This blog post from our Corporate DB Plan Focus Group is the first in a series of monthly updates about the impact of interest rates on corporate defined benefit (DB) plans, designed to highlight trends in the market and inform plan sponsors about significant developments.

Discount rates have been on a rampage this year, and September has been no different. During the month ended Sept. 30, 2022, the single equivalent discount rate for the typical shorter-duration corporate DB plan that is closed or frozen increased by ~78 bps and now sits at 5.26% (liability duration of 9.2 years), double the rate as of Dec. 31, 2021 (2.6%). Much of this change has been interest rate-driven. The yield on the long U.S. Treasury curve was 4.0% as of Sept. 30, 2022, up 52 bps from August end and 211 bps from the beginning of the year. Long Credit AA spreads were 129 bps over like-duration Treasuries at the end of September, up 16 bps over the month. For the year-to-date period, Long Credit AA spreads are up 38 bps over like-duration Treasuries, which is not a large jump, but it does represent a meaningful increase off the Dec. 31, 2021, level of 91 bps.

September 2022 Discount Rate Update

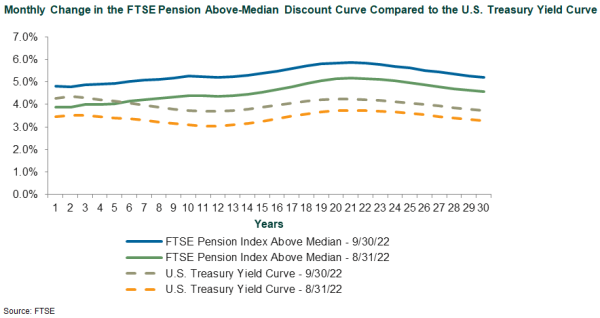

As compared to August, the September discount rate and Treasury curves, as illustrated below, both shifted up in parallel fashion, but there was a slight bear-flattening of the Treasury curve as short-term rates rose more than longer-term rates.

Pension Liability Index Detail

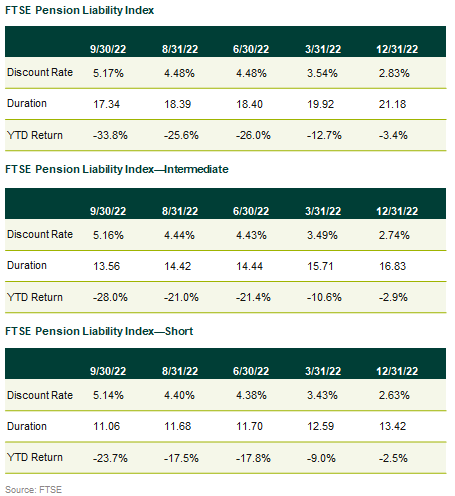

Over the month, plans with shorter-duration liabilities (typically those that are closed and frozen), experienced a larger increase in discount rates than plans with longer durations. Rate movements drove the liability returns, with longer-dated plans as represented by the full index below falling 11.1% for the month vs. shorter-duration plans, which fell 7.5%. Given the rapid increase in rates, many plans are now one-third smaller than they were at the beginning of the year.

Fed Funds Rate

To combat a hot economy and surging inflation, the Federal Reserve has increased the Federal Funds Effective Rate (commonly referred to as the Fed Funds Rate) from 0.00%-0.25% to 3.00%-3.25% in the space of seven months in 2022, with additional hikes expected. The last time the Fed Funds Rate rose this quickly was in 1981, when the Fed increased rates to a whopping 22% to combat then-inflation of nearly 11%. This pushed the U.S. economy into a recession for the next 18 months, but inflation was brought under control to a more manageable 4.5%.

Higher Rates, Lower Liabilities

If there is a silver lining to the current economic environment, where all asset classes minus energy and the U.S. dollar seem to be in lock-step and declining, it is that higher discount rates mean lower liability valuations. Using the Bloomberg Long AA US Corporate Index as a proxy for liabilities, most plans are experiencing liability values approximately one-third lower than at the beginning of 2022. This is an excellent time for corporate DB plans to review their hedging strategy, contribution policy, and risk studies, particularly if these have not been revisited recently.

Disclosures

Certain information herein has been compiled by Callan and is based on information provided by a variety of sources believed to be reliable for which Callan has not necessarily verified the accuracy or completeness of or updated. This report is for informational purposes only and should not be construed as legal or tax advice on any matter. Any investment decision you make on the basis of this report is your sole responsibility. You should consult with legal and tax advisers before applying any of this information to your particular situation. Reference in this report to any product, service, or entity should not be construed as a recommendation, approval, affiliation, or endorsement of such product, service, or entity by Callan. Past performance is no guarantee of future results. This report may consist of statements of opinion, which are made as of the date they are expressed and are not statements of fact. The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to subsidiaries or parents, or post on internal web sites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.