For the first time in more than a decade, hedge funds posted consecutive years of double-digit gains, and they appear to have strong momentum going into 2022 despite much higher market volatility.

Given this development, and the renewed interest it has spurred in hedge funds as an institutional asset class, I wanted to offer a forward-looking view on the hedge fund outlook for 2022, identifying market themes that Callan believes have the potential to drive investment opportunities for hedge fund strategies for the balance of the year. This outlook is meant to provide observations for institutional investors with hedge fund allocations and for those that have started discussions about adding them to their portfolios.

This blog post is a summary of my recent white paper on this topic, available at the link above.

A Shift in the Market Environment to Start the Year

What has become clear over the past 12 months has been a substantial shift in trading in the equity markets. Growth sectors like biotechnology and unprofitable technology stocks started falling in November, with further acceleration in December followed by a difficult January. Equity hedge (long/short) funds, which had long books of growth-biased stocks, saw substantial declines over that timeframe. We expect volatility to persist in the markets as rising rates and geopolitical concerns are likely to remain in the news for the foreseeable future.

As the correction in the S&P 500 continues, generalist long/short managers should be well positioned to pick winners that are attractively priced and have strong fundamental projections. We suspect that bouts of macro-fueled volatility will make it harder for fundamental managers throughout this year as factor rotations and deleveraging may make it more difficult to profit from alpha opportunities.

Short selling has taken a back seat over the past few years due to the strong returns in the equity market. That appears to be changing quickly, to judge from 4Q21 performance and the start of 2022. If elevated market volatility and dispersion among companies continues, we may be entering an environment that favors managers which have a track record of successfully shorting companies based off fundamentals. Risks remain, and managers must still be watchful for short squeezes.

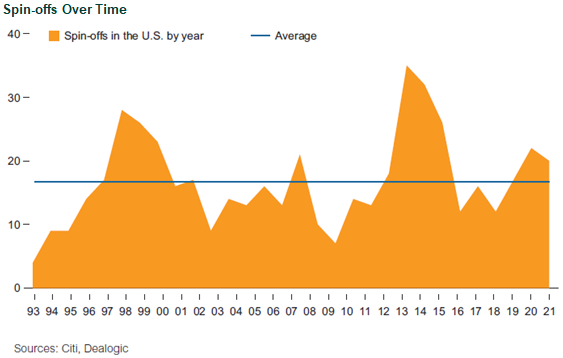

Event-driven strategies wrapped up a strong 2021 as credit spreads remained relatively subdued despite the volatility in interest rates and equities. Managers were able to monetize legacy stressed/distressed positions and played a few new distressed positions. The M&A market remained very active throughout the year, as 2021 volume eclipsed $5.8 trillion, 66 percent higher than 2020 and nearly 25 percent above 2007, which had been the highest on record. Spin-off activity during the year was also above average, and 2022 activity has started off strong.

This should provide a favorable backdrop for equity-oriented event-driven managers over the coming months. Credit spreads remained calm through 2021, but we remain optimistic that higher volatility and dispersion should create more opportunities for long/short credit managers in 2022. A sideways market along with changes to monetary policy could lead to dislocations across credit markets. Convertible bond managers have seen a renaissance in their strategy over the past two years; we expect that to continue. Higher equity volatility, which tends to benefit this type of strategy as the option rises in value, should provide a favorable backdrop for managers to actively trade throughout the year.

Callan continues to recommend multi-strategy hedge fund managers that have allocations to both credit and event-driven strategies. These managers tend to have a lower beta profile to equity markets and the ability to opportunistically allocate capital as areas become more or less attractive.

The start of 2022 has definitely been busy, with labor and supply chain issues, the tragic war in Ukraine, extreme volatility in both rates and equity prices, inflationary pressure, oil over $100 a barrel, and the Federal Reserve starting to raise rates.

These factors combine to create a very challenging investing landscape for managers, but we feel macro funds are best positioned to profit in this environment. This will not be an easy task, as they will need to get the macro forecast correct, as well as trade timing and implementation. Managers that have a track record of doing this over multiple market cycles will be preferred to newer managers. We also suspect that commodities may be in a bull market over the next few years, as demand is more than outweighing supply for certain commodities.

The Hedge Fund Outlook for 2022

Overall, Callan remains constructive on hedge funds in 2022. Now more than ever, institutional investors desire diversifying strategies to protect their portfolios as market volatility returns. Hedge funds have had the wind at their back over the past few years when it comes to performance and asset-raising. They will need to prove they can provide downside protection in volatile markets. Managers in this new environment may turn in better performance, as the underlying dynamics of the markets have changed quickly over the past few months.