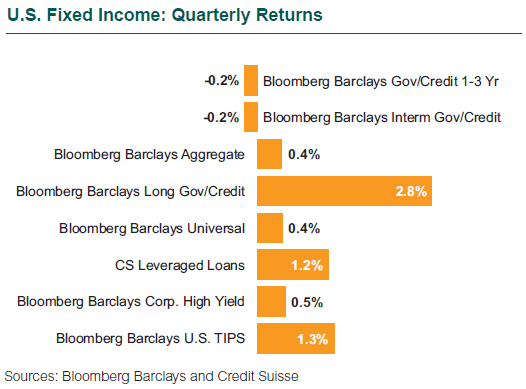

In the U.S., longer-term bonds topped short-term and intermediate-maturity bonds. Investment-grade corporate debt was the best-performing fixed income sector. Returns were mostly flat in developed markets; emerging market debt delivered more muted returns than in earlier quarters.

U.S. Bonds: Strong Fundamentals Tighten Spreads

The U.S. yield curve continued its flattening trend in the fourth quarter. The 2-year U.S. Treasury yield climbed 42 basis points to close at 1.89%, up 69 bps from the end of 2016. At the long end of the yield curve, the 30-year U.S. Treasury yield fell 12 bps during the quarter, ending the year at 2.74%, 32 bps lower than its close in 2016. This trend reflects the Fed’s bias to be less accommodative through monetary policy, as well as benign inflation in the face of a strong labor market. As a result, longer-term bonds sharply outperformed short-term and intermediate-maturity bonds for the quarter and the year.

Volatility in fixed income as well as equity markets sits near historical lows. The overall risk appetite remains elevated, driven in part by globally strong growth and loose monetary policy from central banks, as well as business and consumer confidence. The market is pricing in three Fed rate hikes for 2018, not far from the Fed’s own expectation of where rates will end up in the longer run. Yields on 10-year Treasuries rose modestly from 2.33% at the end of the third quarter to 2.41%.

The Bloomberg Barclays Long U.S. Treasury Index gained 2.4% in the quarter and 8.5% in 2017 versus a -0.4% quarterly and +1.1% annual return for the Bloomberg Barclays Intermediate Treasury Index. Consistent with the low volatility theme evident in the equity markets, the U.S. Treasury 10-year traded in a narrow 60 bps band for the year, the lowest since 2000.

The Bloomberg Barclays U.S. Aggregate Bond Index rose 0.4% during the quarter. Corporate bonds outperformed for the quarter and the year, and yield spreads were the tightest since the Global Financial Crisis, hitting 93 bps over Treasuries. Investment-grade corporate credit was the strongest-performing fixed income sector; tax reform may boost the sector by improving profitability and reducing issuance.

High yield corporates also did well, with the Bloomberg Barclays U.S. Corporate High Yield Index up 0.5% for the quarter and 7.5% for the year. The annual default rate was the lowest since 2013. Issuance was robust in the fourth quarter at $68 billion, but tax reform could negatively impact issuance.

TIPS outperformed nominal U.S. Treasuries as expectations for inflation rose. The Bloomberg Barclays U.S. TIPS Index rose 1.3% for the quarter and 3.0% for the year, and the 10-year breakeven spread (the difference between nominal and real yields) rose to 1.96%.

The municipal bond market performed well in 2017 as rates were steady and demand remained strong. The tax overhaul package is expected to have mixed effects. The change in personal income rates is too small to have a meaningful impact, while the decrease in corporate tax rates is expected to reduce demand for munis from certain corporations. Limiting state and local tax deductions could increase demand for in-state munis in high tax states. Issuance spiked in anticipation of changing regulations, setting a record $62.5 billion for December supply, but the market absorbed it well. The Bloomberg Barclays Municipal Bond Index returned 0.7% for the quarter and 5.4% for the year.

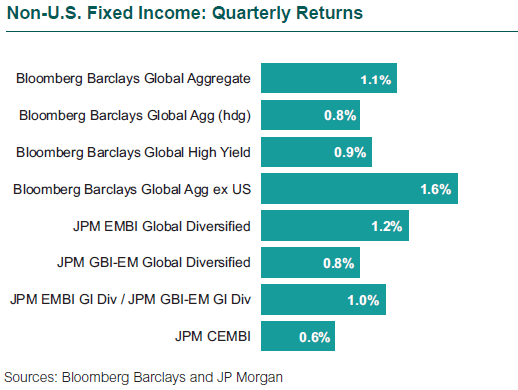

Global Bonds: Flat Returns in Developed Markets; EM Returns Muted

Quarterly returns were mostly flat in developed markets. The Bloomberg Barclays Global Aggregate Bond Index rose +1.1% (unhedged) and 0.8% (hedged).

Emerging market debt delivered more muted returns than in earlier quarters. Higher commodity prices and global growth supported the asset class broadly. The JPM EMBI Global Diversified Index ($ denominated) gained 1.2% in the quarter and 10.3% for the year. Returns were mixed, but beleaguered Venezuela was the outlier for the quarter (-29%) and the year (-34%). The local currency JPM GBI-EM Global Diversified Index increased +0.8% in the quarter and +15.2% for the year. In the quarter, Asian countries (+5%) performed best while Latin America sank nearly 5%.

0.4%

The increase in the Bloomberg Barclays U.S. Aggregate Bond Index in the 4th quarter