This blog post from our Corporate DB Plan Focus Group is one in a series of monthly updates about the impact of interest rates on corporate defined benefit (DB) plans, designed to highlight trends in the market and inform plan sponsors about significant developments. See all posts in the series here.

Discount Rate Trends

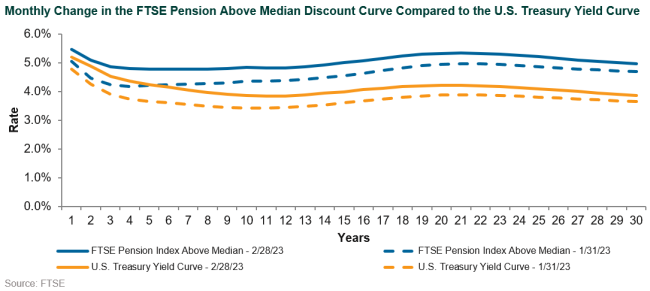

The beginning of February brought a much-anticipated quarter point increase to the Fed Funds rate, bringing it to between 4.50% and 4.75%. Risk assets rallied, not because the Fed finally downshifted to quarter-point increases (from elevated 50 bps and 75 bps hikes earlier in 2022), but following Chairman Jerome Powell’s comments that inflation pressures were easing although still “elevated.” The back end of the curve, which is where much of pension interest risk resides, rallied with the benchmark 10-year constant maturity Treasury yield falling 13 bps on the news. As the month progressed, sentiment changed and interest rates sold off, with the 10-year Treasury moving 40 bps to 3.91%. The curve continued to flatten at the back end with the 30-year Treasury rising from 3.66% to 3.93% over the month, bringing the 10-year and 30-year virtually to parity at the end of the month.

Pension Liability Index Detail

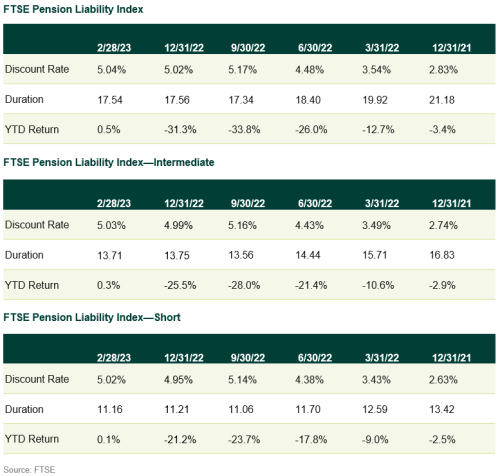

Discount rates moved in parallel fashion with yields, increasing by 35 bps over the month to end at 5.04% for the FTSE Pension Liability Index. Discount rates were flat across durations reflecting the flatness of the back of the yield curve. Spreads over the month remained flat for higher quality long credit, but moved up approximately 10 bps for the full long credit universe. Long credit spreads ended the month approximately 155 bps over like-duration Treasuries, whereas AA long credit spreads ended the month virtually flat to the beginning of the month at approximately 100 bps over. A majority of the move in discount rates for the month was again rate related.

Curve Considerations

Where is the term premium? Much has been written about the potential for a recession when the yield curve inverts. While this is constantly on the horizon of risks for institutional investors, perhaps a more pressing concern is not about the yield curve being inverted but rather the flatness of the curve and what happens when said curve steepens. As an example, at the end of February, an investor was compensated equally for lending the government money over 10 years as over 30 years. It’s challenging to make the case to invest in longer-term debt when there is no economic reason to do so. For pension investors there is often considerable reason to extend duration as interest rate risk is an uncompensated risk. Particularly for those plans that are not well funded, a common strategy is to extend duration while continuing to heavily invest in return-seeking assets.

As a result, the first-order hedge often incorporates STRIPs or long government indices, which target instruments that are generally very long dated. The second-order hedge is often to incorporate credit spread to better align the hedge to the discount rate. The third-order hedge is to adjust the plan’s hedging pool to its liabilities, often segmenting the liabilities by key rate durations to insulate the plan from changes in the shape of the yield curve. When equity risk dominates overall risk it is less common to focus on second- or third-order hedges; however the uniqueness of the current yield curve shape warrants further discussions with your fixed income managers and/or consultant as to how best to structure exposure.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.