One of the biggest differences between developed and emerging market equities involves the ownership structures of companies in the two areas. Most developed market companies, measured by index weight, are widely held with a dispersed investor base, according to MSCI. In comparison, the largest share of emerging market companies are state-owned enterprises (SOEs), in which local or state governments have significant (typically greater than 20%) ownership control.

For SOEs, government ownership can be structured in multiple ways; some governments or government entities may own portions of companies indirectly through a variety of vehicles including central banks, sovereign wealth funds, or holding companies. Others may have varying levels of direct state ownership. As of Dec. 31, 2018, SOEs represented 26% of the MSCI Emerging Markets Index.

Since most global investors have exposure to both developed and emerging markets, we wanted to highlight the differences between these ownership characteristics. These distinctions are also relevant for institutional investors that incorporate environmental, social, and governance (ESG) principles into their investing process, since ownership is a key consideration for “G.” Given the importance of SOEs within emerging markets, institutional investors should be aware of these key points:

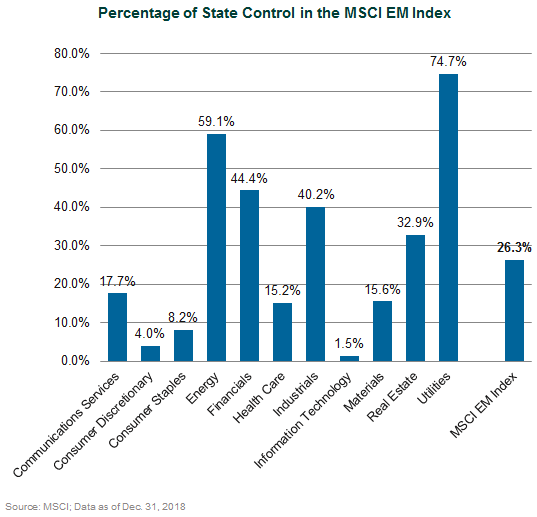

- State ownership appears to be more concentrated among public goods sectors than private sectors. The Utilities, Energy, and Financials sectors tend to demonstrate the most state ownership. These sectors tend to include strategic state assets such as banks, utilities, and natural resources companies, which have large capital-expenditure burdens. Conversely, governments tend to be less involved in Consumer, Information Technology, and Health Care companies, which tend to be less vital for the strategic economic development and welfare of emerging market governments.

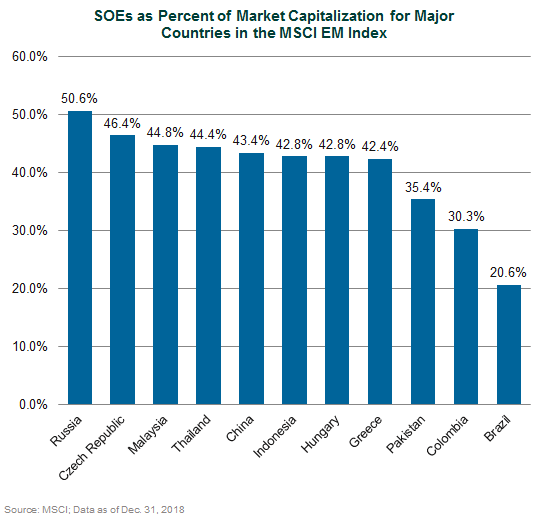

- Of the larger countries in the MSCI Emerging Markets Index, the proportion of state ownership is highest in Russia (51%) and China (43%). Two Middle Eastern countries, the United Arab Emirates and Qatar, have the highest rates overall at 95% and 94%, respectively.

- As China became the largest single country (33%, as of March 31, 2019) within the MSCI EM Index, its SOEs translated to nearly 15% of the benchmark. While SOEs dominate the Energy and Financials sectors in China, they exist within all sectors, including Technology and Health Care. However, this situation could change. In recent years, under mixed-ownership reforms, many Chinese state-owned businesses have been through a methodical process of privatization and are now less influenced by the government. As a result, the number of enterprises administered by the central government fell to 98 in 2018 from 117 in 2012.

- Emerging market SOEs tend to offer relatively high dividend yields when compared to the broad emerging market. This is more commonly seen in Chinese SOEs following recent reform initiatives. In general, many of the SOEs that provide a higher dividend are in regulated businesses such as banks, communications, utilities, and energy. Governments of emerging market countries believe that encouraging SOEs to have more accommodative dividend policies may raise revenue and increase the flexibility of government spending. The dividend revenue can also provide support to government programs. For example, Chinese governments have assisted the relocation of workers due to the closure of “zombie” firms as part of the country’s SOE restructuring.

- Active managers appear to have various research approaches when it comes to SOEs. Even though there are concerns around the misalignment between government interest and those of minority shareholders, it is uncommon for asset managers to restrict SOE investments given that government influence, whether direct or indirect, still widely exists in the emerging markets. They do, however, consider governance structure, management credibility, and other qualitative factors as it relates to both SOEs and privately held businesses. In contrast, some managers choose to restrict owning SOEs due to concerns over more indebted balance sheets and lower growth rates.