Despite some concerns about preliminary versions of the tax overhaul bill last year, investors in master limited partnerships (MLPs) fared well at the end. Under the old and new tax code, the pass-through nature of MLPs protects investors from double taxation; income is only taxed at the investor’s individual tax rate. The new tax law dropped early proposals to eliminate this tax shield.

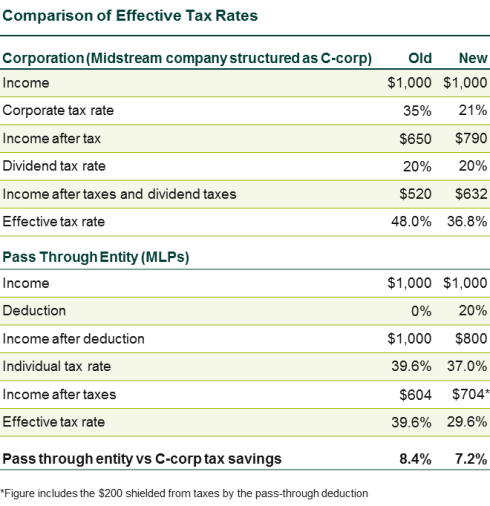

In addition, the new law also provides a 20% deduction on pass-through income. This deduction can effectively reduce the top tax rate on income distributions from MLPs to 29.6%, down from the current top tax rate of 39.6%. This table illustrates a hypothetical scenario and also compares MLPs and corporations under the new law:

In addition, MLPs and their investors may face these significant changes under the new law.

- Lower corporate tax rate: The midstream segment of the energy industry has gradually shifted from the MLP structure toward simpler corporate structures such as a C-corp. The new tax rate of 21% (lowered from 35%) should be positive for the midstream companies that have made this change and may provide another reason for other midstream companies to simplify their corporate structure and lower their cost of capital.

- Immediate depreciation: The new tax law allows qualifying businesses to immediately expense certain equipment and property purchases (100%) through 2022. This may encourage firms to pull forward some of their capital expenditures given the capital-intensive nature of energy infrastructure. For MLPs, this provision should provide an increased tax shield on income since immediate depreciation would lower their taxable income.

- 20% deduction on pass-through income: For MLPs (and other pass-through entities), this deduction means that income distributions could be taxed at the top rate of 29.6% (referenced above) through 2025. However, given the lower corporate tax rate, MLPs now have a smaller relative tax advantage over corporations. For most MLP investors, the 20% pass-through deduction could have a minimal impact since income from MLPs is not counted as taxable income; it is almost entirely treated as return of capital, which reduces an investor’s cost basis.

- High tax burden for non-U.S. investors: The new law requires brokers to withhold 10% of gross proceeds from any sale of MLPs made by foreign investors. Even if the securities are sold at a loss, foreign investors may have to incur this new tax burden.

Callan has addressed the impact of the new law on other areas of the institutional investing industry, including these posts discussing the broad impact, municipal bonds, and endowments and foundations.