Employee benefits offerings are generally subject to inertia—change comes slowly and the effort to deploy new or revised benefits may be daunting to employers and confusing to participants. But the pandemic, the “Great Resignation,” and significant legislative interventions have changed that dramatically. This combination of forces has made the topic of “financial wellness” and its deployment more timely and important.

The federal legislation that has driven a number of changes to the benefits landscape includes the CARES Act, which was meant to help those affected by the pandemic by making retirement assets—normally held sacrosanct—available to employees via coronavirus-related distributions or expanded loan amounts. Student loan repayments have been deferred, and at the same time student loan repayment programs were included as a fringe benefit under the tax code. Limits on flexible spending accounts (FSAs), either for health or dependent care purposes, were temporarily relaxed. This incredible flex of congressional muscle has altered the benefits picture.

The renewed emphasis on financial wellness has also provided a logical entry point for financial services companies that purport to assist with a variety of individual needs to “sell their wares.” Employers need to be cognizant about the motives of providers so as not to dilute the intent to support individuals.

In this blog post we will review the scope of financial wellness as an employee benefit, its utilization, its evolving capabilities, and the risks that these expanded services and tools could pose to employers and fiduciaries.

Financial Wellness: What Is This Thing of Which You Speak?

Financial wellness has been a hot topic for years, although the concept is not well defined and its application continues to be spotty. While still vague, the Consumer Financial Protection Bureau’s definition of financial wellness describes it as a variety of financial concepts that help employees become financially fit and able to act intelligently with respect to their own financial matters.

Organizations that seek to offer a financial wellness package should understand the risks they face, the implications of making these services available, and the compensation structure for the service providers.

Risky Business (for Fiduciaries)

Employee benefits programs are generally covered by federal or state law and accompanying regulations. Retirement plans and some reimbursement plans (e.g., flexible spending accounts, health care savings accounts (HSAs)) are regulated by the Employee Retirement Income Security Act (ERISA) of 1974. As such, these programs are governed by strict fiduciary duties and obligations.

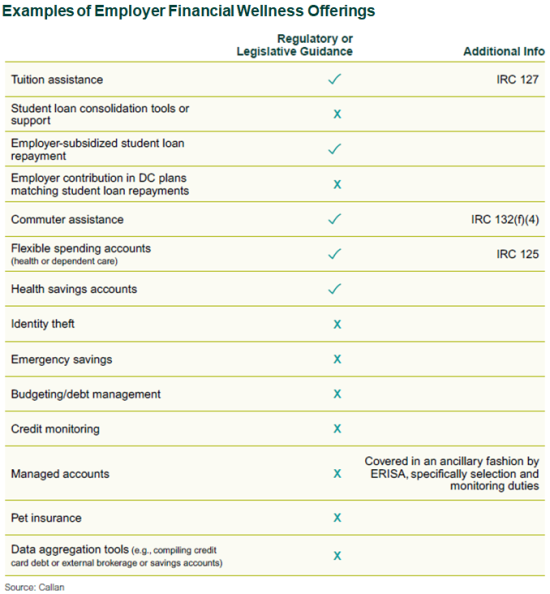

Broad financial wellness benefits are not generally covered by ERISA, which means employers that add benefits outside the existing legislative or regulatory framework do so at their own risk. Plan sponsors should be aware of and consider how to manage these benefits to ensure they are not inadvertently taking on undue risk.

Certain defined contribution (DC) plan recordkeepers and other service providers have expanded their offerings or partnered with an external party to support financial wellness initiatives. The broader financial wellness mandates may generate revenue for those providers—either directly (e.g., participant-paid fees) or indirectly (e.g., revenue shared from the financial wellness partner). Notably, financial wellness services are not covered by the required service provider fee disclosures (i.e., 408(b)(2) disclosures), and providers do not need to provide fee transparency for their services.

Although offering a new or expanded benefit to support employees may seem like an easy “win” for employers, it comes with real and significant risks.

Let’s Talk Specifics

This set of examples describes some of the services available:

Student loan consolidation and forecasting tools: These allow borrowers to manage educational debt—either for themselves or their children. The service gathers current balances, payment amounts, and repayment history, and then projects pay-down strategies using different payment options and amounts. The platform also analyzes the potential effect of student loan consolidation or refinancing, and will direct participants to a lending platform.

Emergency savings vehicles: While ERISA provides a framework for after-tax savings within a DC plan, there is less clarity about how to support savings outside of the retirement program. Some providers offer a savings program through payroll deduction.

Managed accounts and data aggregation services: Managed accounts and related data aggregation are a mature tool for DC service providers—participants can provide their login information for their personal bank accounts, brokerage, or other savings vehicles. This service pulls in that account information, which is then used to support retirement readiness projections, power managed account services, and generate recommended actions for participants.

Employer-selected investments for health savings accounts: Some providers have recommended that employers consider aligning investments with those offered in the DC plan.

Protecting Employers and Employees

As employers look into expanding their benefits to support and retain employees, there are opportunities for the organization to protect itself and its employees. Treating these benefit programs with the same level of scrutiny as an ERISA-covered program is a helpful bulwark against fiduciary claims. Employers should also consider when benefits associated with (and compensated by) the DC plan might benefit non-participants and if that would violate the “exclusive benefit” rule under ERISA—where plan participants are subsidizing non-participant benefits.

By employing strong boundaries and clear documentation, employers may guard against potential future litigation and establish protections for the employees utilizing the benefit offering.

Disclosures

Certain information herein has been compiled by Callan and is based on information provided by a variety of sources believed to be reliable for which Callan has not necessarily verified the accuracy or completeness of or updated. This report is for informational purposes only and should not be construed as legal or tax advice on any matter. Any investment decision you make on the basis of this report is your sole responsibility. You should consult with legal and tax advisers before applying any of this information to your particular situation. Reference in this report to any product, service, or entity should not be construed as a recommendation, approval, affiliation, or endorsement of such product, service, or entity by Callan. Past performance is no guarantee of future results. This report may consist of statements of opinion, which are made as of the date they are expressed and are not statements of fact. The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to subsidiaries or parents, or post on internal web sites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.