This blog post from our Corporate DB Plan Focus Group is one in a series of monthly updates about the impact of interest rates on corporate defined benefit (DB) plans, designed to highlight trends in the market and inform plan sponsors about significant developments. See all posts in the series here.

Discount Rate Trends

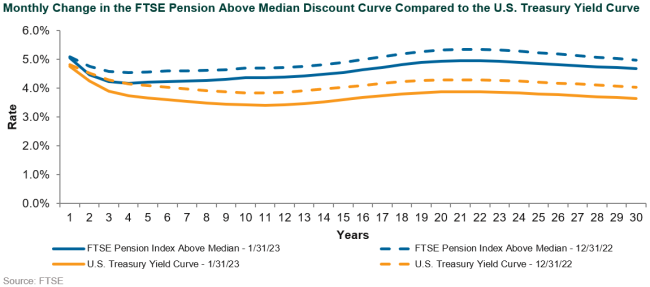

Thankfully January brought an end to December’s freezing weather (the average high temperature across the U.S. was 24.1 degrees, 3.9 degrees colder than the 1991-2020 average!), and for corporate plan sponsors, the first month of the year also broke the trend of 2022’s significant upward rise in interest rates. In January, the single equivalent discount rate for the FTSE Pension Liability Index dropped 33 bps from 5.02% to 4.69%. Much of this retrenchment in discount rates was interest rate-driven. The Treasury yield curve largely parallel shifted downward from 5s to 30s, but bull-steepened at the front end, reflecting the anchoring of rates at the very short-end. Spreads also moved meaningfully during the month, with higher-quality rates (AA long credit spreads) tightening by 9 bps and lower-quality spreads (BBB long credit spreads) tightening by 14 bps.

The difference in AA and BBB spread movements over a one-month period caused us to review longer-term trends. Over the past 10 years, we evaluated the relationship between AA long credit spreads and BBB long credit spreads. The differential between AA and BBB long credit spreads has been comfortably inside the long-term average over the past three months. (For reference, the average differential over the past 10 years, between higher- and lower-quality investment grade spreads, is around 94 bps.)

Looking back over recent history, from October 2020 through May 2022, the spread relationships were meaningfully tighter at an average of 72 bps, reflecting an ebullient market and penchant for risky assets. With uncertainty in the path of future monetary policy and perhaps even fiscal policy following mid-term elections, we continue to believe that 2023 will be characterized by volatility in both spreads and rates.

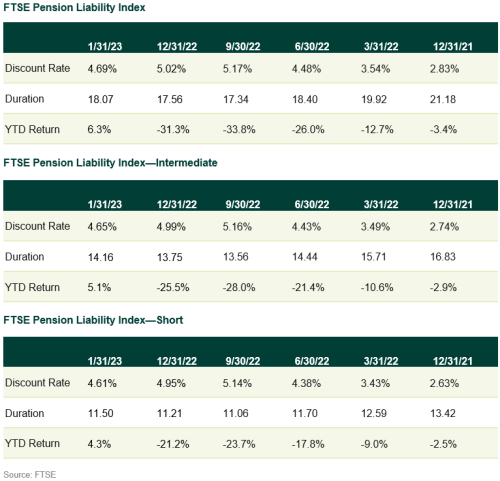

Pension Liability Index Detail

Discount rates fell in January to the lowest level since August 2022. As noted above, the FTSE Pension Liability Index single equivalent discount rate dropped from 5.02% to 4.69% for the month. The shorter-duration liability discount rate curves moved in tandem with the full index. The Intermediate Duration Index’s single equivalent discount rate fell from 4.99% to 4.65% and the Short Duration Index tightened 34 bps as well, from 4.95% to 4.61%. The primary reason for the move was related to Treasury yields rallying by approximately 30 bps during the month on increased optimism that the U.S. economy would avoid any sort of economic landing (hard or soft) following the most aggressive interest rate hiking cycle since the early 1980s. Spreads were not to be left behind and also rallied on perceived better economic news. Long credit BBB spreads tightened by approximately 14 bps in January, moving from 192 bps over like-duration Treasuries to 178 bps over, while long credit AA spreads tightened by 9 bps.

Caught in the Middle

The Pension Protection Act of 2006 radically changed pension economics by requiring assets and liabilities of single-employer corporate pensions to be disclosed on a company’s balance sheet. For the purposes of accounting, PPA yield curves with no smoothing and a mark-to-market approach became the norm for calculating an “economic” pension liability. On the other hand, federal legislation under ERISA called for a separate set of discount rates to be used for funding purposes.

As we fast-forward from 2006 to 2023, there have been multiple instances of funding relief passed, which, in effect, has had the impact of artificially inflating interest rates and lowering the value of liabilities. Legislation such as Moving Ahead for Progress in the 21st Century, the American Rescue Plan Act, and the Infrastructure Investment and Jobs Act increased the interest rates used to value liabilities for the calculation of contributions. For the most part, plan sponsors were allowed to “smooth” interest rates over a 25-year period, which increased interest rates and thereby lowered liabilities and their associated contributions.

So now as we begin 2023, plan sponsors are caught in a position that funding relief never contemplated—that the 2022 surge in interest rates has virtually wiped out funding relief, translating to lower (ERISA) funding ratios and higher minimum contributions. In addition, unless a plan sponsor has elected to use an acceptable alternative, the calculation of PBGC premiums is based on liabilities measured using “spot segment rates.” This is particularly problematic for small plans that utilized the Lookback Rule.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.