Listen to This Blog Post

As we wrapped up the first two months of 2025, one trend has been crystal clear: The transition in market dynamics that started in March 2022—characterized by higher interest rates, rising inflation, and deglobalization—is starting to accelerate. January began on an optimistic note, as corporate earnings and solid economic data pushed markets higher and dampened potential inflationary concerns. February saw the “Magnificent 7” face declines as investors began to rotate into sectors such as Financials, Industrials, and Health Care. Tariffs and trade war rhetoric began to bubble up in February as it was becoming clear that there is a trend toward deglobalization and trade protectionism, which tend to be negative for markets.

Hedge Funds in 2025: Here’s What to Expect

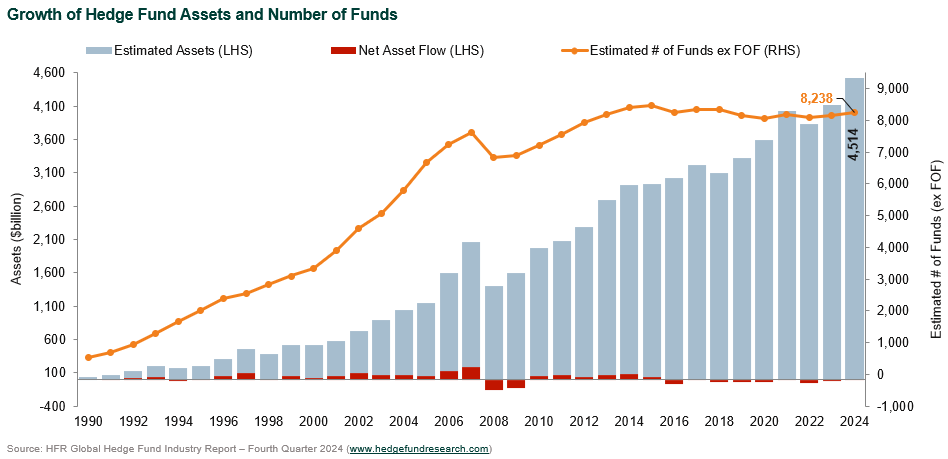

This change in market dynamics has led to higher levels of company-specific risk, and, in Callan’s opinion, an improved opportunity set for hedge fund managers. According to HFR, total global hedge fund capital ended the year at an estimated $4.5 trillion, an increase of $53.5 billion over the prior quarter and $401.4 billion for the full year. Hedge fund managers received allocations from institutions looking to diversify their long-only equity and fixed income exposures. The 2024 increase is the highest since 2021.

Here are the five major trends shaping the hedge fund outlook for 2025.

- Normalized interest rate environment: With risk-free rates now at 4%-5%, hedge fund strategies with meaningful cash holdings (e.g., market-neutral, long/short equity, arbitrage strategies, and macro) now generate an attractive short-interest rebate, providing a buffer to returns. Strategies like fixed-income arbitrage and relative value function better when short-term rates are positive, resulting in a higher carry on these strategies that make them more attractive.

- Hedge funds as a portfolio diversifier in an era of high correlation: The traditional 60/40 model failed in 2022, as both stocks and bonds declined simultaneously. This breakdown in diversification highlighted the necessity of alternative strategies that are uncorrelated to traditional assets. With increased market dispersion, fundamental long/short equity strategies can capitalize on sector and stock-specific divergences. Macro strategies tend to outperform in periods of inflation and volatility, providing a hedge against a broader market downturn.

- Disintermediation of traditional lenders: Higher interest rates and regulatory constraints have made banks more reluctant lenders, allowing hedge funds to step in via credit risk transfer transactions and outright loans to companies. Though there has not been an outright distressed credit cycle, there has been a slight uptick in defaults, and companies are now being forced to refinance debt at higher rates. Stress has been growing on companies that are being forced to refinance debt. Credit-focused hedge funds tend to thrive on these event-driven inefficiencies.

- Higher dispersion in equity markets improves alpha generation: For much of the post-2008 era, passive investing dominated as easy monetary policy lifted all assets indiscriminately. Now, as higher interest rates have set in, company fundamentals matter again, benefiting skilled active investors. The gap between strong and weak companies is widening, allowing fundamental long-short managers to take advantage of stock mispricings. (My colleague Tony Lissuzzo did an extensive blog post on this topic, “Is This a Time for Active Managers to Shine.”)

- Liquidity constraints in private markets: Over the past decade, many institutional investors significantly increased their allocations to private equity, real estate, and venture capital. However, these asset classes are now encountering liquidity constraints. Hedge funds provide a more liquid alternative to private equity-like strategies while maintaining the ability to capitalize on distressed and opportunistic investments.

Wrapping It Up

For institutions managing diversified portfolios with long-term horizons, Callan believes hedge funds can play a critical role in enhancing risk-adjusted returns for those comfortable paying the fees that go along with those managers. Hedge funds have the ability to add non-correlated return streams to institutional portfolios that protect against traditional long-only asset class sell-offs. Strategies such as macro and relative value trading tend to perform well when the market becomes volatile and dispersion increases across asset classes. Compared to private equity and venture capital, hedge funds offer better liquidity while still having the ability to be opportunistic around event-driven situations.

Increased market dispersion, normalized interest rates, and increased volatility tend to favor active management, making hedge funds more attractive. Though there is not a discernable distressed cycle, credit market opportunities—as companies must refinance in a higher interest rate environment—offer attractive rates of returns for hedge funds. Given these structural shifts, institutional portfolios could maintain or increase hedge fund allocations to optimize risk-adjusted returns in the evolving investment landscape.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.