This blog post from our Corporate DB Plan Focus Group is one in a series of monthly updates about the impact of interest rates on corporate defined benefit (DB) plans, designed to highlight trends in the market and inform plan sponsors about significant developments. See all posts in the series here.

Discount Rate Trends

Financial markets haven’t gotten much of a breather in 2023, with inflation headwinds lingering, bank failures and, in May, the rush to get the debt limit raised before the Treasury ran out of money. The debt limit represents the total amount of money outstanding that the U.S. government is authorized to use to support its spending, including for Social Security, military salaries and benefits, Medicare, tax refunds, and, importantly, interest on the national debt. Treasury Secretary Janet Yellen began her appeal to Congress in January 2023, informing it of the current limit (~$31.4 trillion) and that the U.S. Government was set to breach this limit in 2023. Notably, suspension of the debt limit or increasing the current limit does not authorize the government to increase spending, but rather allows it to meet current obligations. The debt limit historically becomes a pawn in political brinkmanship, and this was no different in 2023.

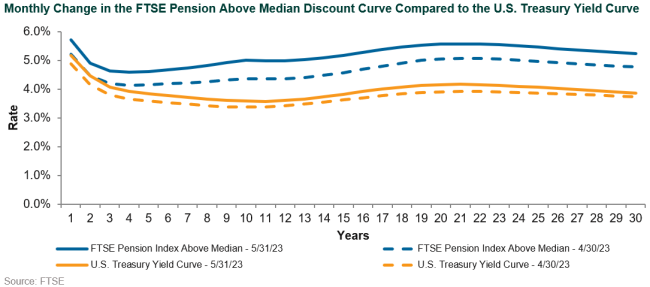

Why does this matter? Should the debt limit fail to be increased or suspended, the U.S. government would default on its debt, which has never happened before and which would call into question the primacy of U.S. Treasury securities as the linchpin of the global financial system. This would cause unprecedented global financial instability and roil markets. As illustrated in the chart below, markets began pricing in additional risk, as both the Treasury and FTSE Above Median curves (which incorporates credit spreads) rose month-over-month. Interest rates, as measured by the 10-year, experienced a fair amount of volatility intra-month, which is masked by the month-over-month prints of 3.55% (May 1) and 3.60% (June 1). Interestingly, if we stick to standard month-end comparisons, rather than beginning of month, the difference widens from a 5 bps month-over-month move to 20 bps (3.43% on April 28 vs. 3.63% on May 31)—again illustrating significant daily rate volatility experienced during May.

Pension Liability Index Detail

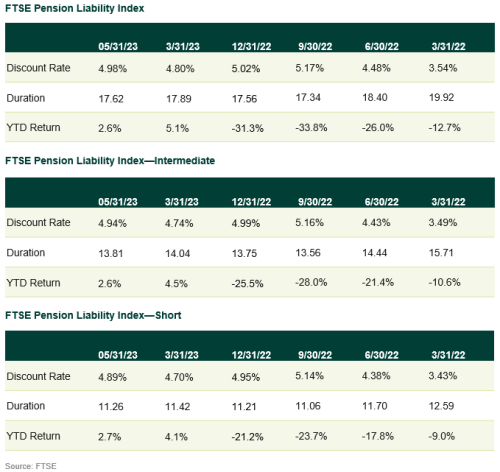

The FTSE Pension Liability Index rose 23 bps to end May at 4.98%. Intermediate and Short FTSE Pension Liability Indices moved similarly, each increasing 23 bps to 4.94% (Intermediate) and 4.89% (Short), respectively. Decomposing the indices into rates and spreads, interest rates moved by 20 bps as measured by the 10-year Treasury note, while long credit spreads increased marginally from 157 bps over like-duration Treasuries to 161 bps.

We are reminded that despite the short-term increase in interest rates, comparing YTD returns on liabilities in 2023 vs. 2022 is quite different. YTD 5/31/22, interest rates had nearly doubled from the start of the year and liabilities had already shrunk by approximately 22%. In contrast the interest rate environment in 2023 remains active, but not as directional as the prior year. For well-hedged plans, both asset and liability pools are likely slightly higher than at the beginning of the year, more so for asset pools that have retained some return-seeking assets.

Out With the Old, In With the New

For our younger readers the acronym LIBOR, for London Interbank Offered Rate, may hold limited utility, but for many of us, LIBOR has been a part of financing in private markets and short-term markets, and a cornerstone of global lending. On June 30, 2023, we will have a changing of the guard. U.S. dollar LIBOR will cease at the end of June and be replaced with SOFR (the Secured Overnight Financing Rate). For those unfamiliar with why LIBOR is being phased out, a quick recap: LIBOR is set by a consortium of banks on what they believe they would pay (not what they actually pay). As a result of the hypothetical versus the actual, LIBOR was manipulated. A bank submitting a lower rate (again not actual) signaled to the market higher creditworthiness, and therefore would be in a position to garner greater deposits and the potential for higher lending revenue. As this chapter closes, we are reminded of the efficiency of capital markets and need for regulation, a view that was underscored earlier this year within the banking industry.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.