Fund sponsors should understand the characteristics of the assets in which they are invested, or are evaluating as possible investments. This better positions them to make informed judgments about their long-term strategies and the construction of their portfolios. This tenet is especially relevant for investors in private equity given the wide dispersion of returns across private equity strategies. Both growth equity and late-stage venture capital focus on investments in growing companies, for instance, but differ significantly in many characteristics.

With a clear understanding of the two, investors can better determine which strategies suit their objectives, and more effectively evaluate fund offerings and general partners when making new investments.

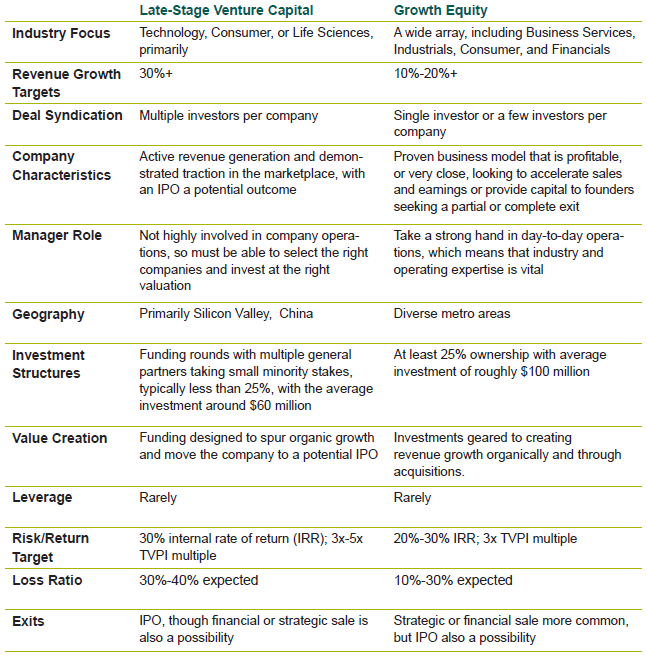

Here we take a close look at what distinguishes the two strategies, with an emphasis on the distinctions at the portfolio company level.

Armed with the ability to distinguish between late-stage venture capital and growth equity, investors become more informed limited partners. Knowing the differences in portfolio company characteristics, investment structures, value creation strategies, and risk/return profiles empowers an investor to better assess general partners, fund offerings, and underlying investments. Ultimately this leads to a more successful implementation of its private equity program.

For more detail about this topic, please see my white paper available here.