In addition to the seismic shifts in the geopolitical and economic order caused by Russia’s invasion of Ukraine in late February, the war has caused major swings in global asset prices across equities, fixed income, currencies, and commodities. Market uncertainty remains at an all-time high, as participants try to figure out what the outlook is for both Russia and Ukraine as this punishing conflict and tragic humanitarian crisis continues on.

Hedge Funds and Ukraine: How Managers Have Done

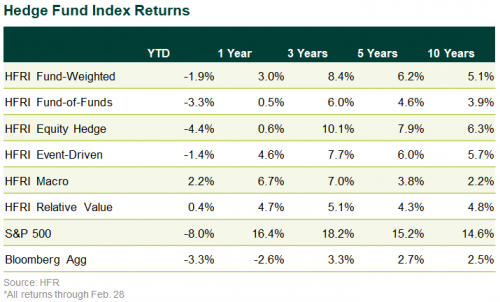

In this post I want to provide an analysis of the performance of hedge funds year to date (YTD) through the end of February, categorized by strategy type, and how they have been grappling with this crisis:

- Macro managers have performed well, as they have been able to correctly position their funds to profit off the increase in global market volatility across asset classes. Commodity trading has been the most profitable this year, as oil and natural gas have soared due to the Eastern European conflict. Managers remain active traders in the energy complex, in addition to trading other commodities like wheat, nickel, gold, soybeans, and corn. Many managers are wagering that food costs and gasoline prices will remain elevated through the summer months, as a lack of exports from Ukraine and Russia pushed prices higher over the past few weeks.

- Relative value managers are up on the year slightly. Managers focused on interest rate-sensitive strategies tended to do better as volatility has increased across the yield curve in anticipation of the Fed’s just-announced decision to hike rates by 25 bps despite the ongoing conflict.

- Event-driven managers have been down on the year, as long equity positioning with a tilt toward technology has been a drag on performance, while credit positioning has offset some of those losses.

- Equity hedge managers have had a rough start, as those with a growth focus have gotten hit hard, a continuation of what occurred over the final few months of 2021. According to Morgan Stanley Prime Brokerage, overall alpha from equity hedge managers YTD has been negative, as long alpha across almost all sectors is down, with the only two exceptions being utilities and energy. But equity hedge managers with a focus on value stocks and those active in energy and basic materials have seen strong performance.

Though we are only two months in, hedge funds have provided protection in the current drawdown when compared to the S&P 500 Index. Callan expects global volatility to remain elevated and will continue to follow the industry closely to see how it compares to broader market indices.

As Callan has spoken to a number of managers over the past few weeks, we have come away with a few main themes. Hedge funds are not looking to get involved with Russian debt or equity, and for those with positions going into this conflict, they have written those positions down. The majority of managers are well aware that wading into distressed Russian debt or equities would create headline risks and far outweigh any gains that could be made on those positions.

What we have seen from managers, especially in macro, has been trading in commodities. Managers expect to see volatile prices across the complex while the conflict continues in Eastern Europe and as supply/demand dynamics dominate trading. Managers are also trying to figure out what multiple rate hikes by the Federal Reserve coupled with the ongoing conflict in Eastern Europe will mean for asset classes. As global markets appear poised for further turmoil, the hedge fund community will be under intense scrutiny to see how it navigates this uncertain environment.