Much of asset allocation work rests on the back of modern portfolio theory, which asserts that diversification stands as the lone “free lunch” offered up by the market gods. But in reality, the ascent of target date funds (largely built on modern portfolio theory) since the passage of the Pension Protection Act in 2006 has coincided with a period in which markets rewarded a lack of asset class diversification.

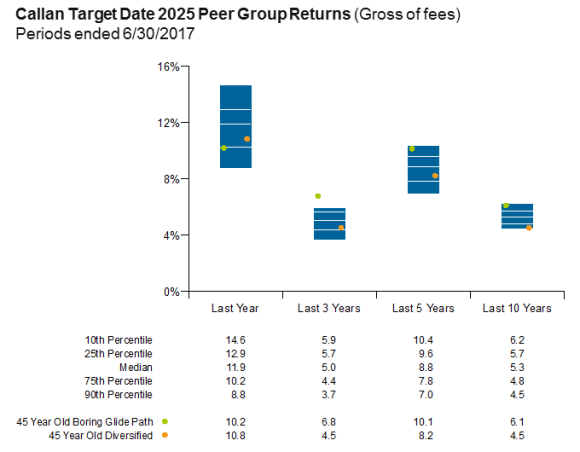

To illustrate the point, Callan constructed a “boring glide path” that uses the market consensus profile for equity to fixed income but only invests in the S&P 500 and Bloomberg Barclays U.S. Aggregate Bond Indices. Using as the starting point someone aged 45 in 2007, the boring glide path easily topped the median peer in Callan’s Target Date 2025 style group as well as the more diversified (24 underlying asset classes) Callan Target Date Index 2025 consensus glide path over the last 10 years. (The first measures the performance of all the 2025 TDFs in Callan’s database; the second represents Callan’s consensus glide path for a 2025 TDF.)

Hope Springs Eternal

Fear not! Perhaps the previous 10 years were an aberration. If we turn the clock back further to the time period from 1997 to 2007, the free lunch from diversification tastes better. Over this time period, the more diversified consensus glide path bests the boring glide path as well as the median peer (the 10-year peer group is limited, therefore the distribution is not shown).

The moral here: Do not give up on diversification; the next 10 years will not look like the previous 10, or the previous 10 before that. (In fact, Callan research has found that over the last 25 years, a broadly diversified asset mix has delivered returns per unit of risk superior to that of the stock market and “simple” diversified portfolios.)