As MAD magazine’s Alfred E. Neuman proclaims, “What, Me Worry?” In the third quarter, global markets fully embraced that fearless mantra. And why not? Discarding past worries of stubbornly slow economic growth and other trifling distractions, markets focused on positive catalysts suggesting rising prices ahead.

Corporate earnings worldwide enjoyed a notable uptick. Shrinking ranks of unemployed in major economies like the U.S. and the euro zone lifted consumer confidence, even if real wage growth was still elusive. Hopes further rallied around pending tax reform in the U.S. Meanwhile, China’s well-curated markets did not stray far from a message of support for the country’s 19th National Congress, which took place in October, just after the quarter ended. Volatility as a measure of perceived risk reached cyclical lows across the major markets. Amid this synchronicity of global progress, investors seemed unfazed by the twists and turns surrounding North Korea, the turmoil at the White House, and the destructive hurricanes that battered the South.

The S&P 500 Index’s 4.5% jump was impressive, but edgier markets leapt higher. The Russell 2000 Index surged 5.7%. The MSCI Emerging Markets Index soared 7.9% while the MSCI World ex USA gained 5.6%. Investors were more enamored with Technology and other higher beta plays than value-based sectors, as the Russell 1000 Growth (+5.9%) outpaced the Russell 1000 Value (+3.1%). Bond markets held steady, more or less, with the Federal Reserve confirming a measured balance sheet reduction plan. Oil traded modestly higher on tighter projected supply, while the euro gained 3.7% against the dollar. Reflecting geopolitical uncertainties and a marginally weaker dollar, gold added 3.4%.

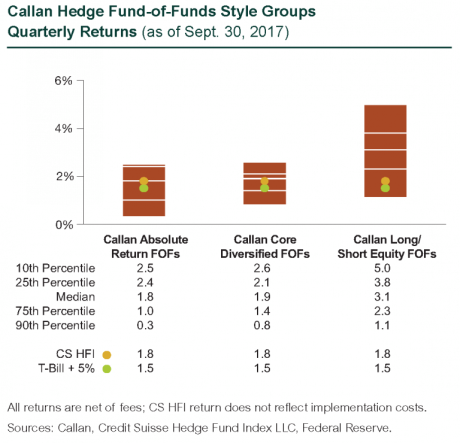

Amid this risk-on environment, hedge funds got some traction. Illustrating raw hedge fund performance without implementation costs, the asset-weighted Credit Suisse Hedge Fund Index (CS HFI) rose 1.8% in the third quarter. As a proxy for live hedge fund portfolios, the median manager in the Callan Hedge Fund-of-Funds Database advanced 2.0%, net of all fees and expenses.

Within CS HFI, the best-performing strategy was Emerging Markets (+5.6%), in which embedded market beta explained some but not all of the gains. Other strategies performing particularly well were Equity Market Neutral (+4.4%) and Long/Short Equity (+3.0%), both of which benefited from an improved stock-picking environment. Although the pace of merger deals slowed recently, Risk Arb (+1.7%) continued to generate attractive risk-adjusted returns. Given relatively little bankruptcy activity, Distressed (+1.6%) achieved modest gains. Managed Futures (+1.3%) and Global Macro (+1.8%) benefited slightly from top-down trends and discretionary calls, particularly in the equity markets.

Within Callan’s Hedge Fund-of-Funds Database, market exposures meaningfully affected performance in the third quarter. Supported by the equity rally, the median Callan Long/Short Equity FOF (+3.1%) handily beat the Callan Absolute Return FOF (+1.8%). With exposures to both non-directional and directional styles, the Core Diversified FOF advanced 1.9%.

Since the financial crisis, liquid alternatives to hedge funds have become popular among investors for their attractive risk-adjusted returns that are similarly uncorrelated with traditional stock and bond investments but offered at a lower cost. Much of that interest is focused on rules-based, long-short strategies that isolate known risk premia such as value, momentum, and carry found across the various capital markets. These alternative risk premia are often embedded, to varying degrees, in hedge funds as well as other actively managed investment products.

Measuring the performance of these alternative risk premia in the third quarter, the Credit Suisse Neuberger Multi-Asset Risk Premia Index gained 0.8% based upon a 5% volatility target. Within the underlying styles of the Index’s derivative-based risk premia, the biggest winner was Equity Momentum (+6.9%), followed by Currency Value (+3.7%) and Currency Momentum (+3.2%). The leading detractor was Equity Value (-2.8%).

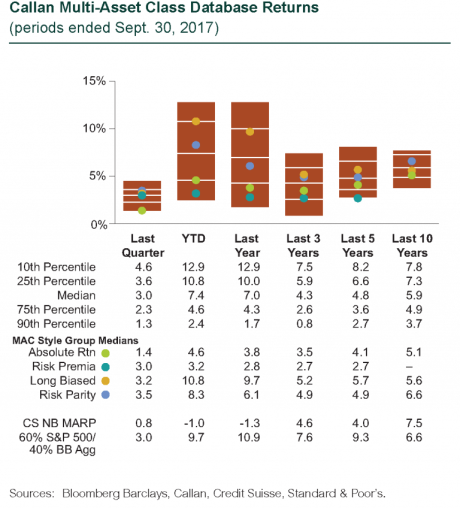

Within Callan’s database of liquid alternative solutions, the median managers of Callan Multi-Asset Class (MAC) style groups generated positive returns, gross of fees, consistent with their underlying risk exposures. For example, the median Callan Risk Premia MAC rose 3.0% based on its exposures to uncorrelated style premia (such as those in the CS Neuberger Index noted above) targeting 5% to 15% portfolio volatility. Typically targeting equal risk-weighted allocations to major asset classes with leverage, the Callan Risk Parity MAC gained 3.5%. Its traditional unlevered benchmark of 60% S&P 500 and 40% Bloomberg Barclays U.S. Aggregate Bond Index trailed with its 3.0% return. Given a usually long equity bias within its dynamic asset allocation mandate, the Callan Long-Biased MAC (+3.2%) marginally outperformed the 60%/40% index. As the most conservative MAC style focused on non-directional strategies of long and short asset class exposures, the Callan Absolute Return MAC edged ahead 1.4%.