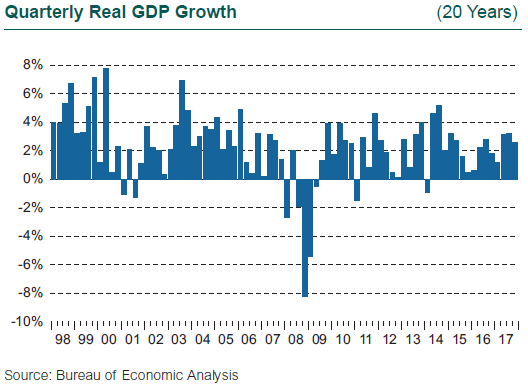

The U.S. economy closed out 2017 with decent momentum, recording a solid 2.6% gain in GDP in the fourth quarter after growth above 3% in each of the prior two quarters. Investor sentiment felt disconnected as the year unfolded; the underlying global economy appeared to be steadily improving and capital markets reported robust results, while unease around geopolitics and the impact of multiple natural disasters stoked anxiety about the future.

By midyear, 2017 felt like the culmination of the unhappiest bull market we’d ever seen. Stock markets then proceeded to hit a number of record highs as the year concluded, the job market continued to improve, unemployment reached a generational low in the U.S., and retail sales rose. A historic revision to the tax code became law at the end of the year, which included a substantial corporate tax cut.

After perhaps jumping the gun in the first part of the year, then held back by frustration after not getting expected tax and regulatory changes enacted during the middle quarters, the “animal spirits” of the economy and the capital markets appear to have been unleashed once again. Enthusiasm for growth and risk-taking seem apparent. Is now the time to worry, as phrases like a market “melt-up” enter the popular lexicon?

GDP growth averaged 2.3% for the year, up from 1.5% in 2016. The result for 2017 was impressive given the damage caused by severe hurricanes in the third quarter. Since the Global Financial Crisis (GFC), GDP has increased at a very modest 2.2% annual average, far below the growth typically seen following a recession and below the 3% long-term average since the early 1960s. While gains have been slow and steady, they have gone on now for a sustained period of time, one of the longest expansions on record, and as a result the unemployment rate has been pushed to a generational low of 4.1%. The job market keeps chugging along, creating over 2.1 million new jobs in 2017, or 183,000 per month. The peak years of job creation in the current cycle were 2014 (3 million) and 2015 (2.7 million). While the monthly rate of 183,000 is still robust, and well in excess of the 100,000 needed to keep the market at a steady state, the rate of job creation is tailing off, suggesting we might be reaching the limits of full employment.

Despite this tight labor market, wage gains remain remarkably subdued, with annual increases in hourly earnings in the 2%-2.5% range for each of the last four years. The rate of growth in total compensation has begun to rise; the employment cost index has inched up from 2% growth to hit 3% in several quarters during 2017.

Confidence in the sustainability of the current spate of growth rose with the release of the aforementioned animal spirits. The impact of the tax cut is expected to be modest, perhaps adding 0.2 to 0.3 percentage points to GDP growth in 2018, and most if not all of the investment gains are already built into the stock market. The wild card is how corporations plan to “spend” the tax cut. The optimistic outcome is that the extra money goes into capital expansion and job growth. Other outcomes include returning the capital to owners through dividends and share buybacks, to existing workers through wage gains, or to consumers in the form of price cuts. Longer term, the $1.5 trillion increase in the deficit is viewed as a potential drag on growth.

One other potential stimulus still to take shape is the proposed program of substantial infrastructure spending. This spending could spur further growth when the economy is already running hot, and therefore stimulate inflation beyond the current benign levels. The tight labor market suggests we might already be facing limitations on growth from the existing set of labor and capital inputs available in the U.S. economy.

Inflation remains remarkably benign, clipping along at 2.1% in December (year-over-year). Oil prices have recovered from the sharp decline of several years ago, which spurred top-line inflation, but core inflation (net of food and energy) remains below the Fed’s target of 2%. The tight labor market, the impact of the corporate tax cut, and the potential for substantial infrastructure spending all suggest that inflation could finally be poised to move. Another potential impetus for inflation is the improving outlook for the global economy, which appears to be moving into synchronized growth across disparate regions.

2.6%

Gain in U.S. GDP in the fourth quarter