The use of environmental, social, and governance (ESG) investing principles, traditionally focused on equities, has become increasingly prevalent in fixed income markets. More investment managers are applying ESG analysis to bonds, and many have developed customized ESG frameworks to specifically evaluate various segments of the global credit market.

In addition, a myriad of bond choices have emerged for the “impact-minded” investor, beginning with the issuance of “green bonds” more than 10 years ago. Impact bonds come in a variety of flavors and derive their name from the fact that they have a well-defined use of proceeds or a specific set of goals designed to make a positive impact.

In this post, I highlight the major parts of the fixed income market and how ESG principles are being used to evaluate securities within the asset class.

Corporate Bonds

ESG considerations vary across industries and are based upon materiality for a specific industry. In addition, the degree to which management is open to change and engagement is also often evaluated. Issues to assess may include:

- E: Carbon emissions, energy management, waste management, water usage, pollution, sustainability initiatives

- S: Workplace diversity and inclusion, workplace health and safety, human capital management, supply chain management, product safety, community involvement

- G: Board independence and diversity, shareholder rights, accounting practices, disclosure, transparency, corporate culture

Securitized Sectors

ESG metrics can pertain to the issuer, the collateral, and/or the source of proceeds for residential mortgage-backed securities, commercial mortgage-backed securities, or asset-backed securities.

- E: Can be an evaluation of collateral such as LEED-certified commercial properties, or an assessment of natural disaster or climate change risks to commercial or residential properties. Use of proceeds may be important, such as ABS issuance to fund solar panel installation.

- S: Typically most applicable for mortgage-backed securities. Includes responsible lending (reasonable-sized loans for low credit borrowers); access to affordable housing within underserved communities; financing small businesses and/or economic inclusion opportunities.

- G: Often applies to the structure of the securitization. The economics/waterfall of cash flows, alignment of interests, integrity of reporting, and degree of credit enhancement fall under structure considerations for certain securitized sectors.

Sovereign Debt

Factors considered vary across developed and emerging markets and also depend on the unique attributes of each country.

- E: Energy policy, climate risks, natural-resources management, pollution

- S: Health, inequality, political and social freedom, employment, mortality rate, gender equality, education, poverty

- G: Political stability, corruption, rule of law, regulatory enforcement, accountability

Municipal securities

These are state and local bonds, backed by either taxation power or specific revenue streams. Criteria used to evaluate them include:

- E: Clean water, energy efficiency, use of renewables, waste disposal

- S: Unemployment, inequality, obesity, graduation rates, affordable housing

- G: Budget process, management diversity, accounting deficiencies, pension funding

Municipal bond sectors such as transportation, hospital, tax-backed, water and sewer, and education all have unique characteristics that require customized ESG frameworks for appropriate analysis.

Impact Investments

Impact (sometimes labeled sustainable) bond issuance is expected to continue to grow. According to a February 2020 report from Moody’s, “green, social and sustainability-related debt is continuing to grow and could hit a combined record of $400 billion in 2020, up from $323 billion in 2019.” While still a small fraction of the global bond market, demand for impact-oriented bonds shows no signs of abating. Green bonds remain the largest segment of impact debt. Roughly half of the issuance comes from Europe, and proceeds are used broadly across transportation, buildings, energy, and water.

Green bonds: Issued by governments, supranational organizations, banks, and corporations to finance projects that have positive environmental or climate goals. Europe accounts for the largest issuance in green bonds, followed by the U.S. and China. Proceeds from green bond issuance span a variety of areas, including clean energy projects, low-carbon buildings or transportation, clean water, and waste management.

Blue bonds: Proceeds are used to finance ocean conservation or marine projects. This is a relatively small portion of the impact bond market.

Social bonds: Guided by principles in the International Capital Market Association’s Social Bond Principles to finance projects that deliver positive social outcomes. The guidelines were developed in 2018 and are voluntary. They cover a bond’s use of proceeds, process for evaluating projects, management of proceeds, and reporting. Social projects include affordable basic infrastructure (clean water, sanitation, transportation), access to essential services, food security, socioeconomic advancement, affordable housing, and health care.

COVID bonds: Fall under the social bond umbrella. A recent innovation, with proceeds used to address the impacts of COVID-19. Issuers range from the World Bank to Guatemala to companies such as Pfizer and Bank of America (e.g., lending to hospitals and nursing facilities).

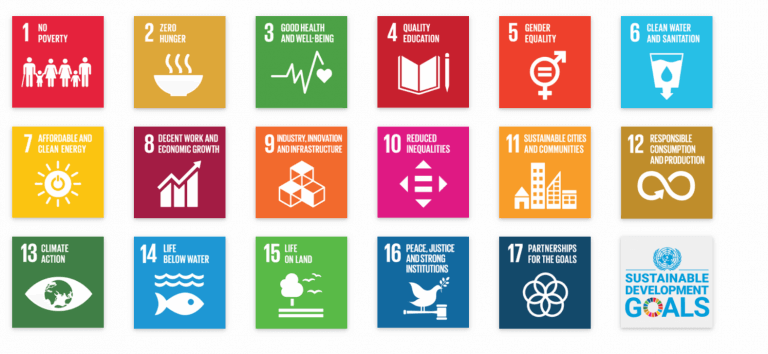

SDG bonds: A 2019 development whereby bond issuance is linked to one or more specific sustainable development goals (SDGs), shown below.

With these bonds, coupons are adjusted if goals are or are not met. The first bond in this category was issued in September 2019 by a large Italian utility, and proceeds will be used to advance four of the SDGs (7, 9, 11, and 13). If specific goals are not met by a specified date, the coupon rate will increase by 25 bps. These bonds are a new innovation, and the degree to which investors embrace this structure remains to be seen.

While there continue to be more ESG options across equity strategies, we expect the growth in fixed-income ESG strategies to continue. We are seeing an increase in the number of managers that are incorporating ESG metrics into broad fixed income strategies, as well as an increase in thematic, impact-oriented strategies.

A necessary first step when considering a fixed-income ESG allocation is to clearly define objectives. These may include risk-reduction or alpha generation by viewing issuers through an ESG lens (e.g., low ESG-rated issues that are improving could be an alpha opportunity); furthering specific or general environmental or social outcomes alongside market returns; or targeting a specific theme such as affordable housing or clean energy. Once objectives are clear, identifying and evaluating possible solutions can follow. As the number of options continues to grow, we believe that investors are well-served by understanding the breadth of the landscape in conjunction with developing well-defined goals.