Welcome to our new blog post series, the Callan Client Question, where our Corporate DB Plan Focus Group shares answers to interesting issues raised by our clients.

Q: “How is the interest rate hedge ratio calculated, and what does it mean if our plan is 100% hedged?”

A: Simply put, the interest rate hedge ratio measures how well the defined benefit (DB) assets move with the liabilities when interest rates change. It is defined as the dollar change in assets divided by the dollar change in liabilities due to interest rate changes. Interest rate hedging involves managing the fixed income assets of the DB plan to ensure the plan is insulated from changes in interest rates.

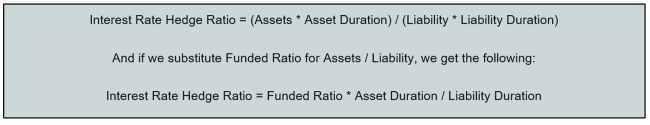

There are two formulaic representations for the hedge ratio:

For a plan whose interest rate hedge ratio is 100% (i.e., 100% hedged), its assets and liabilities should change by the same amount when interest rates change.

Let’s look at a sample plan that is not 100% hedged and how we would get it to be fully hedged.

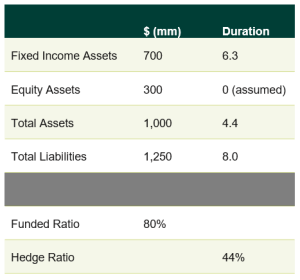

This plan is 80% funded (Assets/Liabilities or 1,000/1,250) and its interest rate hedge ratio is 44%:

Hedge Ratio = Funded Ratio * (Asset Duration/Liability Duration)

or

44% = 80% * (4.4/8.0)

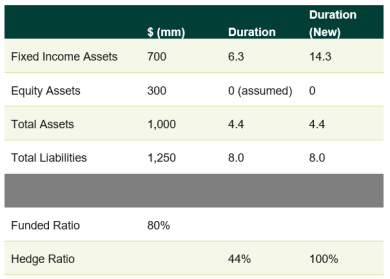

So how do we get this sample plan to be 100% hedged? The only variable in the equation above that the plan has control over is the asset duration (which is controlled by the amount allocated to fixed income and the underlying fixed income duration), so let’s solve our equation to be for the asset duration (and as noted above, interest rate hedging involves managing the fixed income duration only, since equity duration is more complex and outside the scope of most corporate DB plans).

Asset Duration Needed = Hedge Ratio * (Liability Duration / Funded Ratio)

10 years = 100% * (8/.8)

The last step is to calculate the fixed income duration necessary to get the total portfolio to a duration of 10:

Fixed Income Duration = Total Duration / FI % of Portfolio

14.3 years = 10 years/0.7

Now we have a fully hedged plan that is insulated from changes in interest rates. We should qualify this is for parallel yield curve shifts only. Hedging for non-parallel curve shifts and credit spreads can be considered once the equity allocation risk of the plan is not the dominant risk of the plan.

Institutional investors interested in employing an interest rate hedge, to offset changes in the pension liability when interest (discount) rates change, should be aware that while the hedge can protect funded status in falling markets (vs. being unhedged), it can hurt funded status in rising markets. As the funded ratio is the leading indicator for most other pension metrics, they are also being implicitly hedged.

There are additional factors that influence how the interest rate hedge is implemented, including:

- Liability characteristics (plan type, forms of payment, participant demographics)

- Liability to be hedged (ERISA, accounting, termination)

- Funded ratio of the plan

- Desired amount of liability interest rate risk to be hedged

- Beliefs and conviction of the level of interest rates in the future

- Contribution policy (minimum required, static amount, discretionary, etc.)

Implementation of a hedge can be tricky, so it is important that institutional investors fully weigh these factors before proceeding.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.