“Reports of my death have been greatly exaggerated.”

—Mark Twain

In setting the rules governing qualified default investment alternatives (QDIAs), the Department of Labor (DOL) mandated that a default option must contain a mix of “equity and fixed income exposures.” As a result, many target date funds (the most prevalent QDIA) have glidepaths with a diversified mix of asset classes. But judging by the past decade or so, diversification has proven a headwind for TDFs.

Instead, boring has been beautiful. To illustrate this, Callan constructed a hypothetical “most boring glidepath” containing only the S&P 500 and Bloomberg Barclays US Aggregate Bond Indices to meet the minimum diversification standard for a QDIA.

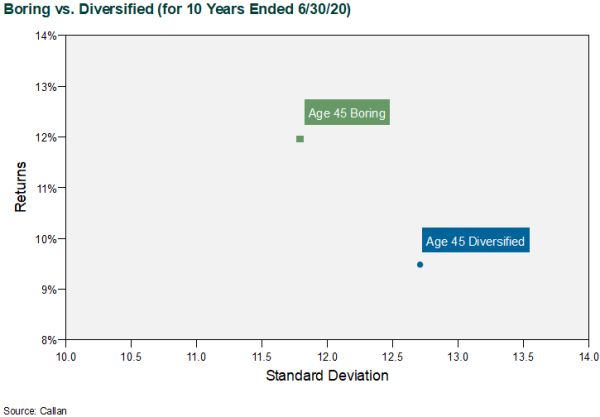

The result: Our boring glidepath performs better historically compared to peers, as well as to a glidepath containing the market average underlying exposure to 24 distinct asset classes. Below we show results for an age 45 allocation using both our boring glidepath and the 24 asset class glidepath. We imposed the index returns for these asset classes upon the glidepath, going back 10 years.

Keep in mind that going “boring” would have resulted in lower fees, superior performance, and the perception of lower fiduciary risk. Over a 10-year period, contributions would have grown 17% more with the boring glidepath. This incorporates only asset allocation, not the impact (or lack) of alpha and the effect of fees.

Does this analysis point to an existential crisis for diversification, or at least a sad revisiting of investing orthodoxy? No. Buried in the small print is the usual caveat: “Past performance is not indicative of future results.” Perhaps we can take solace in the belief that the next 10 years will be unlike the past decade (that’s my belief!). But our analysis does help explain why few plans have embraced alternatives and other sources of non-correlated returns, and that their day may come in the future.