Hope may not be a strategy, but it elevated risk appetites in 3Q20. Markets were assured that a second round of massive U.S. fiscal stimulus was coming, despite delays by congressional bickering. To promote risk away from cash, the Federal Reserve locked down any worry of short-term rates rising soon by announcing its intention to allow inflation to run over a 2% threshold that had been an implied ceiling. These commitments to ultra-easy fiscal and monetary policies helped investors see past a pandemic-stricken economy, which is struggling to get everyone back to work and revive consumer spending. The growing promise of vaccines available soon was the “chef’s kiss” to this quarter’s market-lifting optimism that the economic nightmare will soon be over. Late quarter concerns of renewed lockdowns due to rising COVID-19 cases, though, reminded markets of lingering risk.

The impact of hope upon markets was spread unequally, depending on proximity to the expected stimulus. For the quarter, the S&P 500 Index jumped 8.9%, narrowly powered by mega-cap tech, whereas gains in the Russell 2000 and MSCI EAFE Indices were roughly half as much. MSCI Emerging Markets surged 9.6% on the reflationary hopes of China as well as the U.S. Inflation concerns also lifted gold spot prices about 5%, with the U.S. dollar slipping 3.6%. The Bloomberg Barclays US Corporate High Yield Index advanced 4.6% as riskier credit spreads tightened, but 10-Year Treasuries gained nothing in the quarter.

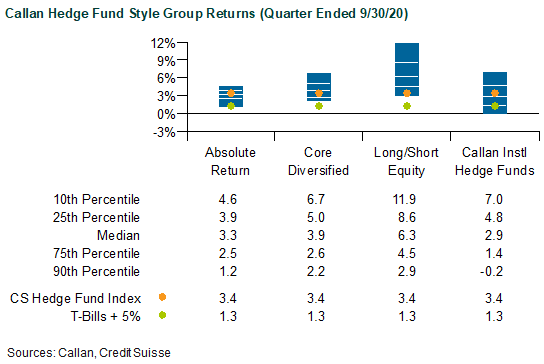

Active bets of hedge funds proved mostly positive due to continued low rates and the potential for additional government stimulus. Representing a paper portfolio of hedge fund interests without implementation costs, the Credit Suisse Hedge Fund Index (CS HFI) rose 3.4% in 3Q20. As a live hedge fund portfolio net of fees and expenses, the median manager in the Callan Hedge Fund-of-Funds (FOF) Database Group advanced 3.7%.

Representing 50 large, broadly diversified hedge funds with low-beta exposure to equity markets, the average manager in the Callan Institutional Hedge Fund (CIHF) Peer Group added 3.1%. The average CIHF fund focused on Hedged Equity grew 4.1%, benefiting from continued stock and sector dispersion. Those more exposed to Hedged Credit strategies advanced 3.1% on average but were still suffering a 2.4% year-to-date loss, as the recovery of illiquid credit lagged more liquid markets. Funds focused on Hedged Rates edged ahead 2.5% in the quarter but still advanced the most year-to-date (+9.7%).

Within the Callan Hedge FOF Group, market exposures notably affected performance in 3Q. Benefiting from beta tailwinds, the median Callan Long/Short Equity FOF (+6.3%) easily beat the Callan Absolute Return FOF (+3.3%), which typically have exposures to less liquid risk premia like credit. With fuller exposure to both non-directional and directional styles, the Core Diversified FOF gained 3.9%.

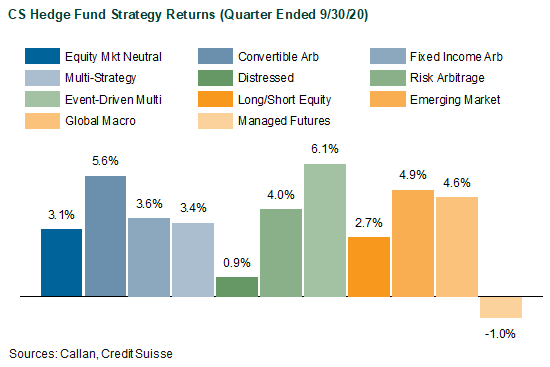

Within CS HFI, the best-performing strategy last quarter was Event-Driven Multi-Strategy (+6.1%), which tends to benefit more in risk-on environments with soft equity catalysts. Another strong strategy was Convertible Arbitrage (+5.6%), as it benefited from unusually strong issuance with discounted pricing. Although the strong bid for risk assets helped, Distressed clawed ahead only 0.9% with its deep value assets mired in COVID-stricken parts of the economy. Without any meaningful asset class trends to track, Managed Futures (-1.0%) was the only CS HFI strategy that lost value.

Since the Global Financial Crisis, liquid alternatives to hedge funds have become popular among investors for their attractive risk-adjusted return potential that is similarly uncorrelated with traditional stock and bond investments but at a lower cost. Much of that interest is focused on rules-based, long-short strategies that isolate known risk premia found across the capital markets, such as value, trend, and carry. These alternative risk premia are often embedded, to varying degrees, in hedge funds as well as other actively managed investment products.

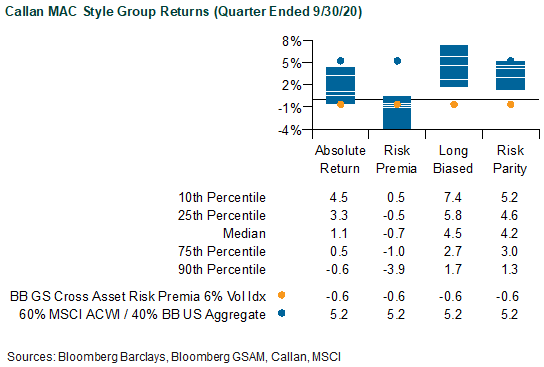

Measuring the performance of alternative risk premia in the third quarter, the Bloomberg GSAM Risk Premia Index (RPI) lost 0.6% based upon a 6% volatility target. Among the index’s unlevered components of risk premia, the biggest detractor was U.S. Equity Value L/S (-6.5%), which has now fallen 22.8% YTD. Another big detractor within the RPI was Currency Carry (-2.4%), in which European funding currencies notably strengthened versus other higher-yielding currencies. As the risk premia that often complements the performance of value, U.S. Equity Momentum L/S gained 3.2%.

Within Callan’s database of liquid alternatives, the median managers of Callan Multi-Asset Class (MAC) Style Groups generated mixed results, gross of fees, consistent with their underlying risk exposures. For example, the median Callan Risk Premia MAC fell 0.7% based on its exposures to alternative betas (such as those in the Bloomberg GSAM index noted above) targeting 5% to 15% portfolio volatility. Typically targeting equal risk-weighted allocations to major asset classes with leverage, the Callan Risk Parity MAC (+4.2%) trailed the traditional unlevered benchmark of 60% MSCI ACWI and 40% Bloomberg Barclays US Aggregate Bond Index (+5.1%) that was less impacted by a stalled bond market. Though usually long equity bias within its dynamic asset allocation mandate, the Callan Long-Biased MAC (+4.5%) similarly underperformed the 60%/40% index. As the most conservative MAC style focused on non-directional strategies of long and short asset class exposures, Callan Absolute Return MAC edged ahead 1.1%.

Given the quarter’s elevated hopes driving up risk assets amid deep uncertainty, the outlook for hedge funds and alternative betas remains ripe with potential “alpha” catalysts. Active trading will need to reconcile any inconsistencies of security valuations between economic winners and losers in the unusually murky future ahead. In such a market setting, strategies of macro, relative value, and event-driven trades are well positioned to play a diversifying role for the traditional long-only investor with muted return outlooks for both stocks and bonds.