By Mark Andersen and Jason Ellement

Multi-asset class (MAC) strategies have existed for decades; the first product with an allocation to balanced stock and bond strategies was launched more than 80 years ago. In the 1980s, MAC strategies evolved, moving beyond static into tactical asset allocation. In the 1990s, MAC strategies expanded globally, seeking improved diversification and increased alpha. But these iterations of MACs largely failed to provide adequate downside protection during the 2000-02 bear equity market and 2008 Global Financial Crisis (GFC).

The investment community responded by emphasizing risk management and expanding the MAC toolkit to include shorting and derivatives, as well as untethering them from a static market benchmark (e.g., a 60/40 portfolio), which could sink a strategy in a bear equity market.

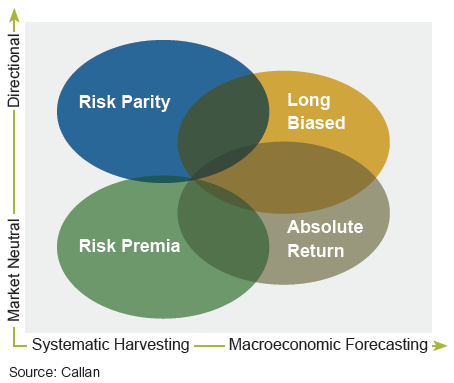

To help investors better understand these outcome-oriented MAC strategies, which vary widely in investment approach, complexity, and targeted outcomes, Callan has developed four broad categories of MACs:

- Absolute Return: Generally lower-risk solutions emphasizing downside protection and using a wide range of return drivers

- Long Biased: Take directional exposure to a wide range of traditional and alternative risk premia, often with a focus on dynamic risk management and downside protection

- Risk Parity: Seek an equally risk-weighted, maximally diversified portfolio allocation, typically across traditional asset classes, to which leverage is applied to achieve the desired return or volatility

- Risk Premia: Focus on systematic exposure to compensated alternative risk premia, such as value, carry, momentum, quality, size, and volatility

Callan classifies MAC strategies into these four categories based on the manager’s investment process/philosophy and metrics such as return, risk, correlation to stocks/bonds, and average stock/bond beta.

Two questions help determine where a MAC strategy belongs in our taxonomy:

- Where on the continuum from “market neutral” to “directional” does the strategy’s market exposure fall?

- What is the basis for the strategy’s portfolio construction, on a spectrum from “systematic harvesting” to “macroeconomic forecasting?”

The answers may be nuanced, and thus categorizing a MAC strategy into one of the four groups may not be a perfect fit. Hence, the MAC groups do overlap, making classification tricky.

But this latest generation of multi-asset class investing is encouraging. They are liquid, transparent, and typically offer a flat fee ranging from 50 to 150 bps. However, short track records, more complexity than traditional asset classes, and lack of a market benchmark make performance evaluation more challenging. In addition, MAC strategies have high implementation risk as long-term success will largely depend on manager skill. And since MAC strategies range widely by approach, Callan expects wide manager dispersion. Investors must build confidence in the investment team and process and be disciplined when the MAC strategy lags in a bull equity market.

For more on MACs, including what is driving interest in them, their implementation, and how they can work with a hedge fund allocation, please see our recent white paper, “All About Outcomes: New Generation of Multi-Asset Class Strategies Focuses on Cutting Risk.”