Listen to This Blog Post

Managing an endowment portfolio has always created unique challenges relating to the delicate balance of long-term growth and short-term spending needs, requiring careful asset-allocation decisions across diverse markets. Layer in maintaining sufficient liquidity, managing volatility, aligning with donor restrictions, and meeting the annual spending requirements while preserving purchasing power, and you quickly see the time requirements, expertise, and adept decision-making needed from any endowment investment committee.

However, prior to 2017 an area of reprieve for endowment portfolios had been their tax-exempt status. Worrying about cost basis, wash rules, and portfolio turnover was one area in which key decision makers were spared, offering more flexibility in how a portfolio was managed and rebalanced.

In 2017, the Tax Cuts and Jobs Act introduced a flat 1.4% excise tax on private colleges and universities with at least 500 tuition-paying students (with greater than 50% of those students located in the U.S.), and endowment assets of over $500,000 per student. Although the legislation brought tax considerations back into the fold for certain private universities, the low rate had minimal impact on portfolio management and asset-allocation decisions.

As it turns out, the 2017 legislation was just a primer to more expansive endowment tax legislation that is set to go into effect in fiscal year 2026 as a result of President Trump’s tax and spending policy legislation, the One Big Beautiful Bill Act, which could change the way certain university endowments manage assets.

Who Is Affected by the Endowment Tax?

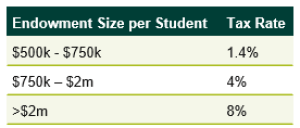

Private colleges and universities with 3,000 or more tuition-paying students (raised from 500) will be subject to the excise tax at a tiered rate based on endowment size per student:

Potential Impact on Portfolio Management

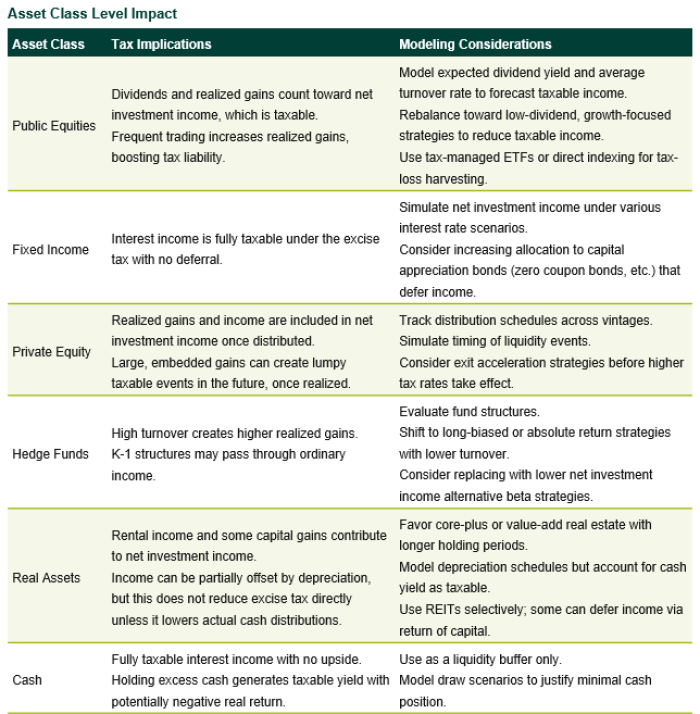

The result of new and material tax burdens on certain institutions could upend some of the modern endowment investment tropes and shift their calculus across asset allocation, manager selection, liquidity, and spending.

- Spending: Increased spending in the near term can reduce taxable asset accumulation.

- Illiquid Assets: Investments in private markets have become a major component of large endowments given the potential for appreciation and high capital gains. Increased pressure to sell these illiquid assets on the secondary market, especially ahead of fiscal year 2026, could result in tilts toward more liquid investments.

- Tax-Efficient Structures (Blockers): Institutions could shift away from traditional total return discipline in favor of more tax-efficient return components (dividends vs. unrealized gains) and re-examine the most tax-efficient fund vehicles for their investments.

- Cost Basis: Since the new taxes won’t go into effect until after the 2025 taxable year, we may see a flurry of asset selling to reset cost basis and realize gains ahead of taxes (much like we saw corporations load up on imports ahead of tariffs). Luckily for large endowments pursuing this strategy, wash-sale rules only apply to investment losses, not gains, allowing for a cleaner cost-basis reset. However, wash-sale rules may need to be considered for future tax-loss harvesting strategies.

The endowment excise tax overhaul will likely reshape private university finance from long-term asset-allocation and payout levels to tactical trades and shrewd tax planning, adding a new layer to the complex landscape of managing perpetual endowment assets.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.