Listen to This Blog Post

U.S. equities retreated in 1Q25, giving back a portion of 2024’s outsized gains. Global ex-U.S. equities outperformed U.S. stocks in 1Q, helped by a weaker dollar. Fixed income markets rebounded as rates declined across the U.S. Treasury yield curve. Safe-haven flows and rate cuts from major central banks supported broad-based gains.

How Global Markets in 1Q25 Did

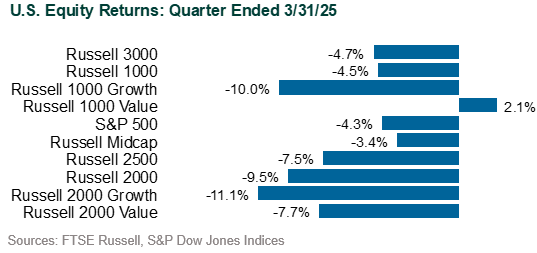

U.S. Equities: The S&P 500 fell 4.3% as investors rotated out of mega-cap growth stocks, particularly in Technology (-12.7%) and Communication Services (-6.2%). The Magnificent 7—a dominant market driver for several years—declined heavily in 1Q, contributing to the sharp underperformance in growth-oriented sectors. AI-chip darling Nvidia suffered the worst single-day market cap decline in U.S. history (almost $600 billion) as worries emerged that a low-cost AI model from a Chinese company would threaten the chipmaker’s dominance.

Defensive sectors such as Health Care (+6.5%), Consumer Staples (+5.2%), and Utilities (+4.9%) outperformed, while Energy led all sectors with a 10.2% gain, supported by strength in natural gas following a colder-than-expected winter. The pullback in growth stocks was most acute in the Consumer Discretionary sector (-13.8%), which had been a top performer in 2024. Weakness in small cap stocks persisted, with the Russell 2000 Index falling 9.5%, as elevated interest rates weighed on more leveraged businesses. Style dispersion was significant during the quarter. The Russell 3000 Growth Index declined 10.0% while the Russell 3000 Value Index rose 1.6%, marking a sharp trend reversal. Value’s outperformance was driven by a strong showing in cyclical sectors like Financials and Energy, while Growth underperformed largely due to its exposure to large-cap Tech.

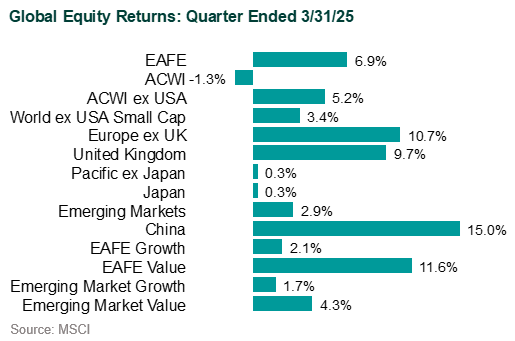

Global Equities: The MSCI ACWI ex-USA Index gained 5.2%, with developed markets (MSCI EAFE: +6.9%) and emerging markets (MSCI EM: +2.9%) both in positive territory. European equities rebounded strongly, especially in Spain (+22.4%), Italy (+17.2%), and Germany (+15.5%), amid improving PMI data and an accommodative monetary policy. There was investor optimism as EU governments announced plans to boost defense spending in response to rising geopolitical tensions.

Emerging markets (MSCI EM: +3.0%) posted modest gains overall, but results varied widely—companies in China (+15.0%), Brazil (+14.0%), and Chile (+17.8%) surged, while those in Taiwan (-12.6%) and Thailand (-13.7%) fell sharply, underperforming on concerns around slowing tech exports and political instability.

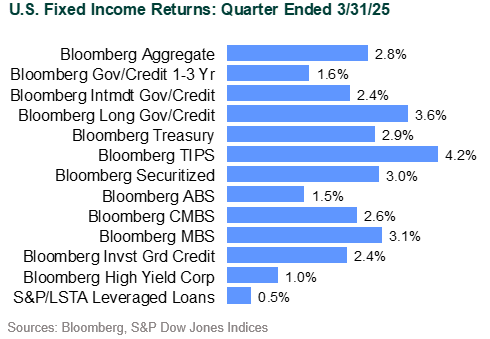

Fixed Income: The Bloomberg US Aggregate Bond Index rose 2.8% as the 10-year U.S. Treasury yield peaked near 4.8% in early January in response to early inflation prints before retreating to 4.2% by quarter-end. Treasuries and agency MBS (+3.1%) outperformed other sectors. TIPS posted strong gains (+4.2%), outperforming nominals as breakeven inflation expectations rose, particularly in the 2-year and 5-year tenors. Investment grade corporates (+2.3%) benefited from declining yields and continued demand, while high yield corporates posted more muted gains (+1.0%) with lower credit quality bonds slipping. Spreads widened modestly across both investment grade and high yield markets but remained below long-term averages.

Municipal bonds lagged the broader bond market, and in March logged their weakest monthly return in four years. The Bloomberg Municipal Bond Index declined 0.2% as supply picked up. Short-duration munis outperformed longer maturities, with the Bloomberg Muni Short-Term 1–5 Year Index gaining 1.0%. The yield ratio of 10-year AAA munis to Treasuries climbed to 77% from 67%, indicating better value versus the start of the year.

Global Fixed Income: Outside the U.S., fixed income returns varied by currency exposure. Hedged global bonds (Bloomberg Global Agg ex-US Hedged: +1.2%) underperformed unhedged (+2.6%) as the U.S. dollar weakened. Emerging market debt delivered solid results, led by local currency sovereign bonds (JPM GBI-EM Global Diversified: +4.3%), while hard currency sovereigns (JPM EMBI Global Diversified: +2.2%) also gained.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.