Although the U.S. has strong historical roots to Europe—who can forget the Niña, Pinta, and Santa Maria?—we’ve tended to carve our own path, from the Revolutionary War onward. The evolution of environmental, social, and governance (ESG) investing has been no exception.

As recently as 2017, a survey from Schroders found that “institutional investors in Europe are significantly more advanced in terms of their adoption of ESG investment practices, compared with their counterparts in the U.S.” The reasons behind this are myriad (differences in the regulatory environment, political climate, and cultural context). But the bottom line: We’re still proud of our history of doing things our own way.

Callan’s sixth annual ESG Survey, published in July 2018, finds that U.S. investors are starting to find their own path forward with ESG investing. For the purposes of our survey, we included as broad a definition of ESG as possible, and looked at various paths to implementation, as we have found that U.S. investors tend to interpret ESG in unique ways that are most meaningful and relevant to their organization.

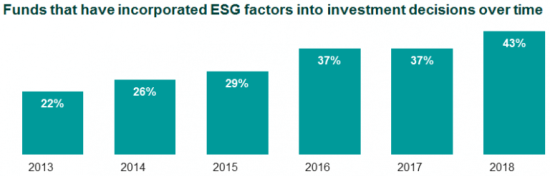

Our survey finds that U.S. investors are starting to catch up to their European counterparts and increasingly adopting ESG practices in their portfolios. In 2018, 43% of funds surveyed incorporated ESG factors into investment decisions—nearly double the percentage in 2013.

What’s driving this uptick? Three reasons: risk mitigation, the pursuit of long-term returns, and the desire to demonstrate deeply held beliefs that are ingrained elsewhere in the organization but had previously not been present in the investment portfolio. (See full survey results, including motivations for and against ESG usage, here.)

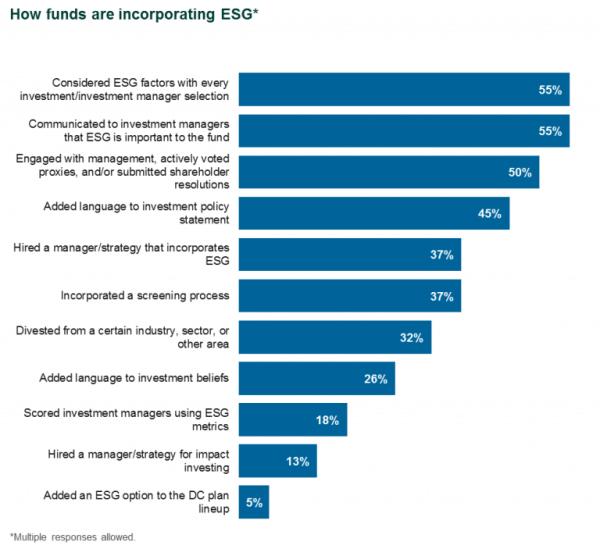

The steady upward trend in ESG implementation across the last six years has manifested in multiple ways for the U.S. institutional investors that responded to our survey. Investors are engaging with investment managers around ESG, both at the manager selection phase and with existing investment managers. Shareholder engagement is gaining traction, with half of funds using this implementation strategy (vs. one-third in 2017).

Foundations and endowments have adopted ESG into investment decision-making at a greater clip than other fund types over the last six years, a trend that continued in 2018 at 64% and 56%, respectively. More than one-third of public funds reported incorporating ESG (39%) in the 2018 survey, up from 35% in 2017. And large funds tend to lead their smaller counterparts: Nearly three-quarters of the largest respondents ($20 billion or greater) have incorporated ESG factors into investment decisions. The largest funds have incorporated ESG factors at the highest rate since the inception of the survey in 2013.

There is one big difference between the New World and the Old World when it comes to ESG investing. Regulation has played a clear role in pushing European pensions and other institutional funds to adopt an ESG framework (in 2016 the European Parliament approved rules requiring that major workplace retirement plans do so by 2019). In the U.S., investors—and not regulators—have been blazing the trails for ESG. While the U.S. Department of Labor has not issued any such guidelines, U.S. investors are finding that ESG practices can help them to better assess the suitability of available investments, and that an ESG lens is another tool to fulfill fiduciary responsibility.

As has been true for 300 years, the U.S. is still borrowing some ideas from Europe but putting its own spin on them!