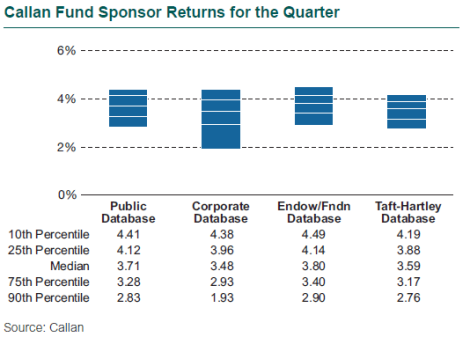

Endowments/foundations (+3.8%) performed best last quarter, followed by public plans (+3.7%), Taft-Hartley plans (+3.6%), and corporate plans (+3.5%). For all funds, the return was +3.7%, according to Callan’s database. Plans with assets below $100 million performed best by fund size, up 3.7%, compared to 3.6% for both medium plans ($100 million-$1 billion) and large plans. A quarterly rebalanced 60% S&P 500/40% Bloomberg Barclays U.S. Aggregate Bond Index portfolio rose 4.1% during the quarter.

Marking a turn of events, the MSCI ACWI ex USA Index outperformed U.S. equity markets over the past year, rewarding funds that have taken steps to diversify away from a home-country bias. Over longer periods of time, Taft-Hartley plans did best over the last five years, up 9.3% annualized. Corporate plans (+5.9%) did best over the last 10 years.

Plans continue to focus on an environment marked by low interest rates, low return expectations, and frustration with the seemingly high cost of diversification while the public equity market has enjoyed such a strong run. Many fund sponsors feel compelled to take on substantial market risk to reach return targets, and are now focusing on finding sources of diversification within the growth bucket of their asset allocation. Sponsors are examining if there is anything more they can do to tamp down the risk within the growth allocation, short of actually reducing the allocation to growth assets.

Asset owners continue to be skeptical of the value of active management, particularly in U.S. large cap equity. Pressure to reduce fees or show the ability to generate consistent alpha has been building for quite some time. Some fund sponsors have undertaken structure work to consider the amount of active versus passive management and to see if there is a way to simplify their manager rosters to gain economies of scale in an effort to reduce costs.

As in past quarters, funds have adjusted their allocations in these ways over the last five years:

- Corporate plans have widened their range of U.S. fixed income allocations, as they are in different stages of efforts to de-risk plan assets.

- Many public funds have increased their allocation to non-U.S. equity and real estate at the expense of fixed income. Simultaneously, some of the fixed income exposure has become more equity-like in nature.

- Endowments and foundations continue to shift from fixed income to asset classes with higher return expectations, such as global equity, non-U.S. equity, and real estate.

The regulatory environment continues to drive the decision-making process for defined contribution (DC) plan sponsors. Heightened fee sensitivity and litigation have resulted in little traction for non-traditional asset classes such as liquid alternatives. DC plans are also focused on the best ways to reduce/eliminate revenue sharing, as well as obtaining even lower fees from investment managers. They are also looking for opportunities to continue streamlining investment fund lineups to achieve sufficient diversification while minimizing participant confusion—including white label options.

Public plans continue to seek return enhancement and further diversification. Reduced capital market return expectations and funding challenges have created a difficult situation for many public DB plans, and some plans are simply constrained by their circumstances. Alternative beta, MACs, and other liquid strategies are being used in a wide range of capacities and are experiencing increased interest.

3.7%

The return of all types of funds, according to Callan’s database