equity REITs Index, gained 1.16% for the quarter.

In the U.S., REITs enjoyed two months of positive returns to start the quarter before giving some of the gains back with a poor showing in March. Retail (-4.75%) fared the worst, hurt by weak earnings results from large retailers and the fear of store closings because of the emergence of e-commerce. Hotel (-1.90%) and Self Storage (-1.42%) also did poorly. Health Care (+6.92%) recovered from a sharp decline in the fourth quarter on the back of the failure of the new administration to fulfill its promise to repeal the Affordable Care Act. Specialty (+13.23%), Timber (+12.85%), Infrastructure (+12.25%), and Data Centers (+11.45%) all experienced double-digit gains.

Europe, as represented by the FTSE EPRA/NAREIT Europe Index, bested the U.S. in both local currency and U.S. dollar terms, buoyed by a weakening greenback and improving economic data. Markets also reacted positively to the failure of populist politicians to gain power in the Netherlands. As in the U.S., Retail lagged the broader index as e-commerce continued to take market share from traditional retailers.

The Asia-Pacific region beat all others with the FTSE EPRA/NAREIT Asia Index jumping 5.94% during the first quarter in U.S. dollar terms. Singapore and Hong Kong were the major winners, up 17.4% and 16.2%, respectively. In both countries this was mainly attributed to strong performance by their residential sectors.

Commercial mortgage-backed securities (CMBS) issuance for the quarter was down sharply, by 58%, to $11.3 billion from the $26.9 billion in the fourth quarter of 2016. This represents a 42% decrease from the first quarter of 2016 ($19.4 billion).

1.55%

The return of the NCREIF Property Index during the first quarter.