Behold the power of positive thinking. The U.S. economy moved steadily forward with revived animal spirits in the first quarter. That provided the Fed the ammunition to raise short-term rates by 25 basis points, with more increases expected in the rest of 2017. In the euro zone, tangible evidence of growth and inflation emerged, while anti-euro rhetoric abated after the Dutch elections, soothing market worries globally. China officially met its economic growth targets, overshadowing concerns about its unsustainable credit growth.

Despite geopolitical anxieties testing the Trump administration, the S&P 500 Index cleared 6.07% with relatively little market volatility. However, higher stock valuations were leaning more on hopes stemming from Trump’s proposed policy initiatives rather than actual earnings growth. With more upbeat expectations abroad, MSCI World ex USA climbed 6.81%, while MSCI Emerging Markets soared 11.44%. Although oil prices slipped amid plentiful supply, gold leapt 8.64% on the back of rising tensions around the globe. After being beaten down in the prior quarter, the Citi 10-Year Treasury (+0.79%) held steady.

With global risk appetites encouraged by improving fundamentals, most hedge fund strategies generated positive returns. The Credit Suisse Hedge Fund Index (CS HFI), a proxy of unmanaged hedge fund interests gross of implementation costs but net of hedge fund fees, advanced 2.07%. Representing live hedge fund portfolios net of all fees, the median manager in the Callan Hedge Fund-of-Funds Database appreciated 2.29%.

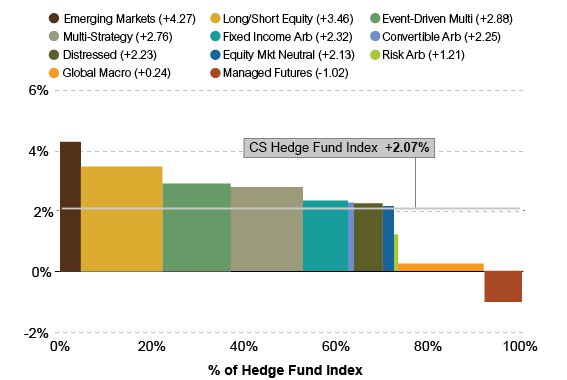

Credit Suisse Hedge Fund Strategy Quarterly Returns (as of 3/31/17)

Source: Credit Suisse Hedge Fund Index LLC, based on index weights as of Dec. 31, 2016

Within CS HFI, Long-Short Equity (+3.46%) was particularly strong in the first quarter compared to 2016, even after adjusting for equity beta. Lower cross-correlations in equity markets helped stock picking, despite continued flows into ETFs and passive funds. Hedge funds in Emerging Markets (+4.27%) particularly benefited from rising equity prices.

Strength in stocks spilled over to credits, as Distressed gained 2.23% and Event-Driven Multi-Strategy grew 2.88%. The positive risk appetite in global markets also helped other types of spread-related strategies like Fixed Income Arb (+2.32%), Convertible Arb (+2.25%), and Equity Market Neutral (+2.13%).

Lack of market volatility and distinct trends left Managed Futures (-1.02%) and Global Macro (+0.24%) struggling.

The relentless bull market in stocks has finally forced the closure of Credit Suisse’s Short Bias index, discontinued due to the lack of underlying funds reporting performance. The disappearance of funds primarily shorting stocks is not surprising after the index suffered losses in 24 of the 31 quarters since March 2009.

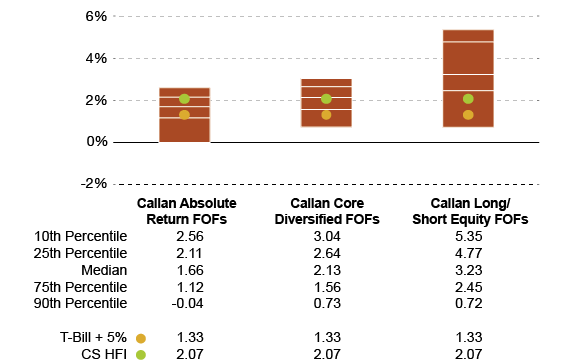

Callan Hedge Fund-of-Funds Style Groups Quarterly Returns

(as of 3/31/17)

All returns are net of fees; CS HFI return does not reflect implementation costs.

Sources: Callan, Credit Suisse Hedge Fund Index LLC, Federal Reserve.

Within the Callan Hedge Fund-of-Funds Database, market exposures differentiated performance. Supported by the stock market rallies around the globe, the median Callan Long/Short Equity FOF (+3.23%) outpaced the Callan Absolute Return FOF (+1.66%). With exposures to both non-directional and directional styles, the Core Diversified FOF gained 2.13%.

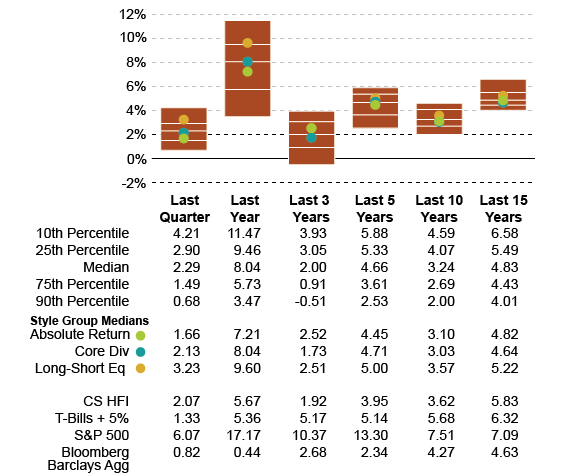

Callan Hedge Fund-of-Funds Database Returns

(as of 3/31/17)

All returns are net of fees; CS HFI return does not reflect implementation costs.

Sources: Callan, Credit Suisse Hedge Fund Index LLC, Federal Reserve.