By taking into account factors such as outside assets, contribution levels, existence of a defined benefit plan, and risk tolerance, managed accounts offer participants the promise of a more personalized asset allocation. According to Callan’s 2018 DC Trends Survey, just over half of plan sponsors offer a managed account solution, and nearly all who do offer it on an opt-in basis.

But there are often limited choices when it comes to selecting a managed account provider, with recordkeepers typically offering only one or two options. In many ways the situation is reminiscent of the target date fund market a decade ago, when many recordkeepers allowed only their proprietary solutions.

And although prevalence is on the rise, plan sponsors and consultants must be aware that not all managed accounts are created equal. Before offering a solution, plan sponsors must understand that managed accounts differ markedly in their underlying methodology and interface. These differences in turn lead to allocations that could drastically vary. Ultimately, these differences will produce divergent participant outcomes. To be clear, there is no single “correct” methodology; each carries its own merits and deficiencies. But plan sponsors must understand the characteristics of their solution and document the process that led to offering it.

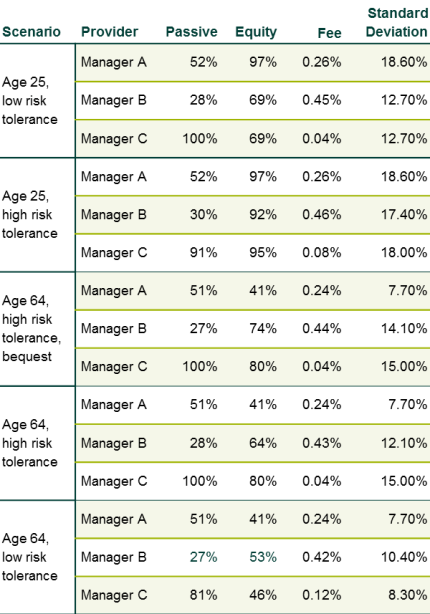

To demonstrate the differences in methodology and outcomes, Callan supplied three leading managed account providers with identical fund lineups, and various sample participants. The table below illustrates the unique characteristics of these sample participants as well as the allocations generated by each of the providers.

As shown, the various providers produced unique asset allocations that differed across aspects such as use of passive strategies, the equity allocation, and fees. These allocations resulted in divergent projected outcomes (represented here by the one-year projected standard deviation). The results also demonstrate the ability of the providers to take into account participants’ self-perceived risk tolerance and unique goals (e.g., desire for a bequest).

In sum, plan sponsors and consultants should evaluate the underlying methodology and functionality of the managed accounts they are considering. Additionally both should continue to press recordkeepers to offer a choice of providers and by extension underlying methodologies.